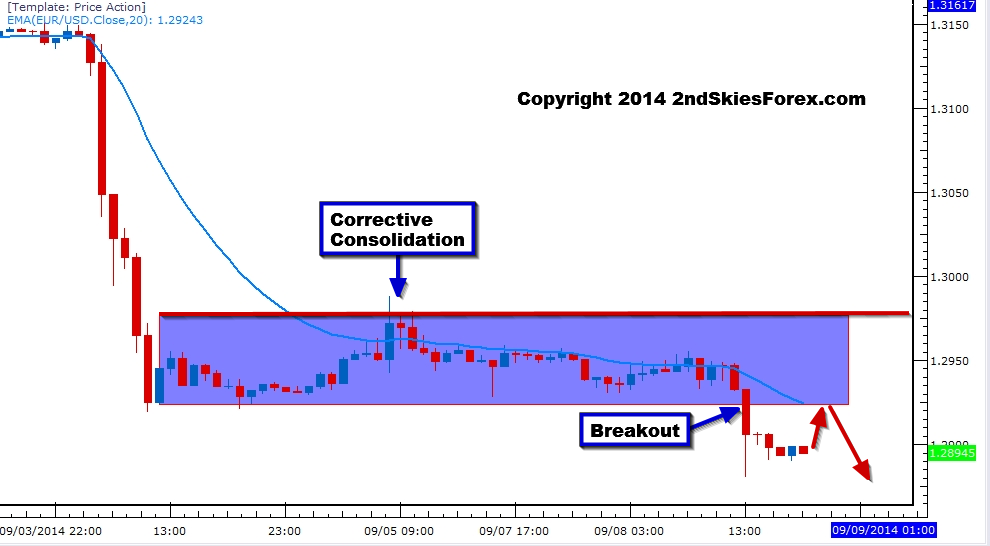

EURUSD – Loses 1.2900 Handle

As we talked about in our weekly market commentary, the price action structure and corrective consolidation suggested the Euro would likely break lower and remain under pressure. That is exactly what happened as you can see from the 1hr chart below, losing the 1.29 handle for the first time in a year.

For now, remain bearish and look to sell on pullbacks into resistance. First level of resistance is at the consolidation base ~1.2923. The top of that base would be another option, while a much stronger pullback towards 1.3100 would be the next level.

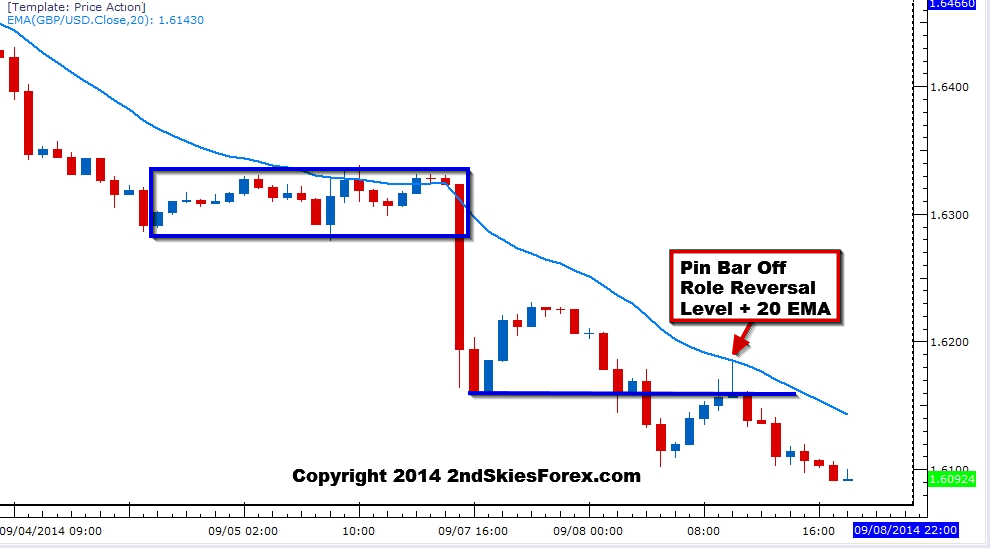

GBPUSD – Scottish Vote Weighing Heavily on The GBP

As we discussed in our market commentary this week, the potential Scottish independence vote will keep a bearish pressure on the GBP with the consequences of a ‘yes’ vote having a huge negative impact on the UK and GBP.

Looking at the 1hr chart below, we can see the massive drop to start the week with the cable actually gapping ~160 pips, then dropping another 70 pips throughout the day, offering a good with trend pin bar setup off the 20 EMA.

For now, although we may see a bounce near term, the price action context should remain bearish all week, and I expect the pair to close lower than the current price.

Look to sell on retraces back into key resistance levels, such as 1.6103 and 1.6159/69. Downside targets are 1.6000 and 1.5921.