- Euro hits 17-month high before ECB’s Visco knocks it lower

- Bruised dollar sets sights on US retail sales as Treasury yields resume slide

- Equities mixed despite China’s aim to boost consumption; earnings awaited

Euro leads charge against US dollar

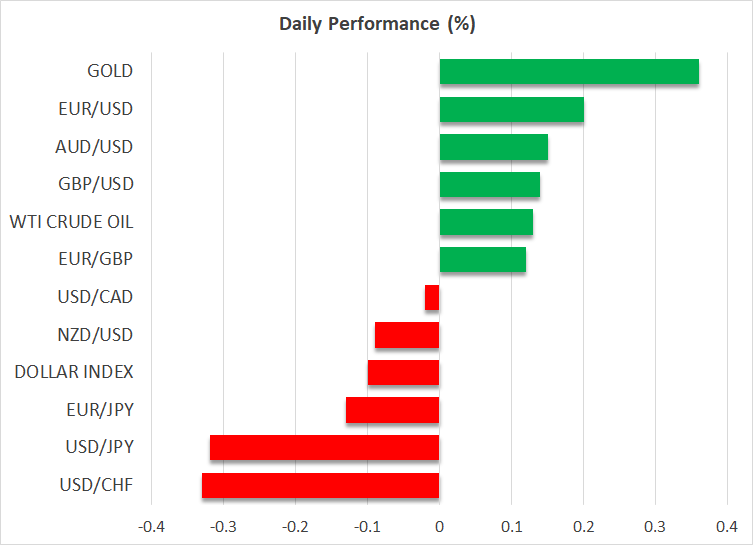

The post-CPI headache for the US dollar is showing no signs of receding as speculation about monetary policy divergence continues to intensify, with the euro being the biggest winner in this latest phase. The single currency briefly surged to a 17-month peak of $1.1275 earlier today as investors upped their bets that the Federal Reserve will slash rates next year, while any cuts by the European Central Bank will likely be more modest.

Although both central banks are almost certain to raise interest rates next week, markets are convinced that this will be a ‘one and done’ hike for the Fed, whereas the ECB will be compelled to tighten again in September. Moreover, with inflation falling more rapidly in the United States than in the euro area, the case for rate cuts in 2024 is a lot stronger for the Fed.

It’s Fed vs ECB

However, the risk here is that investors appear to be ignoring the other side of the argument to this, which is that the US economy has a lot more momentum than European ones so loosening policy too soon could easily re-ignite inflationary pressures. In contrast, the Eurozone economy is struggling to grow right now and a full-scale recession is looking more and more likely.

In this respect, the July policy meetings might be more significant for the euro than the dollar should ECB officials change their tune and acknowledge the risks to growth as well as the recent progress in bringing down inflation.

There were some hints of that from Governing Council member Ignazio Visco today who suggested that inflation could fall to the 2% target faster than that projected in the ECB’s June forecasts. His comments took the steam out of the euro’s rally, wiping out most of its gains for the day.

Yen also shines but risks ahead

The Japanese yen has also rallied sharply lately amid some murmurs that the Bank of Japan could tweak its yield curve control policy when it meets next week. The speculation has lifted Japan’s 10-year government bond yield to around 0.48%, not far from the upper limit of 0.50%, even as yields in other parts of the world have slumped after last week’s soft inflation report out of the United States.

This has helped the yen appreciate by more than 5% from its lows at the end of June when it risked triggering intervention by Japanese authorities in the FX market after brushing the 145 per dollar level.

The danger now is that there could be a sudden reversal of these gains if the Fed does not rule out further hikes next week and the Bank of Japan disappoints by standing pat.

Ahead of those central bank decisions, investors will get one last clue on what to expect from the Fed from US retail sales figures coming up at 12:30 GMT. Canadian CPI numbers are also due at the same time. The loonie was marginally weaker in European trade and so were the Australian and New Zealand dollars.

China concerns weigh on commodity-linked currencies

Riskier currencies are still trying to recover from Monday’s unimpressive GDP readings out of China that pointed to an ongoing slowdown in the world’s second largest economy and largest consumer of commodities. A fresh set of policies to boost consumption were announced in Beijing today, but the measures didn’t go far enough as far as markets were concerned.

The kiwi dipped as much as 0.50% but there was some support for the aussie from the RBA’s meeting minutes that kept the door open to more rate increases.

Lacklustre start for stocks before earnings barrage

Asian equities were also unable to receive much of a lift from China’s latest efforts to shore up growth and shares in Europe were mixed too.

Wall Street’s major indices ended Monday in positive territory, though futures were last trading flat.

Today’s focus will be on the remaining bank earnings, with Bank of America (NYSE:BAC) and Morgan Stanley (NYSE:MS) set to report their results before the opening bell, after which attention will switch to Netflix (NASDAQ:NFLX) and Tesla (NASDAQ:TSLA) when they kickstart the round of tech earnings tomorrow.