Key Points:

- Price action manages to stage a small rise despite plenty of selling pressure.

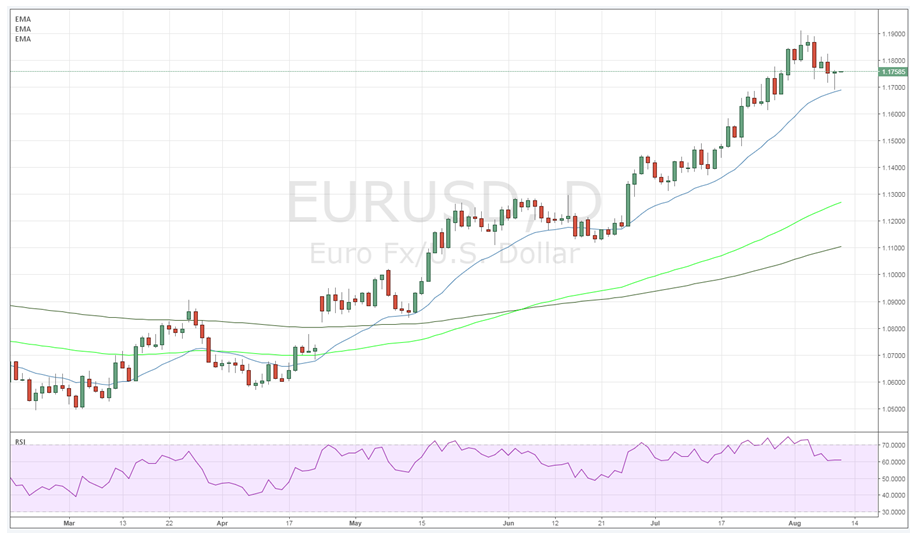

- RSI Oscillator continues to trend lower away from over bought territory.

- A further correction lower likely in the coming session.

The Euro managed to find a modicum of support during today’s session as the pair despite the very evident ongoing selling pressure. The pair was initially pushed to a low of 1.1687 but managed to claw its way back to trade around the 1.1757 mark following the release of a relatively poor U.S. Labour Cost Index of 0.6%, as well as ongoing risk in North Korea. However, given that price penetrated support at 1.1700 the downside is likely beckoning in the coming session.

In fact, a cursory review of the pair’s charts tells us that the coming days could be a little rough for the Euro. Price action has now dipped below the 12EMA and remains fixated on the 1.1700 support zone. Additionally, the RSI Oscillator continues to trend lower, away from overbought territory, signalling that there is still some distance to go before the downside momentum ebbs.

Subsequently, the intra-day bias still remains on the downside, despite the small gain, and the present technical structure supports a target at 1.1606 (38.2% retracement level from 1.1119 to .1908). Once price action reaches that level, expect a rebound to be likely given the renewed focus on the 1.20 level for the pair.

However, the bigger picture still calls for more gains when taking the longer term view with bullish convergence still evident on the weekly charts. In fact, a concerted break of the 55 monthly EMA at 1.1760 could suggest valuations for the pair well above the 1.20 handle which would see the Euro trading in a zone last observed in 2014.

Regardless, our initial bias remains on the downside in the coming session given that the 1.1813 resistance level remains intact. Subsequently, the technical factors argue for further corrective declines with a downside target at 1.1606 likely to be achieved. However, do not expect a sustained break of that level as fundamentals currently argue against it.

Finally, from a fundamental perspective, monitor the U.S. Initial Jobless Claims numbers because they could be a relatively important window into the current health of the economy. A current broad consensus view puts the result at 240k, a slight fall from the prior result of 245k, but watch for any variations. The PPI data is also due for release and could also impact the pair, albeit to a lesser extent.