Euro is getting crushed this morning as the European Central Bank has once again decided to loosen monetary policy. The European Central Bank cut all of its benchmark interest rates at its September meeting, following up on its decision in June to move its deposit rate into negative territory. Another surprise came in that, from the October meeting, the European Central Bank will begin purchasing assets from the private sector in a bid to loosen credit markets within the Eurozone.

This additional measure is the beginning step to a larger plan for the full-scale purchase of European government debt, we believe. There are significant challenges to getting to this destination of course; drastic legal changes are required and we know that the German Central Bank was unhappy with the vote on ABS. There is little chance of getting the Germans onside for full-scale quantitative easing without a significant deterioration in the continent’s economic outlook.

The decision to further loosen policy is a direct result of the continual falls in medium term inflation expectations through the Eurozone. Mario Draghi telegraphed in his speech at the Jackson Hole economic symposium that he was unhappy with five year expectations falling below the 2% level. This month’s run of economic forecasts has seen the European Central Bank’s own forecasting team cut its thoughts on CPI through 2014 to a fresh low of 0.6% – it currently sits at 0.3% – with inflation only set to hit 1.4% by 2016.

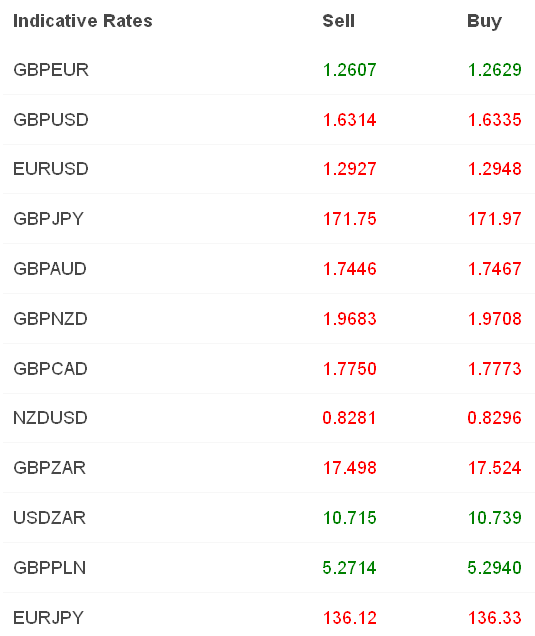

The reaction on the single currency was immediate. EUR/USD fell to the lowest level in 14 months as the measures were confirmed at Draghi’s press conference. It fell across the board, with particular focus now on the relationship between the euro and the Swiss franc. Any weakness in the euro brings the pair close to the Swiss National Bank’s floor of 1.20 and forces the Swiss authorities to buy the single currency. EUR/CHF sits at 1.2061 this morning.

It is too early to tell whether these developments will help the Eurozone but we cannot underestimate the resolve of the European Central Bank. Draghi’s “whatever it takes” speech looks ever more prescient, as every day passes. The key however, is how much policy is left in the ammo bag. Draghi emphasised that the cuts in interest rates now represent the lower bound of where rates will move to. Flippantly, that does mean that the next rate movement will be up although there is little to suggest that would happen in the next three to five years.

European debt markets have gone bonkers on the prospects of further easing, driving prices higher and yields lower. Yields on German debt for up to four years are negative; people are paying to lend the Germans money. Peripheral debt is also flying as everyone begins to believe that the ECB will be hoovering up these bonds like a fat man at a buffet.

I doubt we will see too many try to catch the falling knife that is the euro through today’s session. The EUR/USD move and the subsequent sell-off in GBP/USD was exacerbated by a very strong ISM number from the US’s services sector. The overall index rose to 59.6 from 58.7 previously – the highest since August 2005. Jobs, prices and output were all represented well in their subcomponents and bid up expectations around this afternoon’s payrolls announcement.

Despite the disappointment of a miss in yesterday’s private sector ADP announcement – 204k jobs added vs 220k expected – expectations of the official BLS number remain close to 230k. Any jobs release is more than jobs added and we will be looking for an increase in average hourly earnings and the participation rate to truly show-off a contraction in the level of slack running through the US labour market. This would also keep the USD on its current course higher and would lead a press into the 1.28s and 1.62s in GBP/USD and EUR/USD respectively.

Yesterday’s Bank of England decision to hold rates was as obvious as it was boring to cover.