Speculations that the European Central Bank (ECB) is considering cutting eurozone interest rates in the near future turned the EUR/USD moderately bearish during mid-day trading yesterday. A lack of significant international economic indicators resulted in little other movement among major currencies and commodities over the course of the day.

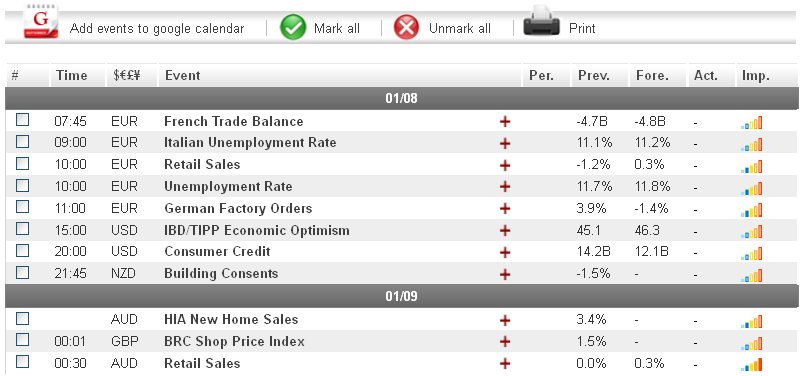

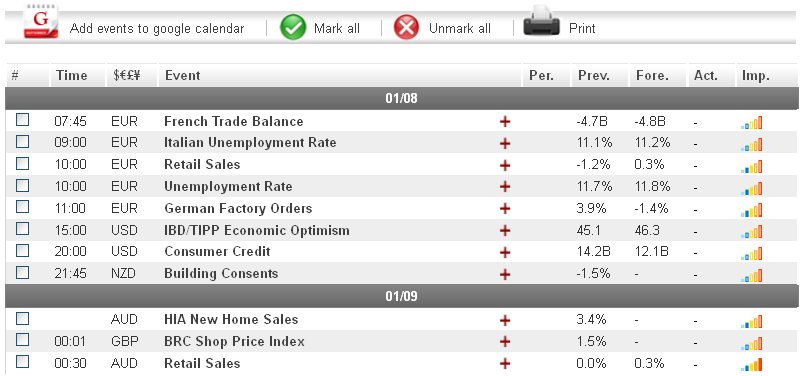

Today, traders will want to pay attention to the eurozone Retail Sales and Unemployment Rate figures, both scheduled to be released at 10:00 GMT. If either of the indicators comes in above their forecasted levels, the euro could see upward movement during the mid-day session.

Economic News

USD - Slow News Day Leads to Little Dollar Movement

A lack of significant international news releases led to a low liquidity environment in the marketplace yesterday, which resulted in little movement for the US dollar. The GBP/USD fell slightly more than 50 pips during overnight trading, eventually reaching as low as 1.6020, before recovering its losses during the afternoon session and bouncing back to the 1.6070 level. Against the Swiss franc, the greenback advanced some 30 pips when markets opened for the week, only to erase its gains during mid-day trading. The USD/CHF was trading at 0.9255 by the end of European trading.

Analysts are warning that the USD may see another light trading session today, due to a lack of significant US news events. Still, traders will want to pay attention to news and announcements out of the eurozone. Any signs that the European Central Bank is considering an EU interest rate cut in the near future could lead to risk aversion in the marketplace, which would boost the safe-haven greenback. Additionally, developments in the ongoing talks between US lawmakers to raise the nation's borrowing limit have the potential to impact the dollar today.

EUR - Eurozone Data Set to Impact Market Today

Speculations that the European Central Bank may be getting ready to lower eurozone interest rates led to moderate risk aversion among investors yesterday, which resulted in the euro turning bearish. Against the Japanese yen, the common-currency fell more than 130 pips during the Asian session, eventually reaching as low as 114.10, before staging a slight upward recovery later in the day to reach as high as 114.71. Against the US dollar, the euro fell close to 60 pips during overnight trading, eventually reaching as low as 1.3016, before bouncing back to the 1.3060 level in the afternoon session.

