Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

As you might have guessed, the EUR/USD got pummeled today as continued worries over the upcoming elections in Greece and inability to form a government are increasing the odds of a Greece exit since it has till early June before the government runs out of cash. Just to give you an idea of how things are going in Greece, on Monday alone, €700mm fled the Greek banking system so this puts additional pressure of a bank run which would simply be the nail in the coffin.

As a result, the EUR/USD shed over 140pips on the day hitting a 4-mos low and is approaching the yearly lows just above 1.2630. A breach of here would send technical models reeling and likely trigger both stops and a fresh wave of selling.

Gold continues to feel it as well hitting 4.5mos lows and is approaching the critical December 30, 2011 swing lows at $1522. Should this get breached, the next layer of support would be $1486 and $1432. Keep in mind gold has climbed for 11 years straight, so a correction is well overdue.

Global markets also followed suit from Europe to the US with every major index selling off. The Dow ended down 63pts while the S&P lost .57%.

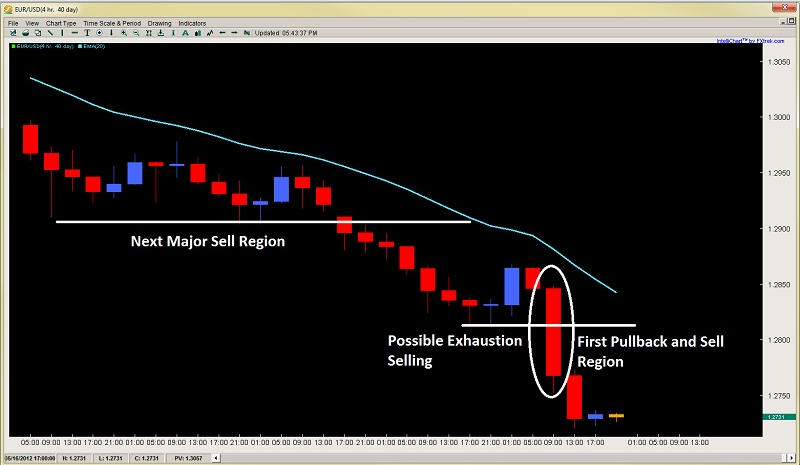

EUR/USD – Looking Over-Extended

Although I do not like buying this pair unless you hold a knife to my throat, I am feeling like the pair is over-extended at the moment. It has sold off 11 of the last 12 days with the last two days being quite aggressive in the selling forming a marubozu followed by another aggressive selling day. The 4hr chart shows possible exhaustion price action selling so I prefer to sell rallies, then trade the breaks lower.

I am looking at a possible pullback to the 1.2812 region as my most aggressive location to sell any rally which would be nice if it met up with the dynamic resistance and 20ema. Pending the right price action trigger, I would consider a short on a pullback here. My next level up to sell would be 1.2900 but I am viewing any rallies as an opportunity to sell targeting 1.2650 which is the yearly low and an eventual break lower.

As a result, the EUR/USD shed over 140pips on the day hitting a 4-mos low and is approaching the yearly lows just above 1.2630. A breach of here would send technical models reeling and likely trigger both stops and a fresh wave of selling.

Gold continues to feel it as well hitting 4.5mos lows and is approaching the critical December 30, 2011 swing lows at $1522. Should this get breached, the next layer of support would be $1486 and $1432. Keep in mind gold has climbed for 11 years straight, so a correction is well overdue.

Global markets also followed suit from Europe to the US with every major index selling off. The Dow ended down 63pts while the S&P lost .57%.

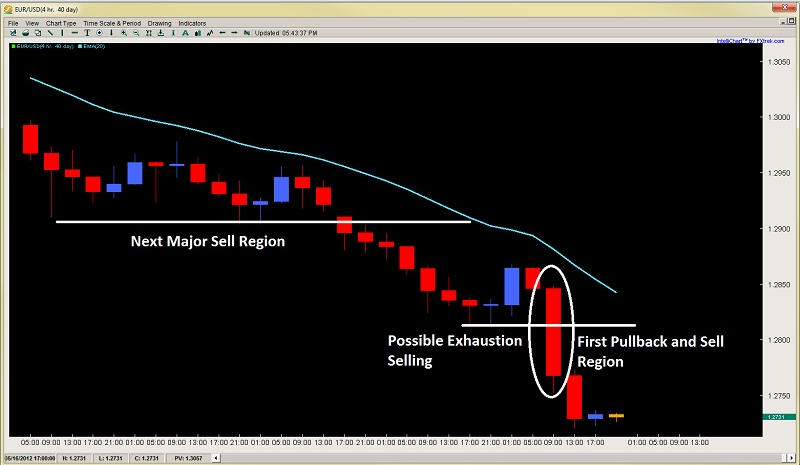

EUR/USD – Looking Over-Extended

Although I do not like buying this pair unless you hold a knife to my throat, I am feeling like the pair is over-extended at the moment. It has sold off 11 of the last 12 days with the last two days being quite aggressive in the selling forming a marubozu followed by another aggressive selling day. The 4hr chart shows possible exhaustion price action selling so I prefer to sell rallies, then trade the breaks lower.

I am looking at a possible pullback to the 1.2812 region as my most aggressive location to sell any rally which would be nice if it met up with the dynamic resistance and 20ema. Pending the right price action trigger, I would consider a short on a pullback here. My next level up to sell would be 1.2900 but I am viewing any rallies as an opportunity to sell targeting 1.2650 which is the yearly low and an eventual break lower.