Key Points:

- US inflation data the key risk event.

- Volatility likely as market positions ahead of September’s FOMC meeting.

- Initial technical bias remains neutral for the week.

Last week was resoundingly positive for the euro dollar as the pair was buoyed by a significant sentiment shift away from the USD. The swing was initially fuelled by a highly disappointing US ISM Non-Manufacturing PMI result of 51.4 and then followed up by some mixed rhetoric on rate hike by a range of FOMC members.

However, the pair could be facing some volatility in the week ahead as a slew of US economic data falls due. Therefore, it makes sense to review the major events of last week and what the EUR/USD could be potentially facing in the days ahead.

The euro dollar had a resoundingly positive week as the pair initially reacted to a broadly weaker US dollar which was largely fuelled by a surprise decline in the ISM Non-Manufacturing PMI from 55.0 to 51.4. This saw the pair rise sharply to above the 1.12 handle as the market continued to see declining chances of a Fed rate hike in the short term.

Subsequently, there was little impact from the improved JOLTS Job Openings and Unemployment Claims figures and the EUR/USD managed to keep most of its gains. In addition, the Eurozone Retail Sales figures rose strongly to 1.1% which helped to offset a slip in GDP to 1.6% y/y.

Finally, the week closed with the ECB deciding not to change the bid rate or induce any additional stimulus within the short term which saw the pair finish around 1.1229.

Looking ahead, there is a busy week ahead for the EUR/USD as a slew of US economic data, focusing on the PPI and CPI indicators is due out. Subsequently, keep a close watch on the US CPI figures because the market will be looking for a strong result to support the Fed’s rhetoric of rate hikes.

Failure to tender some concerted price inflation could place the rate hike story in jeopardy and see further rallies within the pair. In addition, the Eurozone Final Core CPI figures are due to make an appearance and largely forecast to remain steady at 0.8% y/y which is likely to provide more fundamental reasons for some gains.

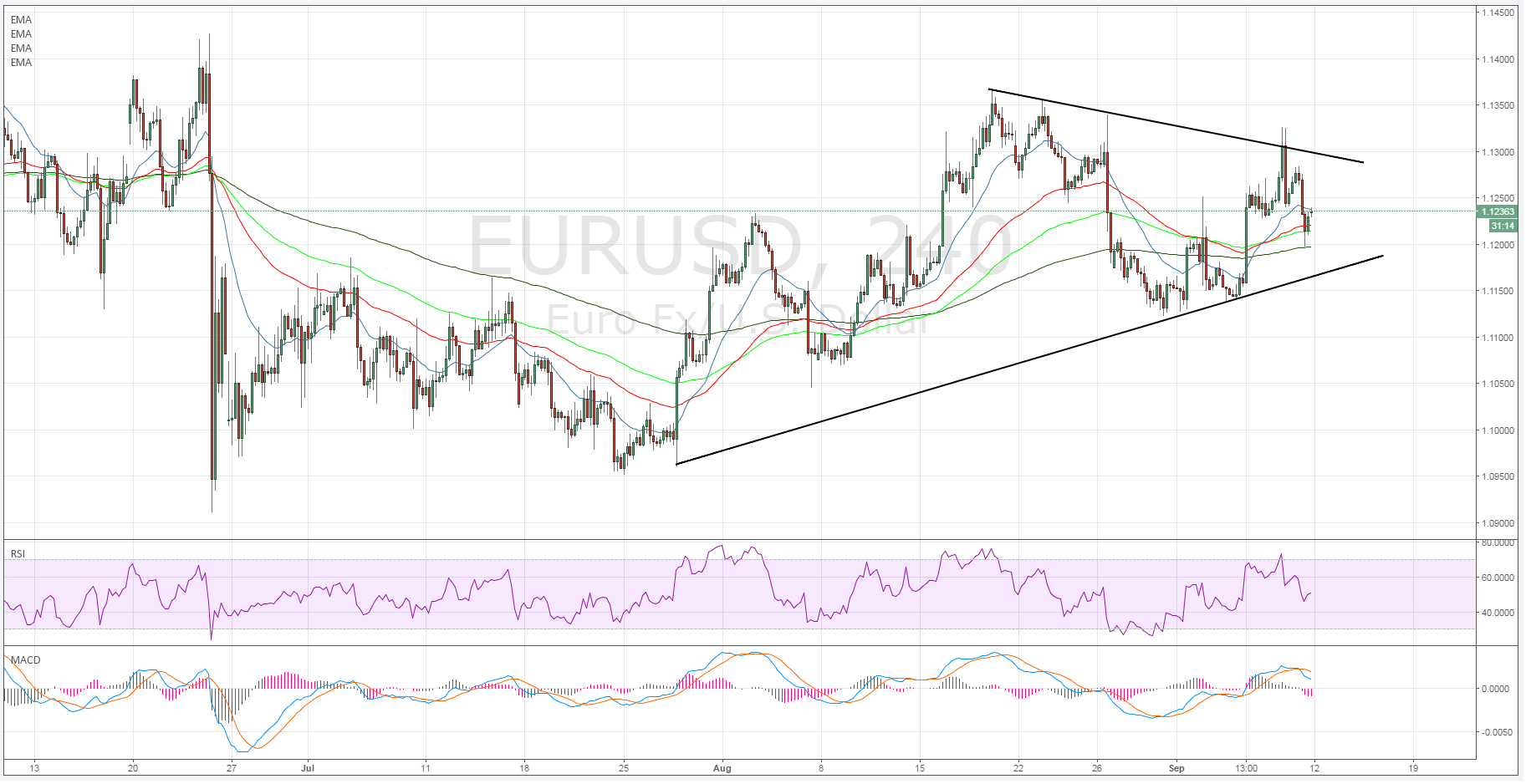

From a technical perspective, the initial bias for the week remains neutral given the recent failure to breach the 1.1365 resistance point. Price action is currently above the 100-day MA but it will need to remain above 1.1326 to keep the focus on the upper resistance level.

The RSI Oscillator remains within neutral territory but is slightly biased to the downside. Subsequently, our bias remains neutral until the pair can either rise back above the 1.13 handle or break below the 1.12 handle. Support is currently in place for the pair at 1.1121, 1.1042, and 1.0950. Resistance exists on the upside at 1.1365, 1.1426, and 1.1533.

Ultimately, it is likely to be the US inflation data that decides the pair’s near term fundamental trend in the week ahead. Subsequently, expect plenty of volatility around its release given that the market is currently jockeying to position ahead of Septembers FOMC meeting and any data points supporting a particular bias are likely to be grabbed for.