In early September, the European Bank (ECB) put its money where Mario Draghi’s mouth was. Specifically, the congregation of decision makers agreed to purchase unlimited amounts of short-term, troubled country bonds in the event that a beleaguered sovereignty requested aid. (Note: A country would have to agree to certain reforms, but… who genuinely wants details?)

Apparently, the ECB president’s promise was all that world markets needed to hear. Italian bonds and Spanish bonds have since risen dramatically. And Greece? The Global X FTSE Greece 20 ETF (GREK) is up nearly 74% since Draghi exclaimed in late July that the ECB would do “whatever it takes” to keep the euro intact.

All’s well that ends well, then?

Not exactly. Country deficits are growing, the region’s economy is contracting and financial institutions still hold the ever-volatile sovereign debts. That makes European financial stocks particularly scary.

Additionally, no country has asked the ECB for a bond bailout. It follows that the ECB’s commitment has yet to be scrutinized. Would creditor nations like Germany even agree to a monumental transfer of its wealth to Spain and Italy? Can Chancellor Merkel of Germany even manage the political ramifications of supporting neighboring nation bailouts with her own re-election bid in the fall?

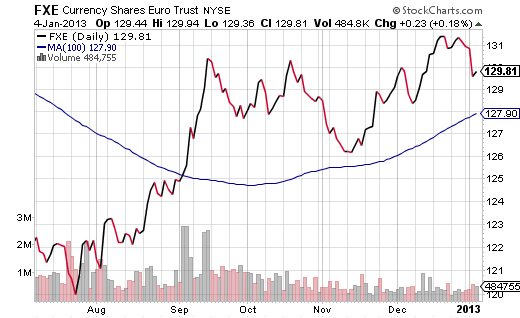

It has been a wonderful ride for the CurrencyShares Euro Trust (FXE) since late July. Not only has FXE picked up 8.3% in a short time period, but it remains above intermediate-term (100-day) and long-term trendlines (200-day).

That said, direct or indirect exposure to the currency is a recipe for misfortune. Optimistically, the euro can survive with a modest economic recovery in the 2nd half of 2013. More realistically, though, there are too many moving parts (e.g., individual country leaders, European Central Bank, International Monetary Fund, private banks, creditors, etc.) for there not to be a reemergence of market pressures.

The good news is… the euro is unlikely to face imminent collapse. On the other hand, I anticipate the euro to fall back out of favor, as the Italian prime minister, Mario Monti, steps down and anti-German rhetoric heats up.

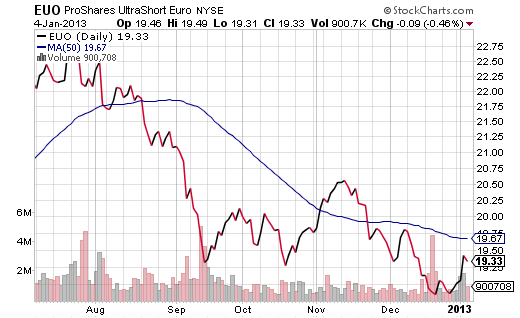

Adventurous traders might consider shorting the currency via ProShares Ultra-Short Euro (EUO). It may make sense at a price point above a short-term trendline (50-day).

Far more importantly for investors, however, is the ability to avoid a euro slide. One who believes that European multi-nationals will survive, even thrive, should look to WisdomTree Hedged European Equity (HEDJ). It will underperform an unhedged fund like Vanguard Europe (VGK) when the euro is strong, but HEDJ will outperform VGK when the U.S. dollar gains ground on the euro.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro-Denominated ETFs May Recoil Rather Than Spring Forward

Published 01/06/2013, 02:06 AM

Updated 03/09/2019, 08:30 AM

Euro-Denominated ETFs May Recoil Rather Than Spring Forward

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.