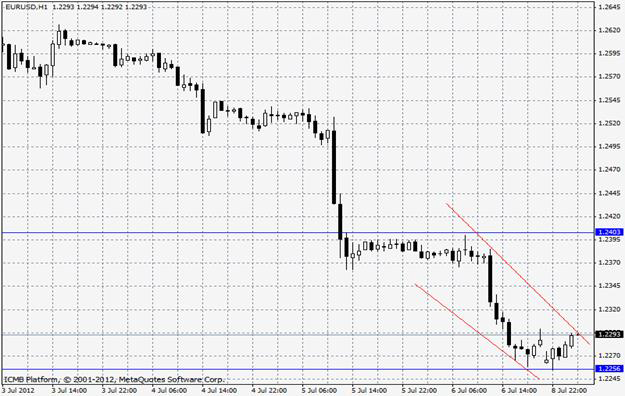

The euro touched its lowest level in two years before regional finance ministers gather in Brussels today to discuss crisis-fighting measures adopted by heads of government at a summit last month. The 17-nation currency weakened versus most of its 16 major counterparts before a bill sale in Italy this week. The euro earlier slid to as low as $1.2251, the weakest since July 2010 before trading at $1.2281, 0.1 percent lower than the close on 6th of July. The shared currency lost 0.3 percent to 97.65 yen.

The world’s most-accurate foreign-exchange strategists say the worst is over for the euro this year, putting them at odds with traders who see more pain as the region’s economy shrinks and the sovereign debt crisis deepens. Wells Fargo expects the euro to reach $1.26 next quarter before easing back to $1.24 in six months. The bank, whose currency calls had an average margin of error of 3.52 percent was the most accurate forecaster for the third consecutive period. EUR/USD" title="EUR/USD" width="625" height="396">

EUR/USD" title="EUR/USD" width="625" height="396">

GBP/USD

U.K. government bonds rose, snapping a four-week decline, as the Bank of England voted to expand its asset-purchase program by 50 billion pounds ($77.6 billion) to help contain borrowing costs. Ten-year yields dropped to the lowest in a month as signs the European debt crisis is worsening boosted demand for the relative safety of U.K. securities. Ten-year gilts outperformed 30-year debt as the central bank left its purchase categories unchanged from its previous round of buying. The pound climbed to the strongest since 2008 against the euro after the European Central Bank refrained from committing to help bring down bond yields in Spain and Italy.  GBP/USD" title="GBP/USD" width="624" height="468">

GBP/USD" title="GBP/USD" width="624" height="468">

USD/JPY

Core Machine orders in Japan plummeted a seasonally adjusted 14.8 percent on month in May, the Cabinet Office said, coming in at 671.9 billion yen. That was well shy of forecasts for a contraction of 2.6 percent on month following the 5.7 percent increase in April. On a yearly basis, core machine orders added 1.0 percent also sharply below estimates for a rise of 7.0 percent following the 6.6 percent increase in the previous month. The total number of machinery orders, including those volatile ones for ships and from electric power companies, saw a decline of 14.5 percent on month and 6.8 percent on year in May.

Japan saw a current account surplus in May, the Ministry of Finance said, down 62.6 percent on year. That was far below forecasts for a surplus of 493.1 billion yen after showing an Y333.8 billion yen surplus in April. Analysts also were looking for a decline of 13.6 percent on year following the 21.2 percent contraction in the previous month. The trade balance showed a deficit of 848.2 billion yen, up an annual 10.0 percent, after showing a shortfall of 463.9 billion yen a month earlier. USD/JPY" title="USD/JPY" width="624" height="468">

USD/JPY" title="USD/JPY" width="624" height="468">

AUD/USD

Australia’s dollar fell against most of its major peers as Asian stocks extended a global rout and amid concerns China’s economy is slowing, sapping demand for higher-yielding currencies. The so-called aussie lost 0.1 percent to $1.0205. It fell as much as 0.5 percent to 80.96 yen, the weakest since June 29, before trading 0.3 percent lower at 81.15 yen. The Australian currency dropped after a report showed U.S. jobs growth last month was weaker than economists expected.

China’s Premier Wen Jiabao said downward pressure on the nation’s economy is still relatively large, the official Xinhua News Agency said. Australian government bonds rallied, pushing the yield on benchmark 10-year debt down as much as 10 basis points, or 0.1 percentage point, to 3 percent. The rate on the 15-year note, the country’s longest-dated debt, touched 3.25 percent, the lowest since 5th of June.  AUD/USD" title="AUD/USD" width="624" height="468">

AUD/USD" title="AUD/USD" width="624" height="468">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Hits Lowest Level In Two Years Before Finance Ministers' Meeting

Published 07/09/2012, 07:10 AM

Updated 04/25/2018, 04:40 AM

Euro Hits Lowest Level In Two Years Before Finance Ministers' Meeting

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.