Key Points:

- US Federal Reserve decision on funds rate looms.

- Volatility extremely likely.

- Cable's fundamental direction difficult to predict.

Last week ultimately proved relatively negative for the euro dollar as Friday’s session saw the pair declining sharply following an unexpected rise in US Core CPI from 0.2% to 0.3% m/m.

Subsequently, the uptick in US inflation data refocused the market on the potential for rate hikes which caused the pair to figuratively fall off the cliff to close the week around the 1.1143 mark. However, the week ahead could be just as volatile for the pair which is why it is salient to review what’s on the horizon for the venerable currency.

The euro dollar initially started last week relatively flat despite a fall in the Eurozone’s Industrial Production figures to -1.1% m/m. However, despite the relative resilience of the pair, Friday proved its undoing as the US Core CPI data surprised the market with a rise from 0.2% to 0.3% m/m.

The gain in inflation subsequently stoked the fires around the coming FOMC meeting and the euro experienced a hellish decline to finish the week around the 1.1143 mark.

Looking ahead, the coming week is going to focus heavily upon the outcome from Wednesday’s FOMC meeting. Subsequently, the likelihood of seeing sharp volatility is relatively strong given that the central bank has been fairly opaque with their expectation setting in the lead up. In fact, statements from a variety of FOMC members are seemingly split on whether a rate hike is currently warranted.

The vast majority of forecasts predict the Fed holding the FFR steady at 0.50%, however, there has been plenty of jawboning from the hawks which clearly clouds the pending meeting. Subsequently, the euro is likely to be volatile and experience some sharp swings regardless of the meeting’s outcome.

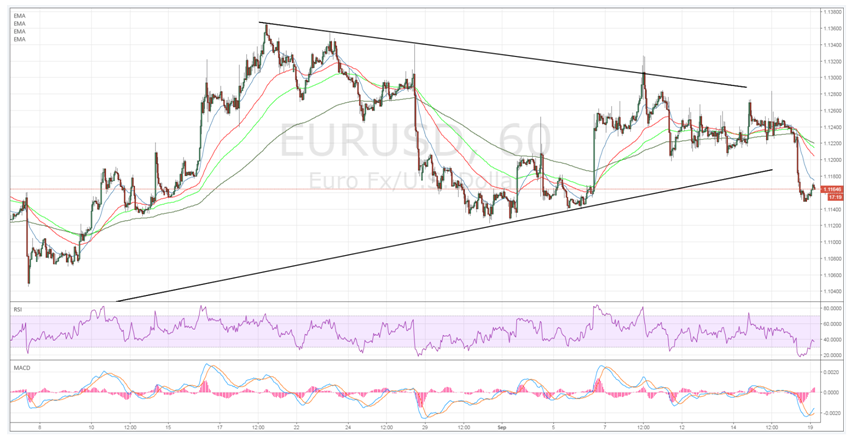

From a technical perspective, the initial bias for the week ahead is relatively neutral given that the move back below the 1.12 handle appears to have stalled. Price action is currently resting upon an area of support and a downside breach would be needed prior to turning our bias to the short side.

The longer term trend still remains predisposed to the downside but 1.1121 remains the key battleground. Support is currently in place for the pair at 1.1121, 1.1042, and 1.0950. Resistance exists on the upside at 1.1366, 1.1426, and 1.1533.

Ultimately, no matter which way the US Federal Reserve elects to take their interest rate policy, it’s likely to instigate some serious moves by the euro dollar. Subsequently, monitor developments closely and consider your exposure ahead of the vote as this is quickly becoming one of the hardest events of 2016 to position for.