EUR/USD

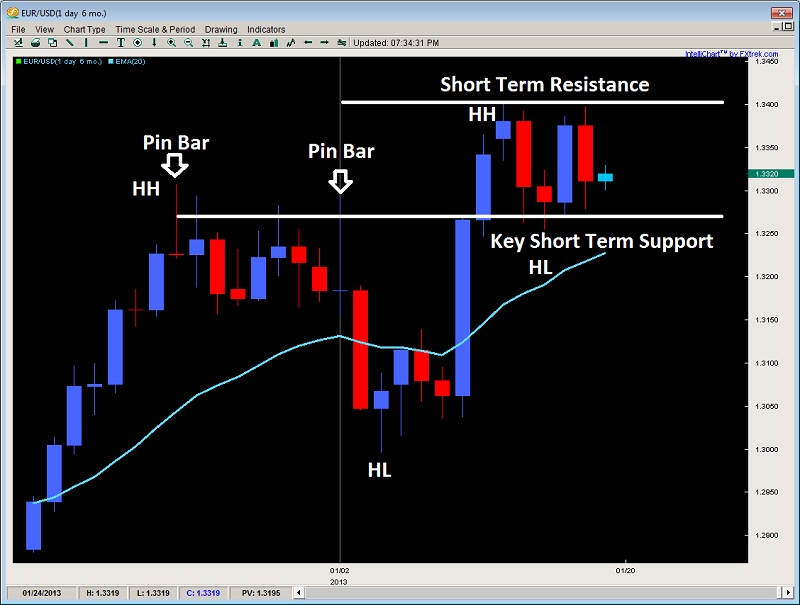

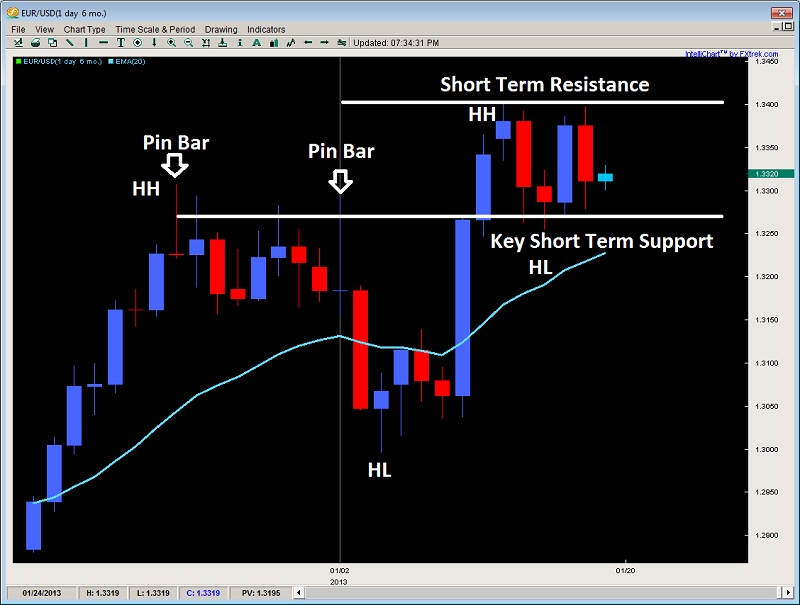

The euro is still holding the uptrend in place with the series of HH’s (higher highs) and HL’s (higher lows), although it has been trotting in place for the last week. However, I do not expect this to remain for this week. The lines in the sand are in place, which offer short term plays for day traders, offering a low risk-high reward trade, but watch for intraday impulsive price action into the short term range levels for the next direction. Preference is still for a buy, but open to selling.

EUR/USD 1" title="EUR/USD 1" width="800" height="575">

EUR/USD 1" title="EUR/USD 1" width="800" height="575">

EUR/JPY

After looking at the daily chart, I wanted to step back and look at the weekly chart for this pair. The EUR/JPY has gained for 6 weeks in a row, which is incredible. Last week it formed a pin bar, suggesting the pair is still underpinned. However, the pair only closed up 70pips on the week and still failed to close above the 120 big figure level.