Turning to today, euro traders will want to pay close attention to EU Retail Sales and Unemployment Rate figures, both scheduled to be announced at 10:00 GMT. If either of the indicators comes in below their expected levels, it may lead to additional rumors that the ECB will soon cut interest rates to boost economic growth in the eurozone, in which case the EUR would likely turn bearish. Later in the week, all eyes are likely to be on the ECB Press Conference, in which EU officials will be able to go into detail about the current state of the eurozone economic recovery.

Gold - Gold Extends Losses to Begin Week

Signs that the US Federal Reserve is unlikely to initiate a new round of monetary easing in the near future caused gold to begin the trading week on a bearish note. The precious metal fell by more than $15 an ounce during European trading, eventually reaching as low as $1642.58 before bouncing back to the $1648 level.

Today, gold traders will want to pay attention to news out of the eurozone and its impact on the EUR/USD pair. If either the Retail Sales or Unemployment Rate figures come in above expectations, the euro could see upward movement against the dollar, which would make gold cheaper for international buyers and lead to an increase in prices.

Crude Oil - Crude Oil Turns Bullish During Afternoon Session

Risk aversion due to fears of an impending eurozone interest rate cut caused the price of crude oil to fall when markets opened for the week. After dropping some $0.60 a barrel during overnight trading, to eventually trade as low as $92.40, the commodity was able to bounce back during the second half of the day and climb back to the $93 level.

Turning to today, eurozone news is likely to determine the direction crude oil prices take. If either the Retail Sales or Unemployment Rate comes in below expectations and signals a further slowing down in the EU economic recovery, oil could turn bearish during mid-day trading.

Technical News

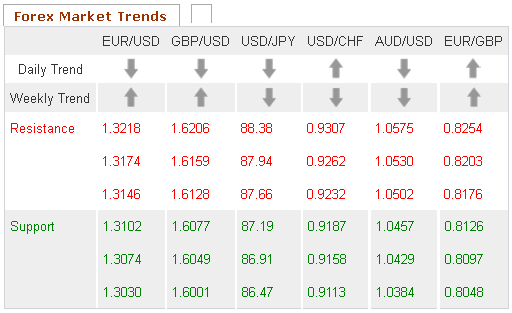

EUR/USD

The Bollinger Bands on the weekly chart are beginning to narrow, indicating that a price shift could occur in the coming days. Furthermore, the MACD/OsMA on the same chart appears close to forming a bearish cross, signaling that the shift in price could be downward. Opening short positions may be the smart choice for this pair.

GBP/USD

The daily chart's Slow Stochastic appears close to forming a bullish cross, indicating that this pair could see upward movement in the near future. Additionally, the Williams Percent Range on the same chart has dropped into oversold territory. Traders may want to open long positions for this pair ahead of a possible upward correction.

USD/JPY

The Relative Strength Index on the weekly chart is currently in overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bearish cross. Opening short positions may be the smart move for this pair.

USD/CHF

The Williams Percent Range on the daily chart has crossed into overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart has formed a bearish cross. Opening short positions may be the smart move for this pair.

The Wild Card

CAD/CHF

The Slow Stochastic on the daily chart has formed a bearish cross, indicating that downward movement could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which has crossed into overbought territory. Opening short positions may be the wise choice for forex traders today.

Today, traders will want to pay attention to the eurozone Retail Sales and Unemployment Rate figures, both scheduled to be released at 10:00 GMT. If either of the indicators comes in above their forecasted levels, the euro could see upward movement during the mid-day session.

Economic News

USD - Slow News Day Leads to Little Dollar Movement

A lack of significant international news releases led to a low liquidity environment in the marketplace yesterday, which resulted in little movement for the US dollar. The GBP/USD fell slightly more than 50 pips during overnight trading, eventually reaching as low as 1.6020, before recovering its losses during the afternoon session and bouncing back to the 1.6070 level. Against the Swiss franc, the greenback advanced some 30 pips when markets opened for the week, only to erase its gains during mid-day trading. The USD/CHF was trading at 0.9255 by the end of European trading.

