Talking Points:

- Euro Probes Below 1.19 vs. US Dollar on Greece Fears, German CPI Ahead

- NZ Dollar Down, Japanese Yen Higher as Risk Aversion Sweeps Asian Markets

The New Zealand dollar underperformed in overnight trade, falling as much as 0.9 percent, as fading risk appetite punished the sentiment-geared currency. The Asia Pacific regional benchmark equity index traded down close to 1 percent near the lows of the session as Japanese and Chinese bourses came online for the first time after the New Year holiday and moved to catch up with Friday’s losses on Wall Street. The yen proved best-supported as risk aversion put pressure on carry trades funded in the perennially low-yielding currency.

The looming snap election in Greece appears to be the catalyst behind investors’ dour mood. The country goes to the polls on January 25 after Prime Minister Antonis Samaras failed to win approval for his nominee to the presidency in a third and final legislative vote last week. The opposition Syriza party leads in the polls – albeit by an increasingly narrowing margin – and traders fret that if victorious, its opposition to austerity measures accompanying Greece’s EU/IMF bailout will revive the risk of ejection from the currency bloc. The euro fell below 1.19 versus the US dollar for the first time since 2006 at the open of the trading week.

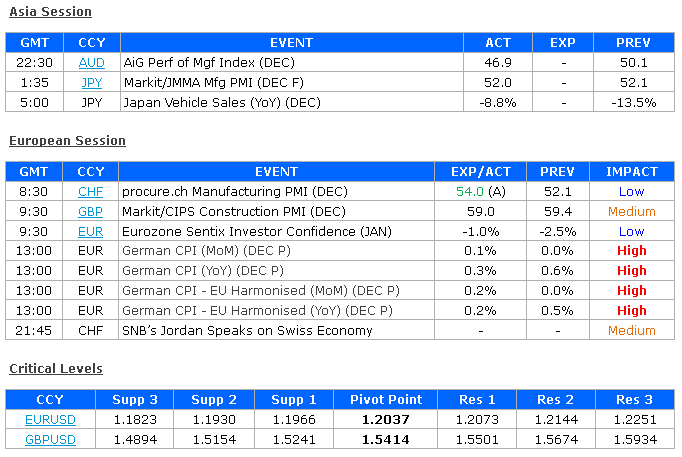

Looking ahead, December’s preliminary set of German CPI figures headlines the economic calendar in European trading hours. The benchmark year-on-year inflation rate is expected to decline to 0.3 percent, the lowest since October 2009. A soft outcome may compound downward pressure on the single currency amid building speculation about a looming expansion of ECB stimulus measures. Speaking in an interview with Germany’s Hamdelsblatt newspaper last week, the central bank’s President Mario Draghi said policymakers were in the midst of “technical preparations to alter the size, speed and composition of our measures at the beginning of 2015, should this become necessary.”