Euro sold off sharply after ECB press conference yesterday and stays weak in Asian session today. The ECB made another dovish statement in May and indicated that additional stimulus measures would likely arrive in June. The central bank noted that the path of inflation was not satisfactory and reiterated that the strength of the euro was a concern. We expect the ECB to cut the main refinancing rates at its June meeting. It might also launch a targeted liquidity injection in order to supporting bank lending.

Technically, EUR/USD is holding above 1.3769 key near term support for the moment and maintains a bullish outlook. But momentum is suggesting high chance of reversal. EUR/JPY is also holding about 140.07 support and is staying in range. EUR/GBP is going to press 0.8157 key long term support level. Bias in EUR/AUD is on the downside after break of 1.4824 minor support and will likely head lower for a test on 1.4652 near term support. So while, bias in Euro is generally on the downside, outlook isn't overwhelmingly bearish yet.

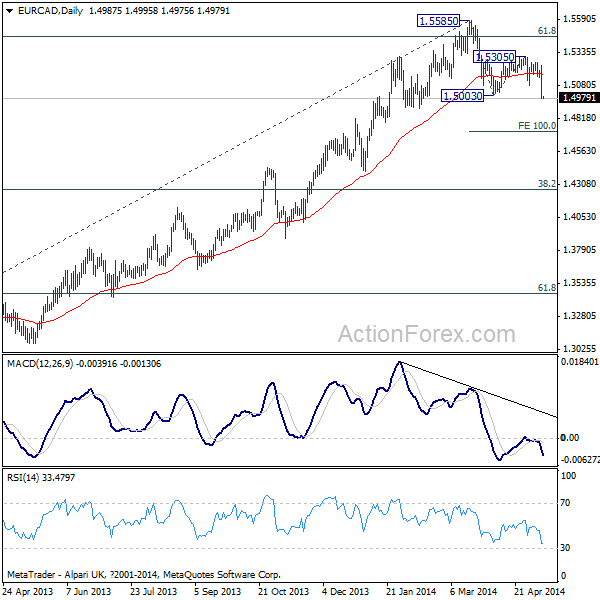

The exception is EUR/CAD. The break of 1.5003 support suggests that the decline from 1.5585 has completed. 1.5585 is viewed as at least a short term top on bearish divergence in daily MACD after hitting a long term fibonacci resistance. Fall from there is viewed as a correction pattern and should now target 100% projection of 1.5585 to 1.5003 from 1.5305 at 1.4723.

A key factor to determine whether EUR/CAD's fall will accelerate is Canadian job data today. Markets are expecting 14.9k job growth in April and unemployment rate is expected to stay unchanged at 6.9%. EUR/GBP's fate could depend on UK trade balance and productions. Elsewhere, Germany will release trade balance and US will release wholesale inventories. Released earlier today, China CPI moderated to 1.8% yoy in April versus expectation of 2.1% yoy, PPI dropped -2.0% yoy versus expectation of -1.8% yoy.