This level will need to be cleared and closed above to bring in new bulls. Otherwise a pullback will be the only other option to bring them in, especially considering Thursday was a big up day and continued with no follow up buying, so there may not be many bulls left to get in.

At this moment, I’ll wait for a pullback towards 116 before getting back in, unless there is a convincing break and close above 120.70.

EUR/JPY" title="EUR/JPY" width="800" height="575">

EUR/JPY" title="EUR/JPY" width="800" height="575">

S&P 500

Starting off the week via a trend pin bar off a role reversal level, the major index gained twice to end the week, clearing a multi-year high in the process, just south of 1480. Considering the index feels over-extended, I’ll only buy on pullbacks, but I’ll also keep the other eye on a possible reversal at these levels, as I’m guessing there are option players parked under the 1500 level. Look for longs on pullbacks near 1475, so watch for possible price action reversal signals here.

Silver

After finding the yearly bottom just sub $29.50 via a pin bar reversal, the precious metal has climbed 7 out of the last 10 days, suggesting the metal was being accumulated sub $30. However, none of the daily bullish closes have been overly impressive, suggesting a) the presence of bears, and b) we are not seeing massive buying coming in yet.

Intraday, the pair is heading into the key intraday resistance at $32.00 which is a pin bar high from Friday. A break above here also has to come up against $32.54, so watch for potential reversal signals here. Buyers can look for pullbacks towards $31.00 before getting long.

XAG/USD" title="XAG/USD" width="800" height="575">

XAG/USD" title="XAG/USD" width="800" height="575">

Original post

The euro is still holding the uptrend in place with the series of HH’s (higher highs) and HL’s (higher lows), although it has been trotting in place for the last week. However, I do not expect this to remain for this week. The lines in the sand are in place, which offer short term plays for day traders, offering a low risk-high reward trade, but watch for intraday impulsive price action into the short term range levels for the next direction. Preference is still for a buy, but open to selling.

EUR/USD 1" title="EUR/USD 1" width="800" height="575">

EUR/USD 1" title="EUR/USD 1" width="800" height="575">EUR/JPY

After looking at the daily chart, I wanted to step back and look at the weekly chart for this pair. The EUR/JPY has gained for 6 weeks in a row, which is incredible. Last week it formed a pin bar, suggesting the pair is still underpinned. However, the pair only closed up 70pips on the week and still failed to close above the 120 big figure level.

This level will need to be cleared and closed above to bring in new bulls. Otherwise a pullback will be the only other option to bring them in, especially considering Thursday was a big up day and continued with no follow up buying, so there may not be many bulls left to get in.

At this moment, I’ll wait for a pullback towards 116 before getting back in, unless there is a convincing break and close above 120.70.

EUR/JPY" title="EUR/JPY" width="800" height="575">

EUR/JPY" title="EUR/JPY" width="800" height="575">S&P 500

Starting off the week via a trend pin bar off a role reversal level, the major index gained twice to end the week, clearing a multi-year high in the process, just south of 1480. Considering the index feels over-extended, I’ll only buy on pullbacks, but I’ll also keep the other eye on a possible reversal at these levels, as I’m guessing there are option players parked under the 1500 level. Look for longs on pullbacks near 1475, so watch for possible price action reversal signals here.

Silver

After finding the yearly bottom just sub $29.50 via a pin bar reversal, the precious metal has climbed 7 out of the last 10 days, suggesting the metal was being accumulated sub $30. However, none of the daily bullish closes have been overly impressive, suggesting a) the presence of bears, and b) we are not seeing massive buying coming in yet.

Intraday, the pair is heading into the key intraday resistance at $32.00 which is a pin bar high from Friday. A break above here also has to come up against $32.54, so watch for potential reversal signals here. Buyers can look for pullbacks towards $31.00 before getting long.

XAG/USD" title="XAG/USD" width="800" height="575">

XAG/USD" title="XAG/USD" width="800" height="575">Original post