Another run of abysmal data from the eurozone saw the single currency take another slapping yesterday. Manufacturing data from the EU showed that a deep recession is becoming increasingly more likely, while unemployment rose to the highest level in eurozone history.

While the UK’s manufacturing PMI was seen as disappointing when published at 50.5, it is positively superb compared to the 43s or 44s that EZ member countries were going through. Anything below 50.0 shows that the sector is contracting and every single manufacturing sector in the eurozone gave a contractionary reading. While this was to be expected from the periphery, the core countries of France, Germany and the Netherlands saw further deterioration. We had previously spoken of there being a “2-speed Europe” with Germany pushing ahead and the rest left in its wake. This is now turning into a “1.5-speed Europe” with nobody expanding and some in a calamitous reversal.

Factor in an unemployment rate of the 10.9% (much higher than the 8.3% in the UK and 8.2% in the US) and the situation becomes increasingly dire. 169,000 people lost their jobs in Europe in March, the equivalent of the population of Swansea, and while most of these losses were seen in the periphery, March was the first month since 2009 where we saw job losses in the German manufacturing sector. Confirmation of core contamination as it were. The employment situation in the eurozone is only going to worsen as austerity continues to bite.

GBP/EUR grinded back above the 1.23 level to get within 0.5% of its 2010 high of 1.2395 and EUR/USD collapsed back below 1.32. Further gains against the single currency will depend on the news from today’s ECB rate decision. Not one analyst is expecting a rate decrease today as a result of the recently high inflation numbers but even so, we may hear some soothing talk from Mario Draghi in his post-decision press-conference around further funds and stimulus for banks or their sovereigns.

Elsewhere, following the UK’s positive construction PMI yesterday (better than expected, although lower than the previous) we get the last, and most important, reading from the services sector at 09.30. The weather is likely to have had an effect on shoppers' attitudes and it is likely to be a negative one. Sterling gains may once again be short-lived.

Data from the US has been a mixed bag of late and once again, the onus will be on today’s jobs numbers which, if poor, will see traders factor in further bets of more QE in the US and a weaker dollar as a result. We also have US services data at 15.00.

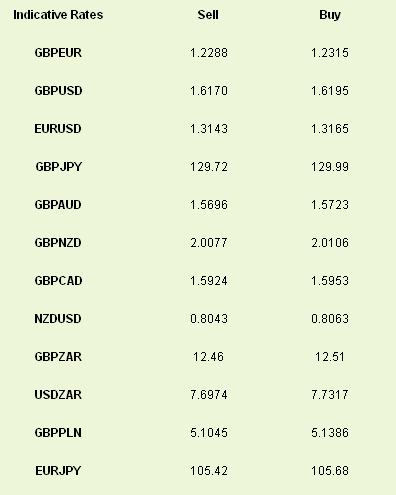

Latest exchange rates at time of writing:

While the UK’s manufacturing PMI was seen as disappointing when published at 50.5, it is positively superb compared to the 43s or 44s that EZ member countries were going through. Anything below 50.0 shows that the sector is contracting and every single manufacturing sector in the eurozone gave a contractionary reading. While this was to be expected from the periphery, the core countries of France, Germany and the Netherlands saw further deterioration. We had previously spoken of there being a “2-speed Europe” with Germany pushing ahead and the rest left in its wake. This is now turning into a “1.5-speed Europe” with nobody expanding and some in a calamitous reversal.

Factor in an unemployment rate of the 10.9% (much higher than the 8.3% in the UK and 8.2% in the US) and the situation becomes increasingly dire. 169,000 people lost their jobs in Europe in March, the equivalent of the population of Swansea, and while most of these losses were seen in the periphery, March was the first month since 2009 where we saw job losses in the German manufacturing sector. Confirmation of core contamination as it were. The employment situation in the eurozone is only going to worsen as austerity continues to bite.

GBP/EUR grinded back above the 1.23 level to get within 0.5% of its 2010 high of 1.2395 and EUR/USD collapsed back below 1.32. Further gains against the single currency will depend on the news from today’s ECB rate decision. Not one analyst is expecting a rate decrease today as a result of the recently high inflation numbers but even so, we may hear some soothing talk from Mario Draghi in his post-decision press-conference around further funds and stimulus for banks or their sovereigns.

Elsewhere, following the UK’s positive construction PMI yesterday (better than expected, although lower than the previous) we get the last, and most important, reading from the services sector at 09.30. The weather is likely to have had an effect on shoppers' attitudes and it is likely to be a negative one. Sterling gains may once again be short-lived.

Data from the US has been a mixed bag of late and once again, the onus will be on today’s jobs numbers which, if poor, will see traders factor in further bets of more QE in the US and a weaker dollar as a result. We also have US services data at 15.00.

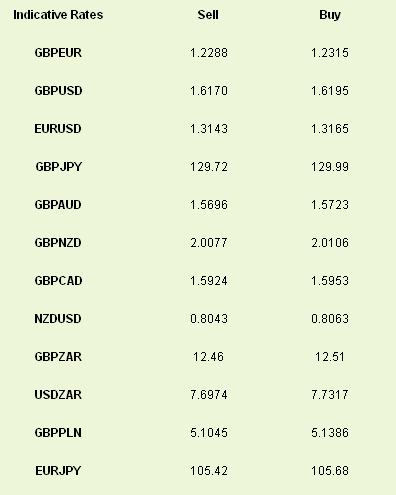

Latest exchange rates at time of writing: