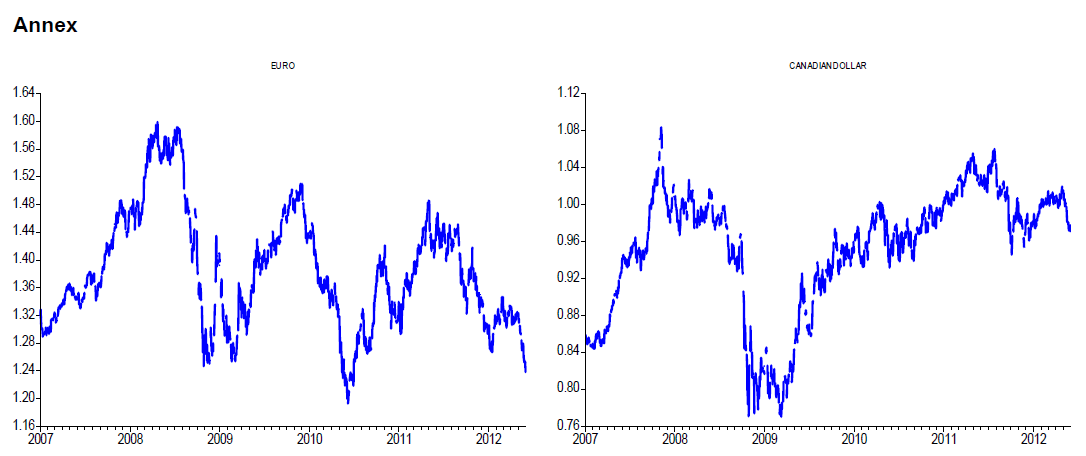

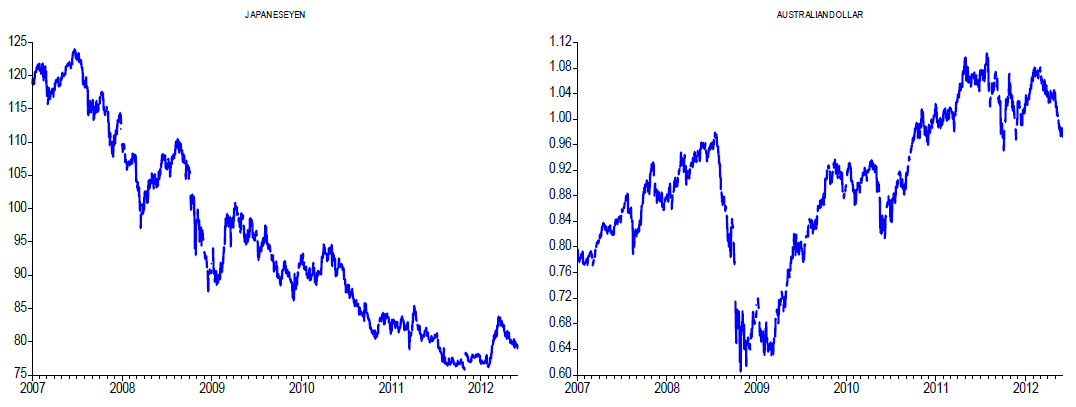

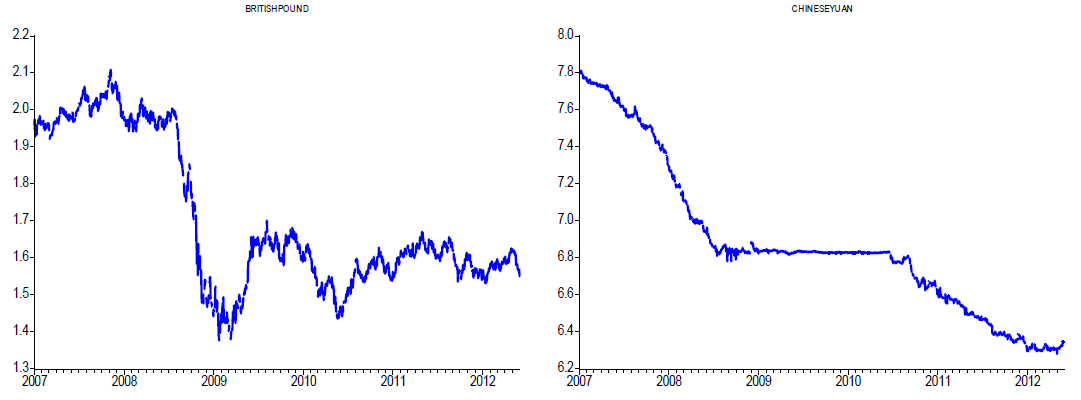

For months now, we’ve been warning about investor complacency regarding Europe. Markets had been grasping at straws, trying to see the positives even when there were none. And in May, the euro finally succumbed to gravity as eurozone banking troubles entered a new more acute phase, and Greece took one giant step closer to the euro exit door. The over- 6% depreciation of the euro against the US dollar in May took the common currency past even our below-consensus mid-year target. In our view, the euro slump has momentum and, as a result, we’re bringing forward our call for the euro to hit USD 1.18 US by year-end (rather than Q1 of 2013 in our previous forecast).

Why such a pessimistic take? There’s no single reason, but rather a litany of problems for which there seem to be no end in sight. The eurozone recession is deepening, a financial crisis is brewing as the banking sector grapples with solvency problems, governments are missing their deficit targets and therefore making little headway in capping their debt, fiscal policy continues to be contractionary with ongoing austerity measures, and policymaking remains seriously flawed as evidenced by the inadequate and belated response to the crisis.

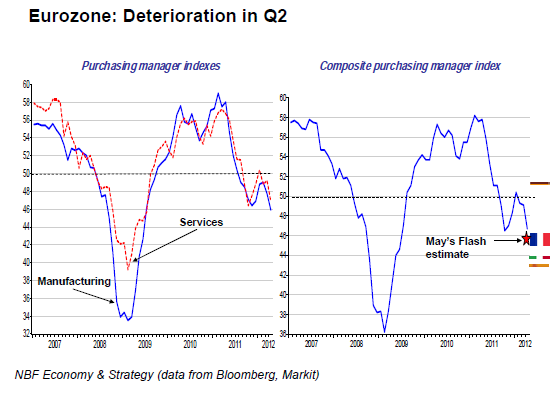

