Volatility in the EUR/USD pair certainly increased as the US Federal Reserve announced the first rate hike in 9 years, but volatility was perhaps slightly more muted than expected. The 1.08 level has become crucial for this pair, and a break below will confirm the formation of a head and shoulders pattern.

The US Federal Reserve raised interest rates for the first time in 9 years as expected last week, by 25 basis points. Trading volumes were heavy on the result which led to a lift in volatility, but the swings were limited. This was testament to the Fed managing the markets expectations wellin the months preceding the announcement, and delivering on those expectations.

The euro was understandably weaker as the market digested the Fed's announcement and the potential for further rate hikes next year. The expected divergence in monetary policy is likely to see the pair drift lower in the early part of 2016.

The week ahead will still be busy as the rest of us wind down for the year. US GDP, home sales, durable goods orders and unemployment claims are all due. Watch out for choppy trading conditions as volumes dry up with the holiday season upon us.

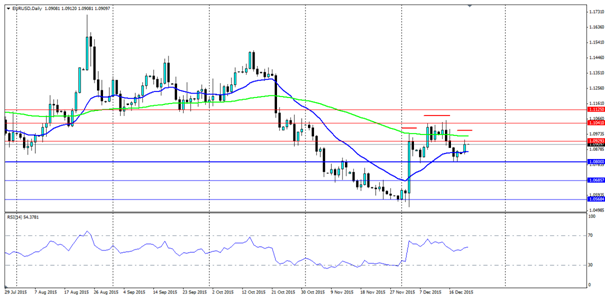

Technicals show a head and shoulders pattern forming, which could lead to a shift lower. The second shoulder is currently forming under the 100 day MA, which will be a solid bearish signal if the MA holds. The neck line at 1.0800 has become quite important for the pair, and a break lower of this will erase all of the months gains and see the early December lows become a target. Support is found at 1.0800, 1.0685 and 1.0568 while resistance is found at 1.0929, 1.1041 and 1.1125.