Key Points:

- Price action reaches critical point.

- Medium term bearish trend likely to predominate.

- Expect a period of moderation and then further declines.

The euro continued its sharp decline last week as it was beset by volatility around the Federal Reserve’s decision to hike the FFR 25bps. In addition, a range of stronger US economic data also impacted the pair and saw it collapse to finish the week around the 1.0448 mark. Subsequently, it makes sense to take a look at what occurred last week and what potentially looms for the embattled pair.

Last week proved highly negative for the euro-dollar as the pair was dealt a blow by the US Federal Reserve’s decision to raise the Federal Funds Rate (FFR) 25bps to 0.50%. Although the hawkish decision was largely forecast, a strong bout of selling commenced which took the EURUSD to below the 1.05 handle. In addition, a range of US economic data also proved relatively robust with Core CPI lifting to 0.2% m/m whilst Unemployment Claims fell to 254k.

In contrast, the Eurozone Services PMI lost ground from 53.8 to 53.1 which further fuelled the selling. Subsequently, the pair never really had a chance to rally and ultimately closed the week out around the 1.0448 mark.

Looking ahead, the lead up to the Christmas holidays is likely to be fairly quiet for the pair given the lack of Eurozone data due for release. However, the US Initial Jobless Claims and Final Michigan Consumer Sentiment figures are due out and may impact the pair’s direction. Regardless, it’s likely that the pair will remains relatively depressed as we head into the thin liquidity of the Christmas period.

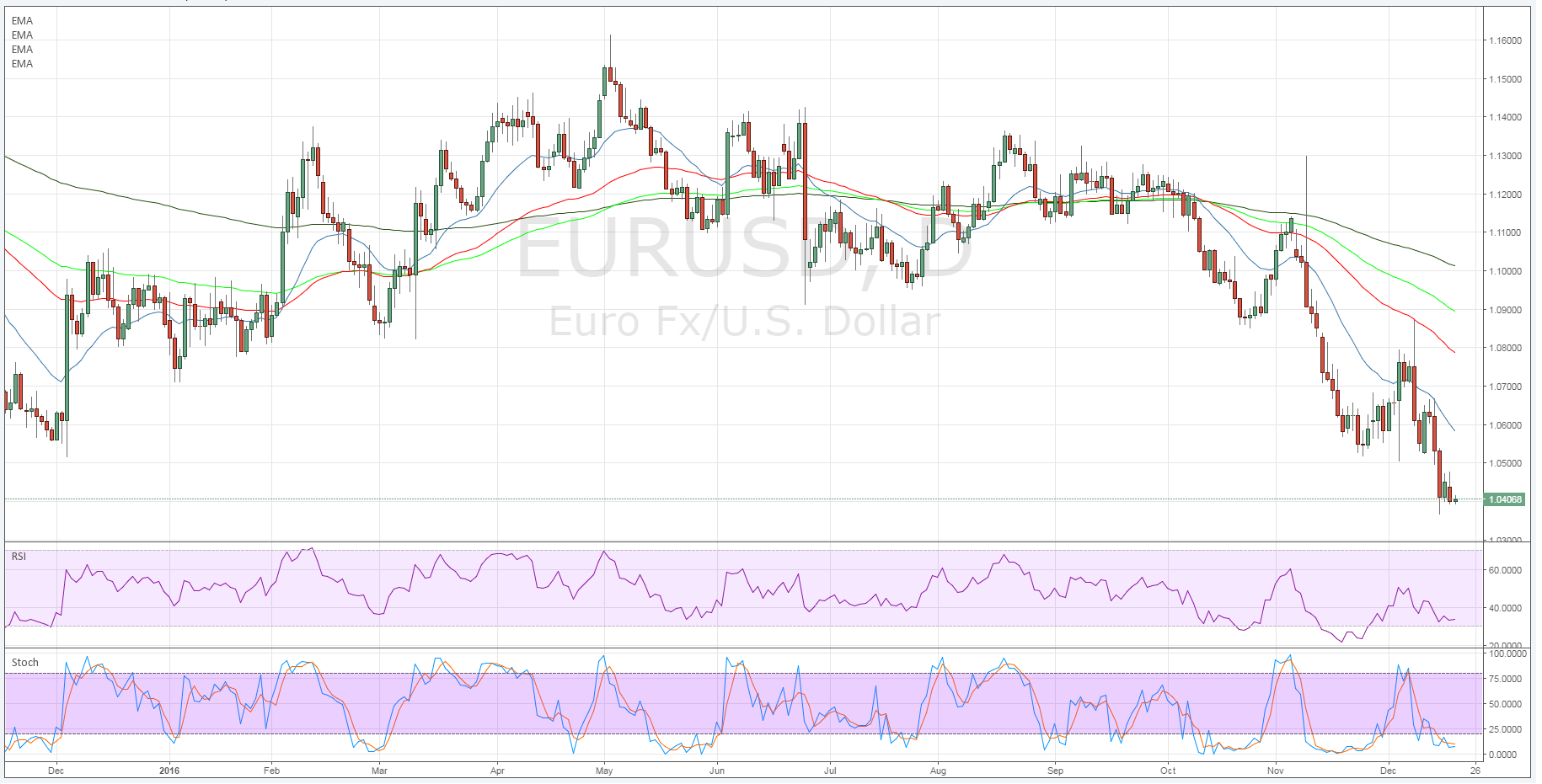

From a technical perspective, the pair remains highly biased to the short side with price action recently having broken through the 1.0461 support zone. In addition, the 50 and 100 EMA’s are still trending lower and the RSI Oscillator is still within neutral territory. Subsequently, the decline is likely to continue, at least in the short term, with a slide towards parity possible in the medium term. Support is currently in place for the pair at 1.0400, 1.0364. Resistance exists on the upside at 1.0657, 1.0690, and 1.0758.

Ultimately, the euro is balancing precariously upon the precipice as, at least in the medium term, parity appears to be calling. However, we may see a period of moderation given that the pair has seemingly discovered some support around the 1.0364 mark. Regardless, the medium-term bear trend remains in play and it is only a matter of time until we see further declines.