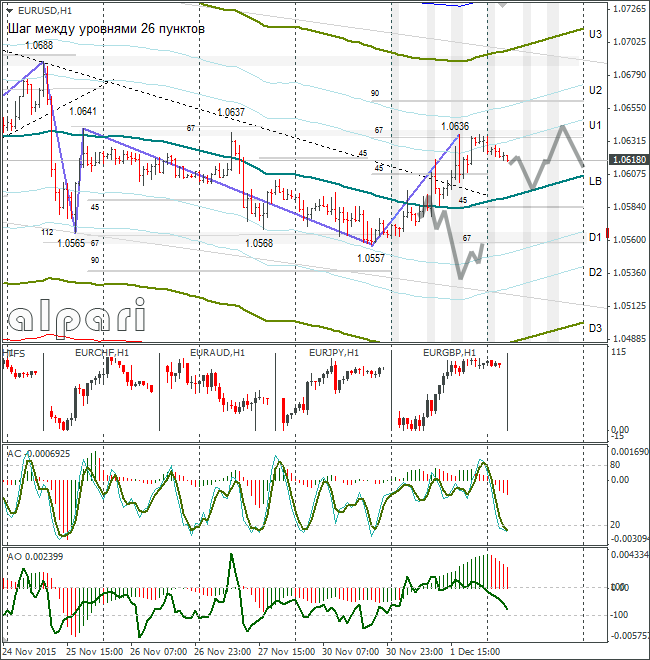

Hourly

Yesterday’s Trading:

On Tuesday, the euro received support from the low value of the UK business activity index. This facilitated a weakening of the pound and thereby a growth in the euro/pound cross.

The euro/dollar rose during the American session to 1.0636. Weak ISM and US Fed representative Evans forced the sellers to close euro short positions.

Evans believes that December is still too early to put up the US base rate due to low inflation.

The US ISM business activity index for November stood at 48.6 (forecasted: 50.5, previous: 50.1).

Main news of the day (EET):

- 11:30, UK construction activity index for November;

- 12:00, Eurozone CPIs and PMIs for November;

- 15:15, US unemployment change from ADP for November;

- 17:00, BoC’s interest rate decision and accompanying statement;

- 15:30 and 19:25, Janet Yellen to speak.

Market Expectations:

Financial market participants are guessing as to what decision the ECB will take and what Mario Draghi is going to say on Thursday. My opinion is to wait until the end of the week and then calculate the target levels for the euro and build trading plans.

There are two important events planned for the end of the week: the ECB meeting and the NFP. If the Non-Farm Payrolls comes out worse than expected, the euro/dollar will invert upwards even if the ECB undertakes more relaxation of it monetary policy (because this is already incorporated into the prices).

On Wednesday trader attention will be on the ADP, the Bank of Canada’s interest rate decision and a speech from Janet Yellen.

Technical Analysis:

- Intraday target maximum: 1.0640, minimum: 1.0595, close: 1.0615;

- Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar has corrected by 67 degrees from a 1.0557 minimum. A change in mood for the crosses has forced the sellers to close their short positions. It’s unlikely that the euro/dollar will update its weekly minimum before Thursday.

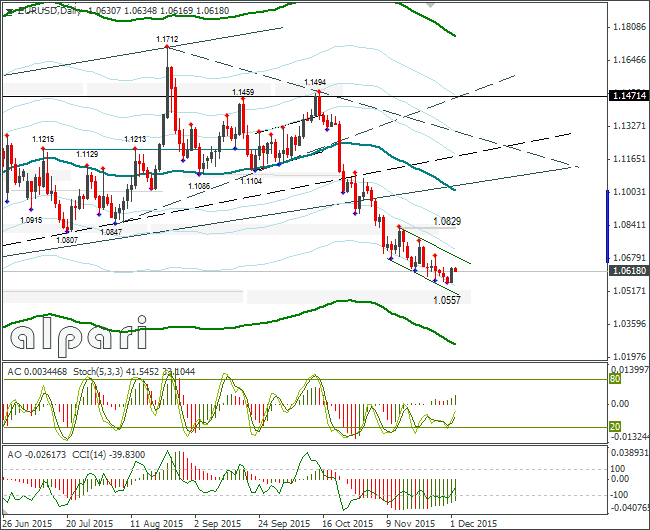

The daily stochastic has flipped upwards, the CCI is intersecting -100. Selling euro against the daily indicators is risky, even on the basis of expectations that the ECB is going to relax its monetary policy. It’s not worth trading euro at the moment just so that you can avoid setting off protective stops if there are fluctuations which go both ways.

In my forecast I’ve gone for a euro recoil to the LB and a growth to 1.0640. Signs of a turnaround have appeared.

Daily

On Tuesday, I didn’t wait for a test of 1.0530. Weak UK stats changed the game on the euro/pound and US stats forced the sellers to close their short positions on the euro. As a result, the stochastic indicator has inverted upwards, the CCI crosses -100. Before the ECB meeting it will be better to wait and see what happens and by this I mean abstain from euro trading.

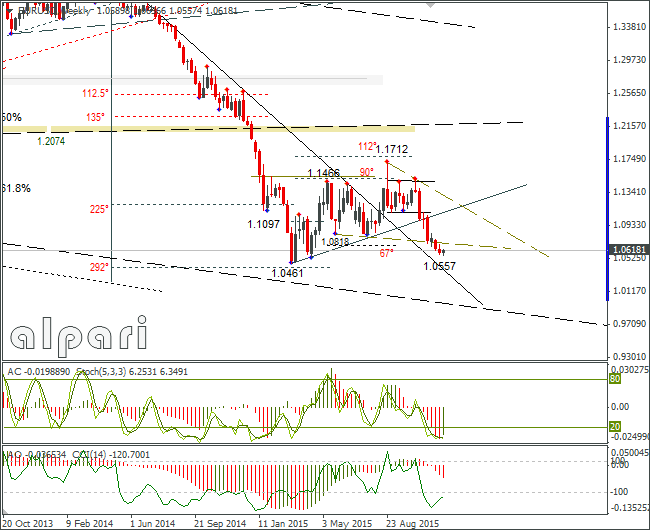

Weekly

After yesterday’s trading, the weekly candle’s picture has hardly altered.