The euro was broadly sold off last week as Greece continued to dominate headlines. Without a haircut, many in the market believe the debt burden will be too large for Greece in the long run. For now the euro has found some support that could see a rejection higher, or will it break lower thanks to the risk?

The Greek parliament voted a resounding 'yes' to accept the conditions of the agreed deal with the Eurogroup. This will see tougher tax hikes and spending cuts than the public voted against just a week ago, which has left many bewildered but PM Tsipras was out of options. The Germans are still against a debt haircut, which would make existing repayments more manageable. There is still downside risk for the euro.

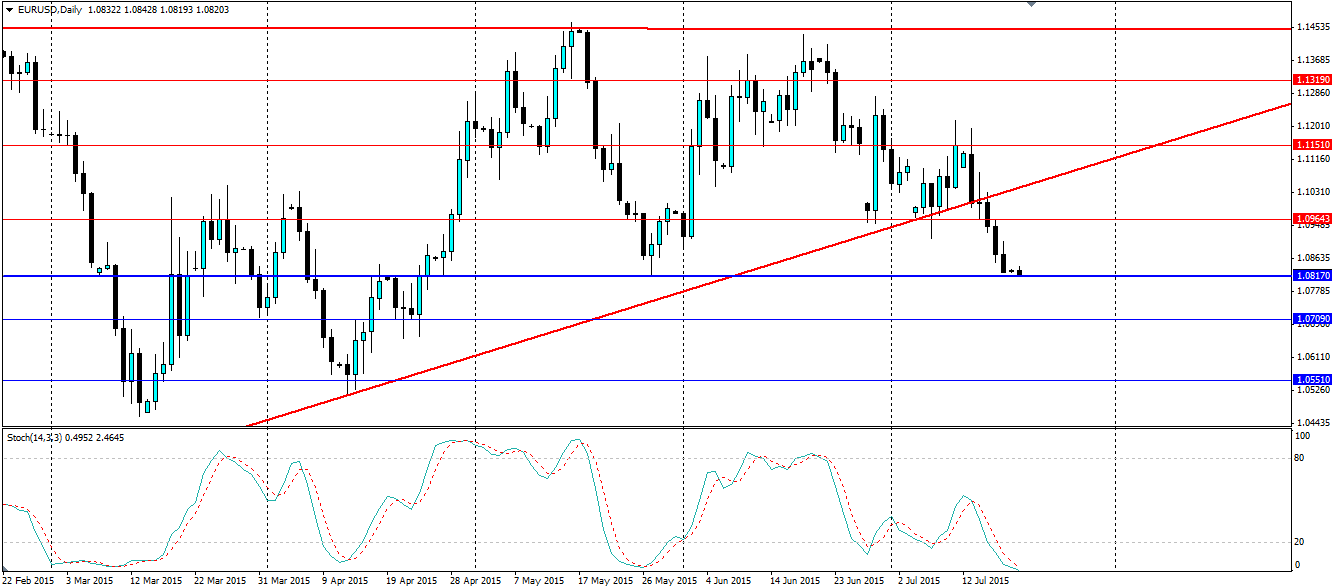

For now the risk appears to be priced in with the euro pushing lower out of the upward sloping triangle, but it has found some support at the late May swing point at 1.0817. This is a level that was a point of interest for price in the downtrend earlier this year. The Stochastic oscillator is extremely low, with a reading at just 0.50 (out of 100.00). This could indicate the momentum is still firmly in the bearish camp which only leaves room for breakout lower.

This is the risk that the support could fail, in which case 1.055 could be targeted, or even the low found in March at 1.0461. This would be the continuation of the bearish breakout from the consolidation pattern we were expecting last week.

For now, however, we see the likely outcome as a bullish bounce with consolidation in the short term. But anything below the current support will likely see the bearish run extend. Support is found at 1.0817, 1.0709 and 1.0551 with resistance found at 1.0964, 1.1151 and 1.1319.