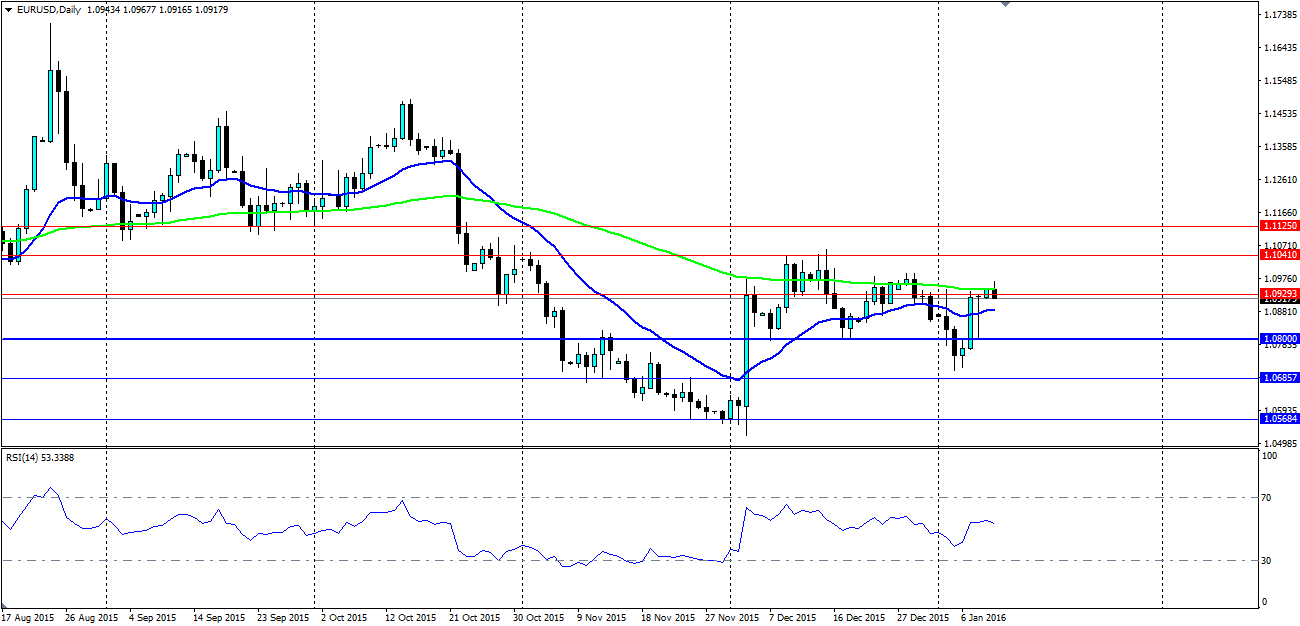

What a week to kick off the New Year! Volatility was felt across the board with the euro trading in a 230 pip wide range, ultimately ending the week higher as it was sought out for its relative low yield and safety. Watch for a squeeze between the 100 day MA and the 1.0800 support level.

The euro was volatile against the US dollar during the first week of the New Year. It was a week that will be remembered for some time as Chinese stock markets threatened to implode and Wall Street had its worst opening week ever.

The euro has an interesting relationship with the US dollar at the moment, with the lower yielding euro being perceived as 'safer' during the turmoil. It is certainly becoming a base for carry trades with the higher yielding US dollar.

EU CPI missed estimates of 0.3% to come in at 0.2% y/y, but the euro gained late in the week as EU Unemployment improved to 10.5%. A poor US wage growth figures outweighed a strong headline NFP figure (292k vs 200k exp) helping the euro to maintain strength at the end of the week.

The news is relatively light out of the EU this week, but the Eurogroup meeting is taking place with could throw up some headlines. Watch for a number of FOMC members speaking, along with the Fed's beige book and US retail sales. Any hint at a slower than expected pace of rate rises will see the euro rally.

Technicals show the volatile week the euro had. It briefly pushed below the 1.08 mark but managed to regain the ground, but watch for another test of this level. The 100 day MA is currently holding as resistance which could see the pair squeezed between the two levels leading to our slight bearish bias. Support is found at 1.0800, 1.0685 and 1.0568 with resistance at 1.0929, 1.1041 and 1.1125.