For the 24 hours to 23:00 GMT, the EUR/USD declined 0.71% against the USD and closed at 1.2645, after Germany’s ZEW indicator of economic sentiment declined for the 10th consecutive month to a reading of -3.6 in October, thereby registering negative reading for the first time in nearly two years, after recording a level of 6.9 in September and compared to market expectations of a fall to a level of 0.0.

In other economic news, the ZEW’s index of Euro-zone economic sentiment dropped to 4.1 in October, down from previous month’s level of 14.2. Markets were expecting it to register a drop to a reading of 2.5. Meanwhile, industrial production in the region contracted 1.8% on a monthly basis in August, higher than market forecasts for a 1.6% decline and following a revised advance of 0.9% in the previous month.

Separately, Germany’s Economy Minister, Sigmar Gabriel downgraded the nation’s growth forecasts for 2014 to 1.2% from 1.8%, citing weaker economic growth and intensified geopolitical tensions.

Yesterday, the European Union finance ministers wrapped up two days of talks in Luxembourg and urged for more investment to improve the bloc’s struggling economies. Additionally, the ministers jointly agreed to crack down on tax evasion that costs the region an estimated $1.26 trillion a year.

In the US, the small business optimism index fell to a level of 95.3 in September, compared to a reading of 96.1 in the prior month. Meanwhile, the Redbook index climbed 3.8% in the week ended 10 October 2014, after advancing 5.4% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.2641, with the EUR trading a tad lower from yesterday’s close.

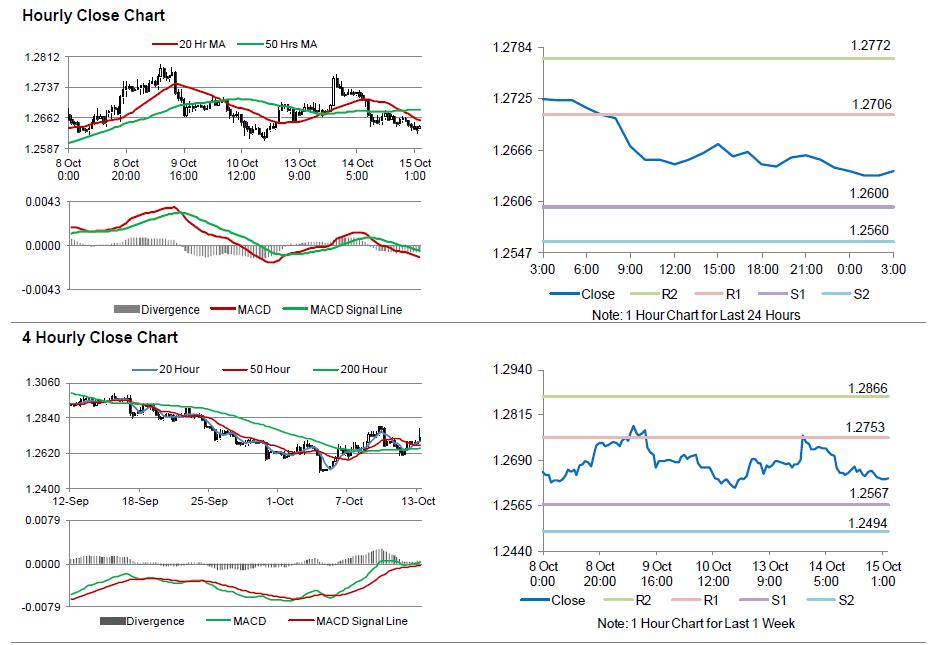

The pair is expected to find support at 1.2600, and a fall through could take it to the next support level of 1.2560. The pair is expected to find its first resistance at 1.2706, and a rise through could take it to the next resistance level of 1.2772.

Trading trends in the Euro today would be determined by Germany’s inflation data as well the ECB Chief, Mario Draghi’s speech, scheduled in a few hours. Meanwhile, the US retail sales data, would also keep the investors on their toes, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.