Analysts are warning that the USD may see another light trading session today, due to a lack of significant US news events. Still, traders will want to pay attention to news and announcements out of the eurozone. Any signs that the European Central Bank is considering an EU interest rate cut in the near future could lead to risk aversion in the marketplace, which would boost the safe-haven greenback. Additionally, developments in the ongoing talks between US lawmakers to raise the nation's borrowing limit have the potential to impact the dollar today.

EUR - Eurozone Data Set to Impact Market Today

Speculations that the European Central Bank may be getting ready to lower eurozone interest rates led to moderate risk aversion among investors yesterday, which resulted in the euro turning bearish. Against the Japanese yen, the common-currency fell more than 130 pips during the Asian session, eventually reaching as low as 114.10, before staging a slight upward recovery later in the day to reach as high as 114.71. Against the US dollar, the euro fell close to 60 pips during overnight trading, eventually reaching as low as 1.3016, before bouncing back to the 1.3060 level in the afternoon session.

Turning to today, euro traders will want to pay close attention to EU Retail Sales and Unemployment Rate figures, both scheduled to be announced at 10:00 GMT. If either of the indicators comes in below their expected levels, it may lead to additional rumors that the ECB will soon cut interest rates to boost economic growth in the eurozone, in which case the EUR would likely turn bearish. Later in the week, all eyes are likely to be on the ECB Press Conference, in which EU officials will be able to go into detail about the current state of the eurozone economic recovery.

Gold - Gold Extends Losses to Begin Week

Signs that the US Federal Reserve is unlikely to initiate a new round of monetary easing in the near future caused gold to begin the trading week on a bearish note. The precious metal fell by more than $15 an ounce during European trading, eventually reaching as low as $1642.58 before bouncing back to the $1648 level.

Today, gold traders will want to pay attention to news out of the eurozone and its impact on the EUR/USD pair. If either the Retail Sales or Unemployment Rate figures come in above expectations, the euro could see upward movement against the dollar, which would make gold cheaper for international buyers and lead to an increase in prices.

Crude Oil - Crude Oil Turns Bullish During Afternoon Session

Risk aversion due to fears of an impending eurozone interest rate cut caused the price of crude oil to fall when markets opened for the week. After dropping some $0.60 a barrel during overnight trading, to eventually trade as low as $92.40, the commodity was able to bounce back during the second half of the day and climb back to the $93 level.

Turning to today, eurozone news is likely to determine the direction crude oil prices take. If either the Retail Sales or Unemployment Rate comes in below expectations and signals a further slowing down in the EU economic recovery, oil could turn bearish during mid-day trading.

Technical News

EUR/USD

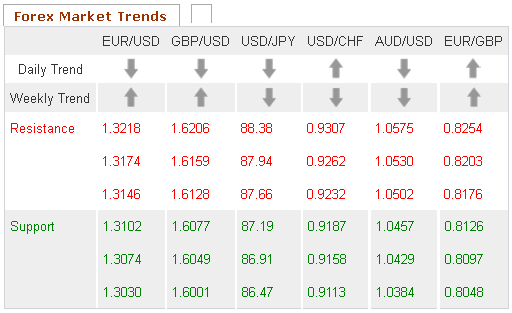

The Bollinger Bands on the weekly chart are beginning to narrow, indicating that a price shift could occur in the coming days. Furthermore, the MACD/OsMA on the same chart appears close to forming a bearish cross, signaling that the shift in price could be downward. Opening short positions may be the smart choice for this pair.

GBP/USD

The daily chart's Slow Stochastic appears close to forming a bullish cross, indicating that this pair could see upward movement in the near future. Additionally, the Williams Percent Range on the same chart has dropped into oversold territory. Traders may want to open long positions for this pair ahead of a possible upward correction.

USD/JPY

The Relative Strength Index on the weekly chart is currently in overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bearish cross. Opening short positions may be the smart move for this pair.

USD/CHF

The Williams Percent Range on the daily chart has crossed into overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart has formed a bearish cross. Opening short positions may be the smart move for this pair.

The Wild Card

CAD/CHF

The Slow Stochastic on the daily chart has formed a bearish cross, indicating that downward movement could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which has crossed into overbought territory. Opening short positions may be the wise choice for forex traders today.