While the eurozone hasn’t had two successive quarters of GDP contraction (with Germany helping keep Q1 growth flat after Q4’s contraction), there’s little doubt, looking at the soaring unemployment rates, that a recession is underway and that it’s deepening. Germany aside, most countries are either heading for or are in recession, while some are in an outright depression with jobless rates above 20% (Spain and Greece come to mind). Prospects for Q2 aren’t great either, with May’s flash PMI slumping to the lowest since mid-2009.

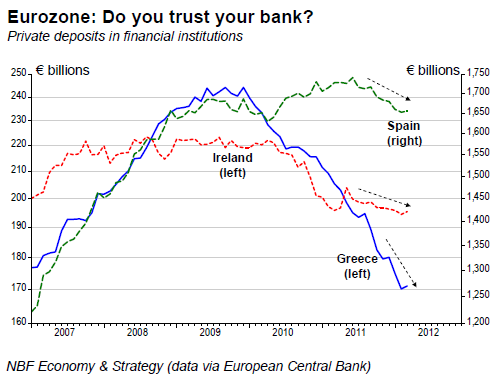

Besides the deepening recession, there’s a financial crisis in the making. Banks, badly battered by massive writedowns relating to the ongoing recession, a real estate bust and exposure to shaky sovereigns, now have to contend with bank runs. Depositors, particularly in the periphery, concerned about the solvency of their domestic banks, or an exit by their respective countries from the eurozone, are sending their cash elsewhere.

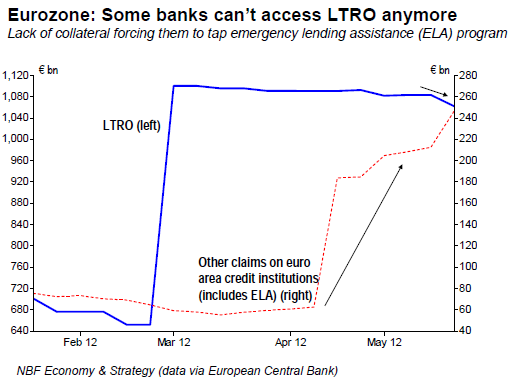

Adding to the miseries of the European banking sector is the waning influence of the ECB’s long-term refinancing operations, which have helped provide liquidity to cash-strapped banks late last year and in February this year. With several sovereign bonds plunging in May, the value of collateral offered by some banks to the ECB has dropped enough as to make it harder for them to qualify for LTRO loans. That’s forcing some of them to tap the emergency lending assistance program. Clearly, a set of more forceful measures than the stop-gap ELA is needed from European policy makers.

