“Non-Farm Payroll Fridays” are called that for the prime reason that the release normally dominates the markets for that day – it is the market’s main focus. This was not the case last Friday, however, as everything was swept away in a wave of euro strength

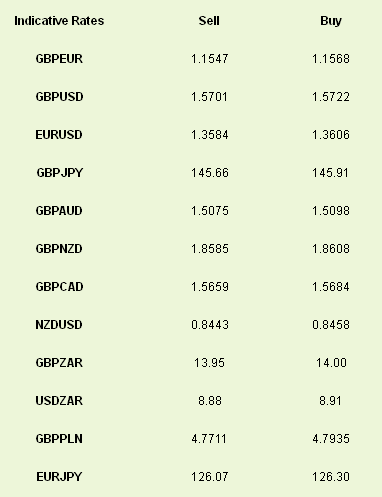

Optimism around the US economy has been one of the key characteristics of 2013 so far, and so it was proved by Friday’s numbers. While January’s number missed expectations slightly the upward revisions to November’s and December’s numbers meant that growth in payrolls has averaged 203k through the past 3 months. USD pushed onwards in the aftermath of the announcement with GBPUSD coming back down towards the 1.57 mark as a result.

GBP had started the day poorly following a miss on the latest manufacturing PMI (50.8 vs 51.0 expected). Given the negativity surrounding the UK economy it is good to see a sector expanding, albeit only slightly, with the output component the highest since September 2011. A key part of the figures was the increase in costs, with companies citing higher prices in chemicals, food, plastics, energy and metals. This will only increase following the recent GBP weakness, although a similar gain in exports has not been reported due to uncertain foreign demand. We expect that this will be the trend of things for UK industry throughout 2013, with the sector dipping between expansion and contraction.

While the UK PMI was better than that of most of its European competitors it did miss market expectations slightly, while Europe’s exceeded theirs (47.9 vs 47.5 expected). We also saw European unemployment surprise everyone by not increasing to 11.9% as expected, instead it stayed at 11.7%. So while the data from the UK was better, Europe’s was better than expected and EURGBP went ballistic as a result.

This continued in the afternoon session with EURUSD trading over 1.37 and GBPEUR coming through the 1.15 mark. We have already heard from some European companies that the increase in the value of the euro will be a major cause of lower profitability for them going forward. BASF, the large German chemical maker issued a similar statement on Friday.

To be honest it is not Germany that I am worried about when it comes to this euro move; it is the tourism industry of the Mediterranean. We know that the Spanish tourism industry was 11% lower in December even before this move. How many Brits will spend a fortnight on a beach on the Costas now that the holiday is another 6% more expensive. Add in the inflation we expect here and you have to think that “staycation” will be the most popular holiday this year.

This week’s ECB meeting has been made even more important by this development; Draghi hasn’t tended to comment on positive flows for the single currency in the past. Will he talk it down on Thursday?

The focus today is on Spain with the latest unemployment reading due. News reports suggest another job may be added to the pile should pressure on Mariano Rajoy increase following the supposed payments of backhanders to the PM. Yields on Spanish and Italian debt are a little higher this morning.

Elsewhere we have UK construction PMI which is expected to once again remain in contractionary territory albeit improve to 49.2 from 48.7.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Drives Onwards Ahead Of Draghi

Published 02/04/2013, 06:34 AM

Updated 07/09/2023, 06:31 AM

Euro Drives Onwards Ahead Of Draghi

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.