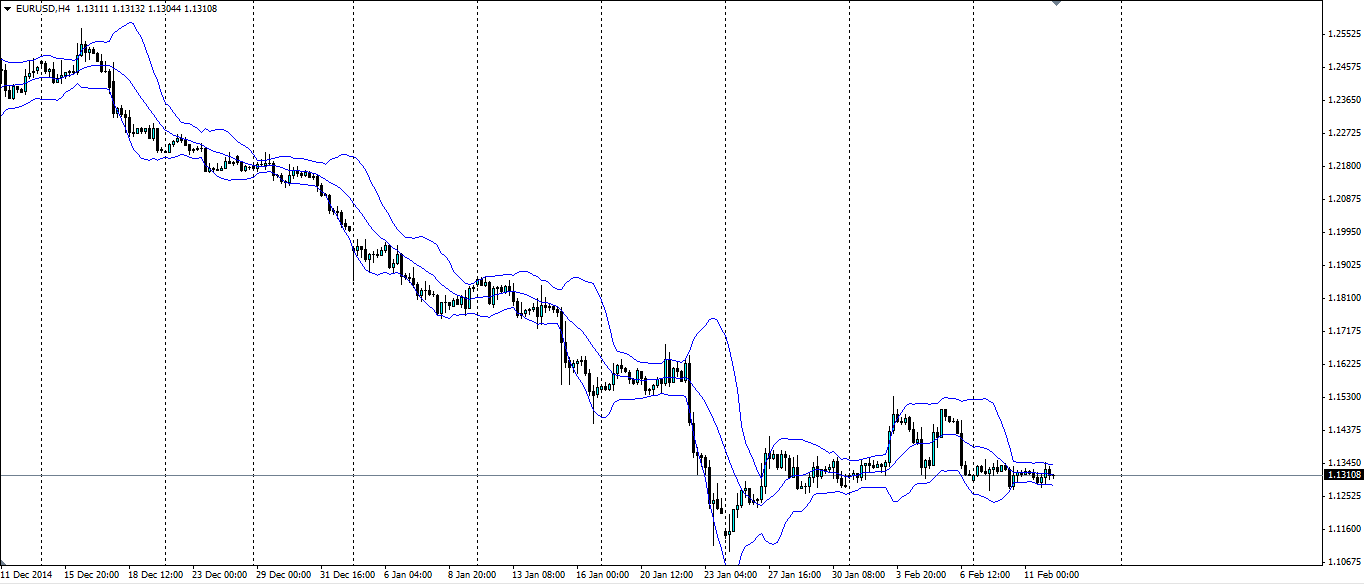

A drying up of volatility has tightened the Bollinger bands® in the EUR/USD pair. This squeeze will inevitably lead to a breakout and here’s how to take advantage of it.

(Source: Blackwell Trader)

The euro has gone a bit flat this week, which is a bit of a surprise. The trouble in Greece is far from over with rumors (which turned out to be false) swirling around the market that an agreement had been reached. This situation could drag on for weeks and could turn ugly if Greece defaults altogether.

The US economy has seen some very strong employment results recently. US non-farm payrolls came in at 257k views the market's expectation of 231k and the JOLTS job openings cracked the 5 million mark for the first time ever, up from 4.97m to 5.03m. This is adding further weight to the case for a rate rise from the Fed around the middle of the year.

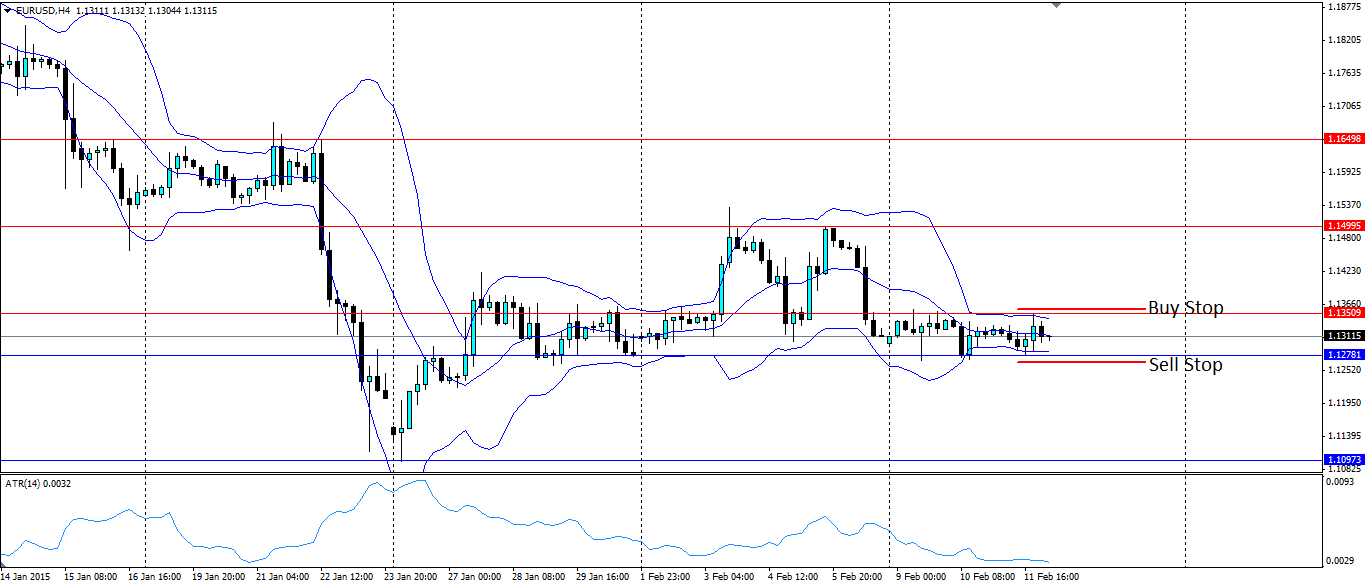

I suspect there are plenty of traders patiently waiting on the sidelines, wary of all the uncertainty surrounding Greece, especially after the Swiss National Bank debacle last month. This has led the euro to trade in a flat range with the Bollinger bands tightening around it. The ATR has fallen to its lowest level since early January.

(Source: Blackwell Trader)

Traders can take advantage of the situation by setting a buy stop just above the bands at roughly 1.1356 to take advantage of the momentum of an upside breakout. Likewise a sell stop should be set below the bands at 1.1265.

Targets for the upside breakout will be the recent resistance at 1.1499 and further resistance at 1.1649. The Sell stop trade will look to target the support at the recent low of 1.1097 with further support found at 1.0948