The major currency pair is hovering near 1.1230 this Monday.

Last week, EUR/USD hit new highs, pushed forward by the expectations of future steps that the US Federal Reserve might make. At the moment, all market concerns have to do with the Fed’s interest rate. Investors expect the Federal Reserve to raise the rate just one more time at the meeting this month and make a new pause after that.

This idea is supported by the US statistics of the employment market and inflation for July.

It is highly probable that the level of 5.5% per annum, which the rate is going to test in July, will be the maximum.

Technical analysis of EUR/USD:

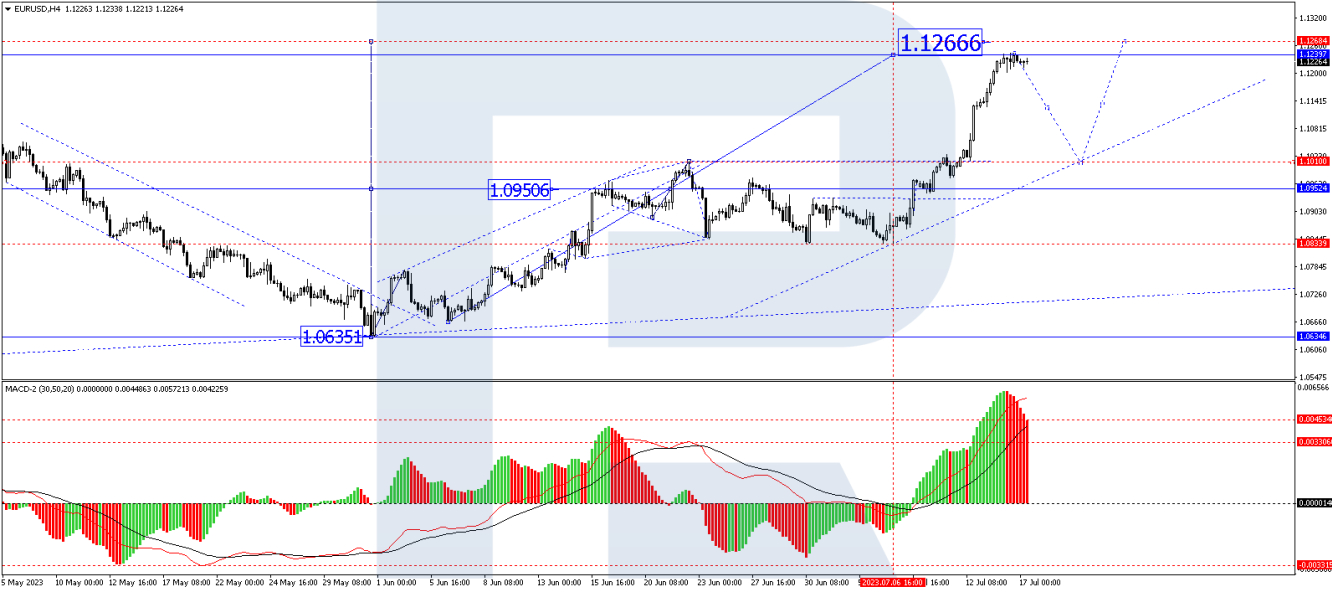

On the H4 EUR/USD chart, a consolidation range has formed around 1.0950. At a certain point, its upper boundary at 1.1010 broke. Today the price has completed a link of growth to 1.1240 and is forming a consolidation range under it. Practically, the quotes have reached the local target of the wave of growth.

They are expected to break the range downwards and develop a correction, returning to 1.1010 with a test from above. After that, a new structure of growth to 1.1270 might form. Technically, this scenario is confirmed by the MACD: its signal line is at the highs, moving out of the histogram area, which is a signal in favour of a decline to zero.

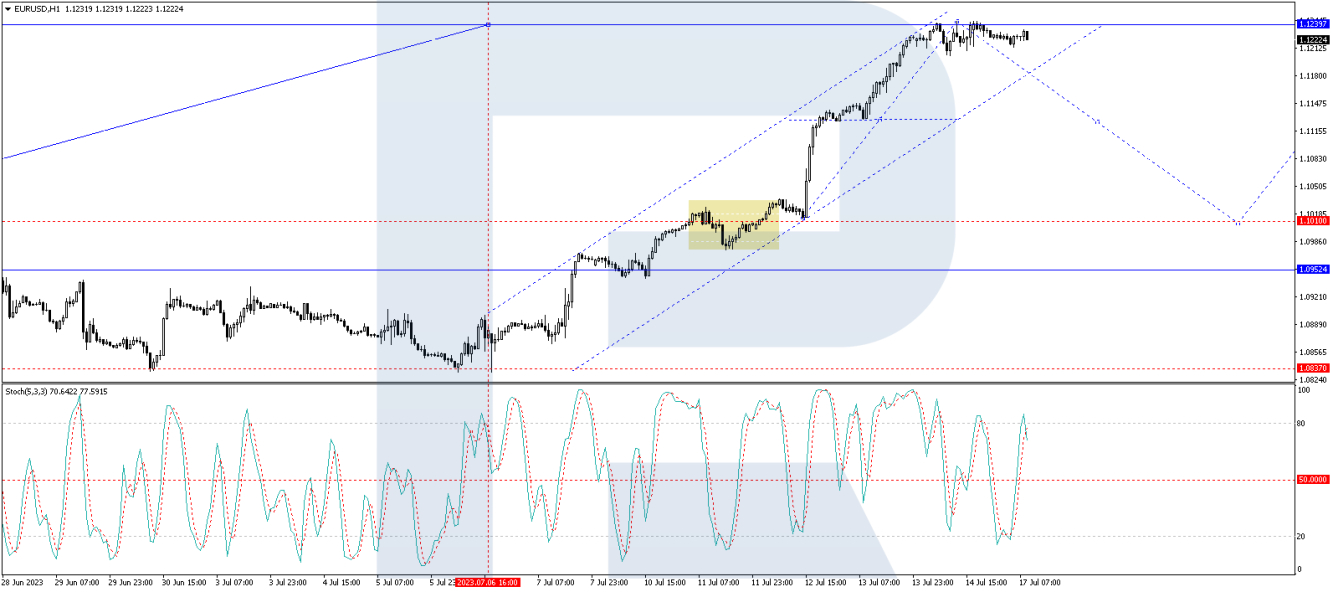

On the H1 EUR/USD chart, the price is finishing the second half of the wave of growth to 1.1240. At the moment, a consolidation range is forming under this level. The quotes are expected to break it downwards and extend the correction to 1.1123.

If this level breaks, the potential for a further correction to 1.1010 might open. Technically, this scenario is confirmed by the Stochastic oscillator: its signal line is above 80 and might drop to 50 today. If the line crosses over this mark, it could even drop to 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.