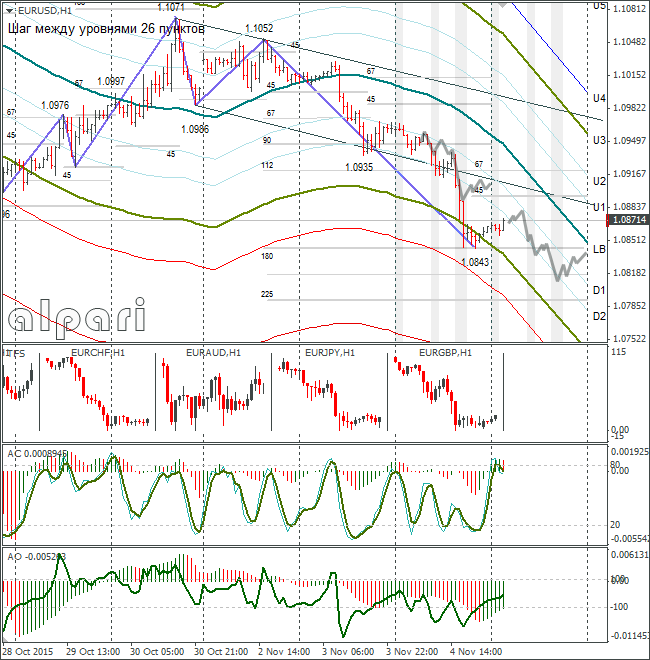

Hourly

Yesterday’s Trading:

Expectations of a euro weakening rang true. Strong service PMI data from the US’ ISM and ADP and comments made by Yellen lent support to the dollar.

Employment creation in the US private sector was down from 190k to 182k (forecasted: 180k).

The ISM’s index for October stood at 59.1 (forecasted: 58.0, previous: 59.0).

Main news of the day:

- 09:00 EET, German industrial orders;

- 12:00 EET, Eurozone retail sales;

- 13:45 EET, ECB’s Draghi to speak;

- 14:00 EET, BoE’s interest rate decision, MPC minutes, Carney to speak at 14:45 EET;

- 15:30 EET, US initial unemployment benefit applications and Fed’s William Dudley to speak;

- 16:10, Fed’s Vice President Fischer to speak;

- 16:50, US consumer confidence index;

- 17:00, Canadian PMI from Ivey;

- 20:30 EET, US FOMC member Lockhart to speak.

Market Expectations:

The dollar is receiving support from a growth in the likeliness that the US interest rates will be increased in September, in addition to a relaxing of ECB monetary policy, which is on the cards.

Today’s key event for the financial market is the Bank of England meeting. Forecasters expect the base rate to be left unchanged at 0.5%. The results of the MPC voting and what Carney has to say afterwards will bear importance for traders.

Technical Analysis:

- Intraday target maximum: 1. 0880, minimum: 1.0813, close: 1.0840;

- Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar has dropped beneath 28th October’s minimum. Now it just needs to break through the 1.0807-1.0838 support zone and open the road to 1.0520 up. The AO indicator isn’t showing bull divergence, so I expect to see an update of the minimum. My target is 1.0813. If the euro/pound cross doesn’t interfere, we could quite possibly see a test of 1.0800. Although, I highly doubt this will happen before the NFP comes out tomorrow.

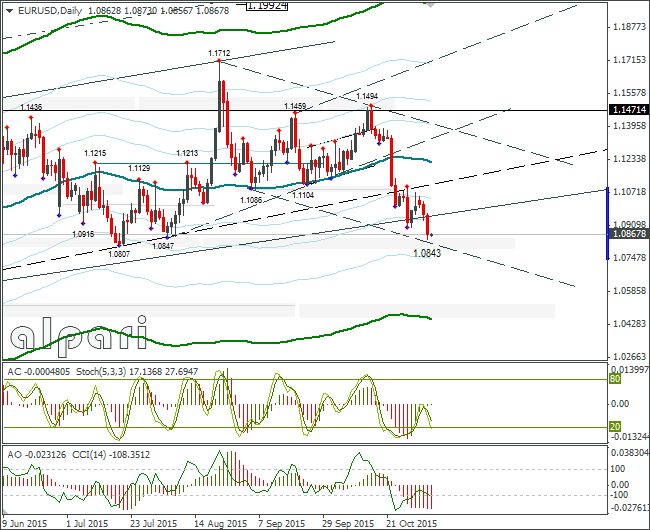

Daily

The minimum has been updated. Now we can target 1.0812/15. Now to the Weekly.

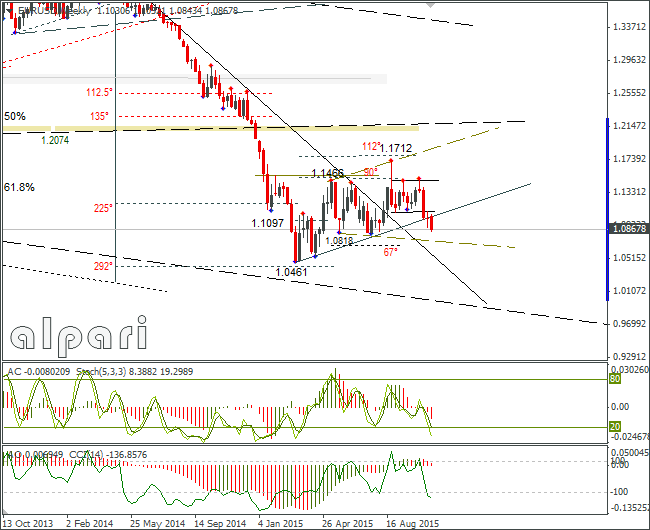

Weekly

The euro is gathering pace. The target is still 1.0818-1.0838. As soon as we pass this level, we can start to set our sights on 1.0520.