- US dollar Index stays top of class

- Market awaits euro Court of Justice pending decision

- Putin’s Russia sees red

- S&P sees Russia in speculative grade?

Capital Markets slated agenda for the next five-days will be considered rather boring compared to the events that kept all asset classes on their toes last week. The UK and France report its December CPI and PPI inflation estimates this Tuesday and Wednesday respectively.

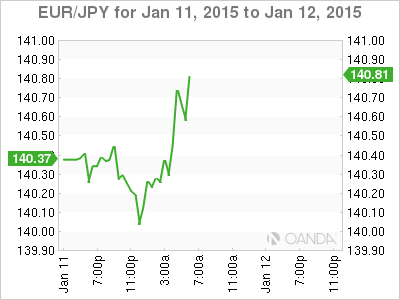

Analysts expect that the continuing drop in energy prices to pull down both headlines, similar to the recent euro CPI outcome. By mid-week, the market will be looking for an improvement in Japan’s machine orders after they slipped badly after the various tax hikes nine-months ago.

Down under, the Aussie release their December unemployment report. At the moment, the trend remains the markets friend. Australian unemployment has been on a rising trajectory for the past 18-months against an environment of sub-par growth and lackluster job creation.

A tough act to follow

Global bourses were racked with volatility last week, as competing economic themes contested for supremacy. The increasing risk of deflation and the eurozone potentially unraveling over a renewed ‘Grexit’ dominated the first half of the week. Risk trading was restored mid-week after Germany’s Merkel insisted that they wanted Greece to remain within the euro fold.

Ms. Yellen reinforced the Fed’s stance of “patience,” while a few newish “doves” voices grew a tad louder. Chicago Fed President Evans declared that higher U.S rates this year would be a “catastrophe.”

Risk on and off, coupled with low inflation and the possibility of deflation has been playing havoc with global yields. U.S. 10-Years seems to be caught within a narrow range (+1.83% to +2.10%), while German bunds, especially 5-Year straddle negative territory as Crude Oil hits fresh multi-year lows. The U.S jobs report revealed December's signs of emerging wage inflation had evaporated and in fact retracted.

Payroll headline look good

Friday’s headline U.S jobs data showed better than expected payroll gains and another tick down in unemployment to +5.6%. Nevertheless, the market dug deeper and ended up focusing on the discouraging hourly earnings component that did away all the good achieved in the previous month. Monthly revisions halved the previously robust November wage gain (+0.4% to +0.2%), while December entered into negative wage growth territory (-0.2%, m/m).

This collectively managed to pull down the year-over-year growth rate to its lowest level in 24-months (+1.7%). Ms. Yellen and company desire wage growth to accelerate to +3% y/y, to help it achieve its +2% inflation target. Nevertheless, the mid-week FOMC minutes established that if the U.S labor market continues to heal, then the Fed is likely to raise rates in the middle of the year even as they remain “patient” on hikes for now. There is a growing consensus that growth in inflation is not necessarily required.

Draghi remains on course

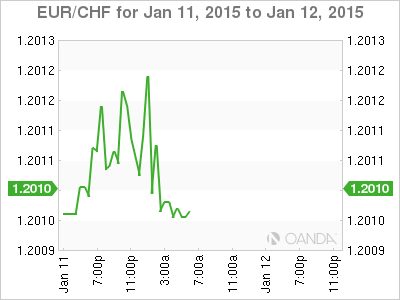

The market continues to price in Euro QE. An overwhelming majority expects that the ECB will swing into action at its January 22, backed by ongoing disappointing data euro region wide. German, French, and UK industrial production numbers all failed to meet market expectations while dreaded inflation numbers supported the disinflation fears within region (Euro-CPI at its lowest level in six-years, -0.2% in December).

For surety purposes, the market awaits for this Wednesday’s European Court of Justice pending decision on Outright Monetary Transactions (OMT) bond buying scheme. A negative assessment has the potential to lead the market to assume the flexibility and the scope of any ECB QE could be limited. With so many in the market already pricing in QE, price action could get very messy very quickly.

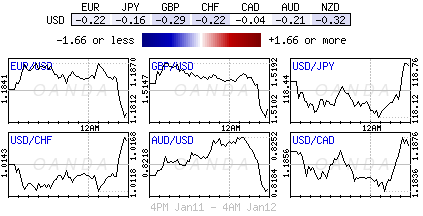

U.S dollar does not miss a beat

The “mighty” dollar remains the dominant currency across the boards. There are many positives supporting it whether it’s U.S. growth, rate divergence, an upbeat Federal Reserve or jobs, are all making U.S. assets attractive and a rising U.S. dollar adds to that appeal. It seems that the market consensus believes that we are in the early stages of a secular bull market for the U.S. dollar. Nevertheless, Friday’s U.S payrolls saw some dollar profit taking outright.

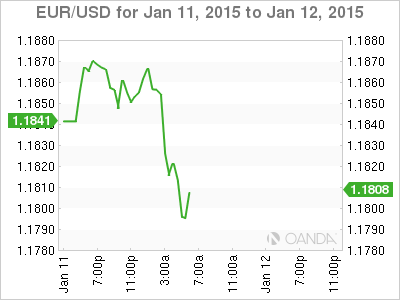

The euro stood firm below €1.1790 and closed out the weekend with a bid tone (€1.1847). The 19-member single unit failed in its attempt, during the overnight Asian session, to take on the plethora of stop-losses located around the €1.19 handle. This forced the weaker Asian longs to exit their euro's after this failed attempt. Europe has since applied further pressure on its own currency, opening up the way for the market to once again test last week’s low €1.1754/62 lows.

The strong decline from the overnight session high technically keeps the €1.1885 resistance protected. A break through the lows with some momentum certainly opens the gates for the market to test its decade lows at €1.1640. Expect the market to reassess their options once there.

Putin’s Russian sees Red

It was no surprise, Fitch ratings last week downgraded Russia to BBB- with negative outlook. This now puts Putin’s homeland one notch away from losing its investment grade. There are rumors that S&P

is expected to push Russia into non-investment grade (speculative) in a matter of weeks. These possible collective actions are beginning to renew a strongly bearish outlook for the country. Russian equities and debt seeing red, coupled with falling crude prices continue inflict pain on the USD/RUB. For now, the market is trying to anticipate what the knock on effect is going to be. Cornering a Russian bear is not very euro healthy.