The euro continues to lose ground and is in negative territory on Tuesday. In the European session, EUR/USD is trading at 1.1036, down 0.26%.

German Ifo Business Climate dips

Germany continues to post soft numbers this week, pointing to weakness in the eurozone’s largest economy. The Ifo Business Climate index fell from 88.6 to 87.3 in July and missed the consensus estimate of 88.0. This was the lowest level seen since November 2022. Business Expectations also slowed slightly, from 83.8 to 83.5 points. This was just above the consensus of 83.4 points.

The soft business confidence reading comes a day after disappointing PMI releases, which saw a deceleration in manufacturing and services in June. The numbers could impact the ECB’s rate policy after a widely expected hike at the Thursday meeting. The ECB has aggressively raised interest rates in order to curb inflation but runs the risk of tipping the weak eurozone economy into a recession. The ECB has signaled that it will raise rates on Wednesday, which would bring the main rate to 3.50%. What happens after July is less certain. This week’s soft German data will provide support to dovish ECB policymakers who want the ECB to ease up on rate hikes, even though inflation remains well above the 2% target.

In the US, we’ll get a look at consumer confidence and manufacturing data later on Tuesday, with both expected to improve. The Conference Board Consumer Confidence index, which rose sharply in June to 109.7, is expected to rise to 111.8 in July. The Richmond Fed Manufacturing index, which has been mired in negative territory, is expected to improve in July to -2, up from -7 in June.

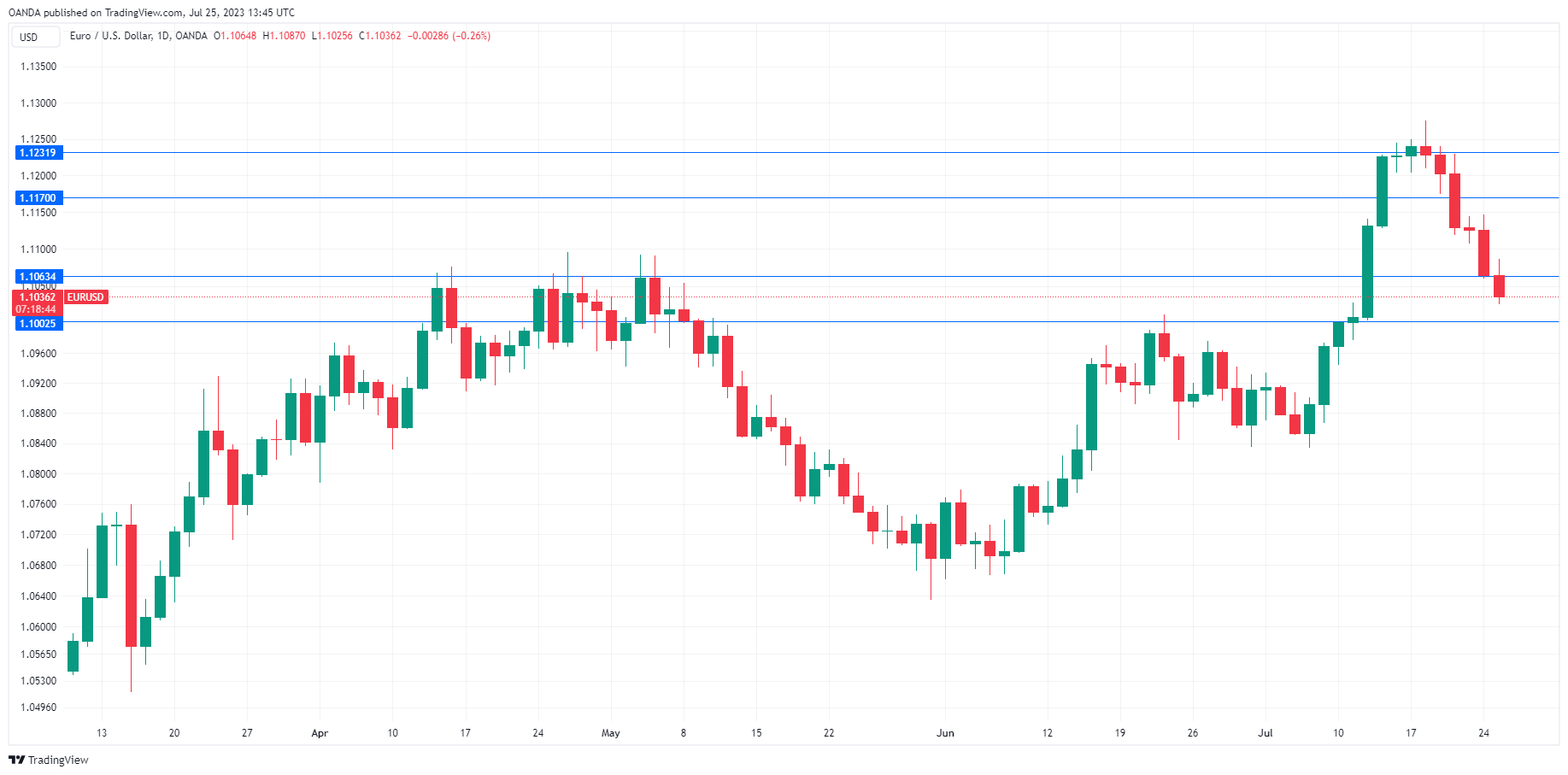

EUR/USD Technical

- EUR/USD is putting pressure on support at 1.1063. The next support level is 1.1002

- 1.1170 and 1.1231 are the next resistance lines