In the meantime, the euro is likely to remain under pressure. Given the ongoing bank runs, we wouldn’t be surprised to see capital controls being implemented. Desperate times indeed call for desperate measures. That, however, is likely to be a negative for the euro.

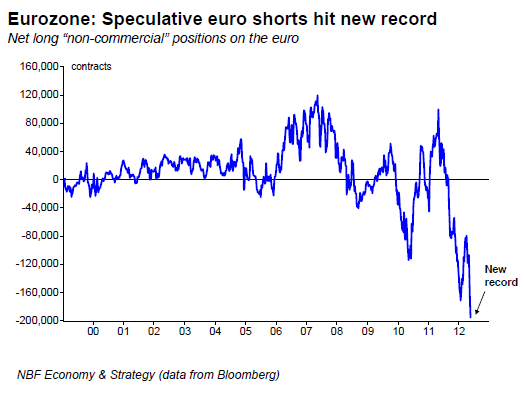

There’s, of course, the potential for a temporary rebound as record speculative short positions are unwound, coinciding with any signs of progress on the policy front. Work will probably be done on tweaking the fiscal compact, on boosting the firepower and mandate of the ESM, and on jointly issued eurobonds. But given the high degree of polarization within the ranks of European policymakers, we anticipate a long drawn out process which would keep the euro’s trajectory biased downwards over the coming months. Our base-case scenario assumes that the right policy mix will be introduced as to help the euro break its downward trajectory in 2013.

Soft Patch For US Economy

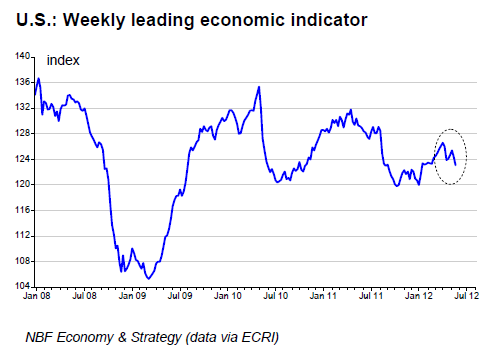

As Operation Twist comes to an end in June, markets are evidently speculating on the Fed’s next move. While not sounding overly dovish, Chairman Bernanke has made it clear that the Fed stands ready to do more if necessary. The current soft patch through which the US economy is navigating has certainly raised the probability of some Fed action.

Monthly indicators indeed suggest that domestic demand is softening. Consumers are taking a breather in Q2 after a healthy first quarter when consumption accounted for the bulk of the GDP increase. Moreover, a second consecutive monthly drop in orders of non-defense capital goods in April hints at a deceleration in investment spending in Q2. The labour market also seems to be moderating with soft nonfarm payrolls and elevated weekly initial jobless claims.

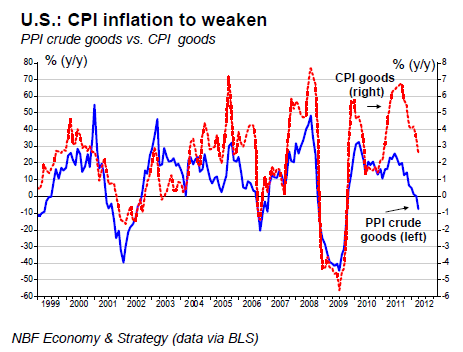

The Fed is likely to act, but the question is to what extent? While we continue to view a large scale bond buying program (i.e. QE3) as unlikely, it’s clear that the bar for such a drastic measure has come down lately. The soft patch in the US is just one of the factors that may motivate the Fed to provide some more stimulus. Disinflation is another. True, both headline and core annual inflation are at 2.3%, i.e. well above the levels of August 2010 when QE2 was dispatched. But recent trends in the PPI suggest a forthcoming drop in consumer price inflation. The dollar’s recent appreciation will also work as to restrain inflation via import prices, albeit with a small lag.

Moreover, external developments support decisive action, perhaps a coordinated response with other central banks. What the Fed could do is ensure that the financial system remains flush with liquidity in the face of potential risks of contagion from Europe.

