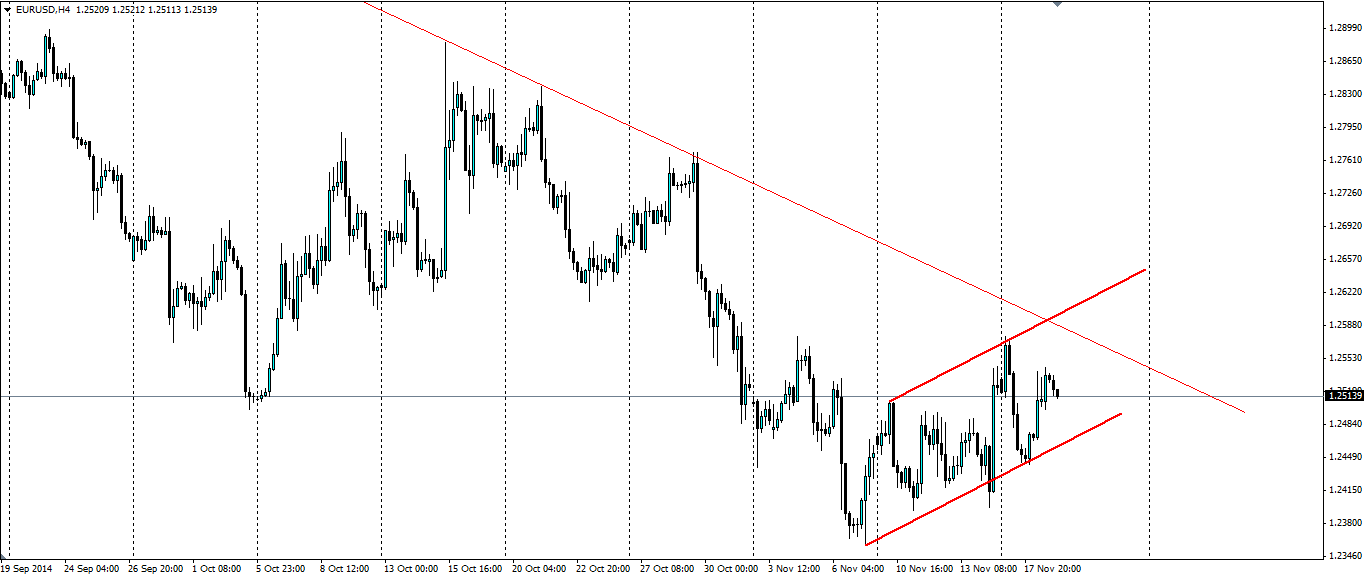

The euro has found a bit of support recently, but there is an interesting convergence of factors and some calendar items that will see volatility return to the EUR/USD pair.

Source: Blackwell Trader

Some slightly positive news for the Euro overnight, which saw the Euro continue in the small upward channel is has formed on the H4 charts. This came in the form of the ZEW Economic Sentiment reports which beat forecasts for Germany (11.5 vs exp 0.7) and the EU (11.0 vs exp 4.3). It is going to take a lot more than just two positive results to change the Euro’s fortunes.

So when the Channel meets the long term bearish trend head on, we can expect a bit of fireworks and it’s likely the trend will emerge victorious. This trend was tested several times in October and remained intact.

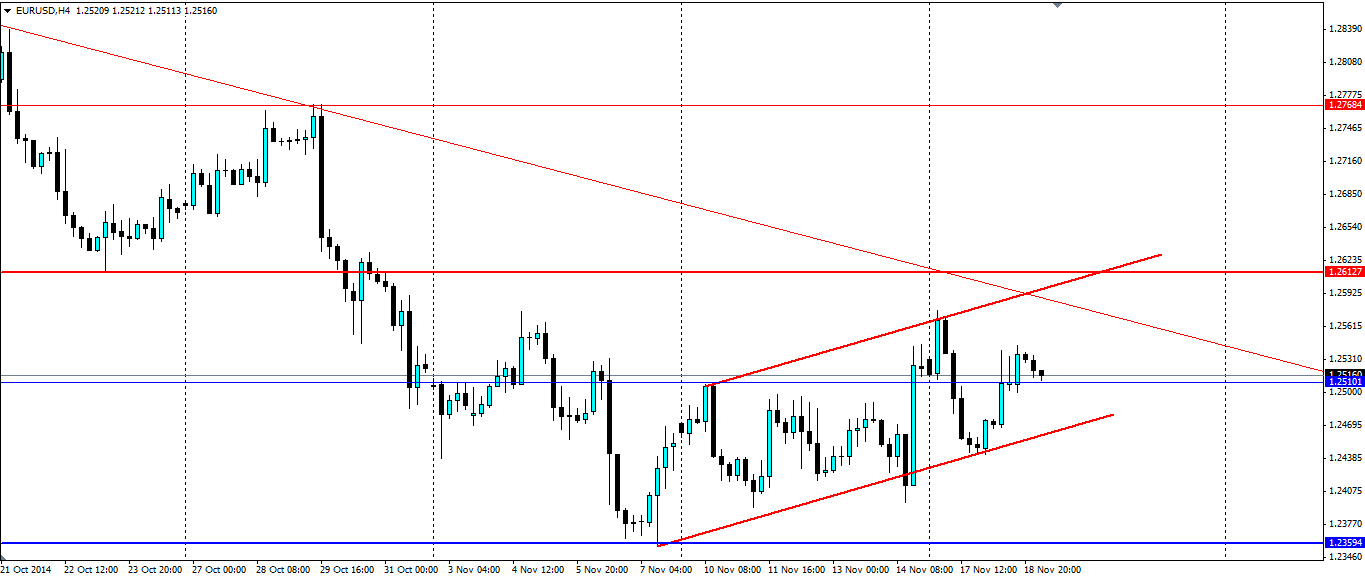

To add to the already volatile situation, the FOMC meeting minutes are due to be released later on today. Federal Reserve Chairwoman Janet Yellen has been surprisingly dovish over the past month or so, despite the plethora of positive news coming out of the US, so we may see that reflected in the meeting minutes. The minutes, however, will show the internal debate at the FED, so we could see other members with a more hawkish bias than Yellen speaking up. Either way, trading is likely to be heavy and the market is likely to move.

Source: Blackwell Trader

The euro is currently sitting on solid support at 1.2510, with more support found at the recent two year low at 1.2359. If we see a breakout of the bearish trend, look for heavy resistance at 1.2613, with further resistance found at 1.2768 and 1.2880.