Canadian Dollar Holds Firm For Now

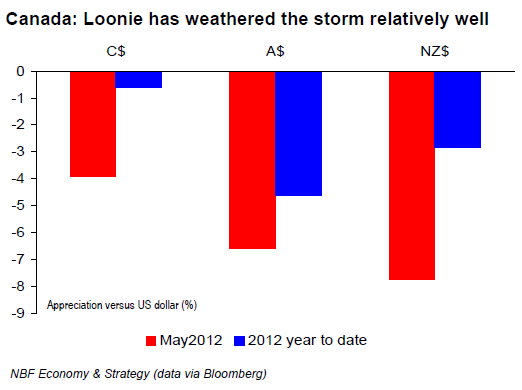

In light of the Europe-related market jitters, the Canadian dollar has fared relatively well. True, the loonie lost around 4% in May, but that was a much better performance than other commodity currencies. So far this year, versus the USD, CAD is down just 0.6% compared to the nearly 5% decline for the AUD/USD cross.

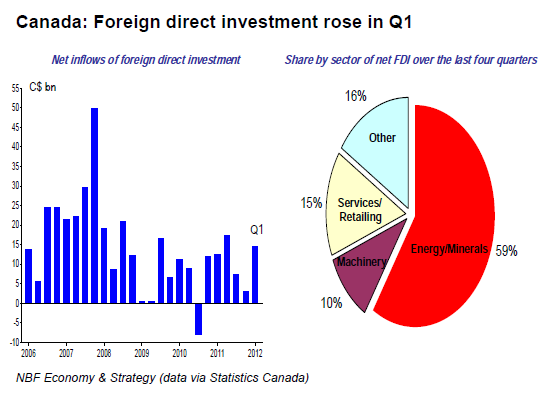

What’s been supporting the loonie this year? Not only have capital flows been coming in at a healthy clip, but the quality of those flows has improved. In Q1, net foreign direct investment soared to CAD 14.6 bn, the highest since the second quarter of last year. The energy and minerals sectors again took the lion’s share of those inflows at CAD 8.2 bn in Q1. Over the last four quarters, the energy/minerals sector’s share of net FDI flows has averaged 59%. With the drop in commodity prices, the inflows in the energy/minerals sector may have softened a bit in Q2, although prospects remain good over the longer term.

Portfolio inflows were also solid in Q1 with healthy foreign demand for Canadian government bonds. We wouldn’t be surprised if that trend extended into Q2, with a flight to safety/quality given the Europe-related market jitters. Indeed, Canada’s government bonds have never looked as good in a shrinking AAA universe.

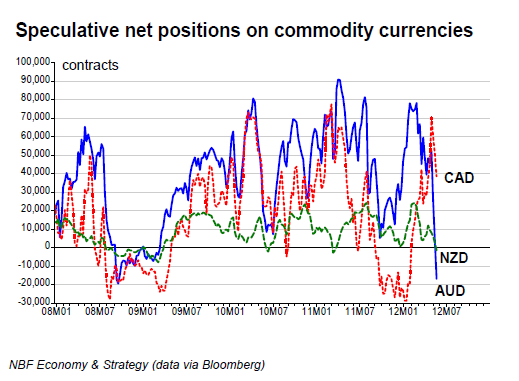

Speculators seem to agree with us about Canada’s relatively better investment prospects. They have remained long CAD while shorting other commodity currencies like the Australian and New Zealand dollars. Rarely has there been such a divergence between CAD and AUD spec positions.

CAD’s relative resilience is all the more impressive given the pared down expectations of interest rate hikes, following a soft print for Q1 GDP growth ― the latter came in at 1.9% annualized, versus the 2.5% that the Bank of Canada had anticipated in its latest Monetary Policy Report.

That said, the likely worsening of the European situation should allow the US dollar to strengthen, meaning that a depreciation of loonie is likely over the near to medium term. We have, as a result, lowered our USD/CAD target to 1.05 by year end. There is, of course, the risk of a much larger depreciation in case the European crisis ends up causing a global recession. But barring the latter horror scenario, CAD should continue outperforming other commodity currencies thanks to solid capital inflows.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Finally Succumbs To Gravity

Published 06/05/2012, 02:11 AM

Updated 05/14/2017, 06:45 AM

Euro Finally Succumbs To Gravity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.