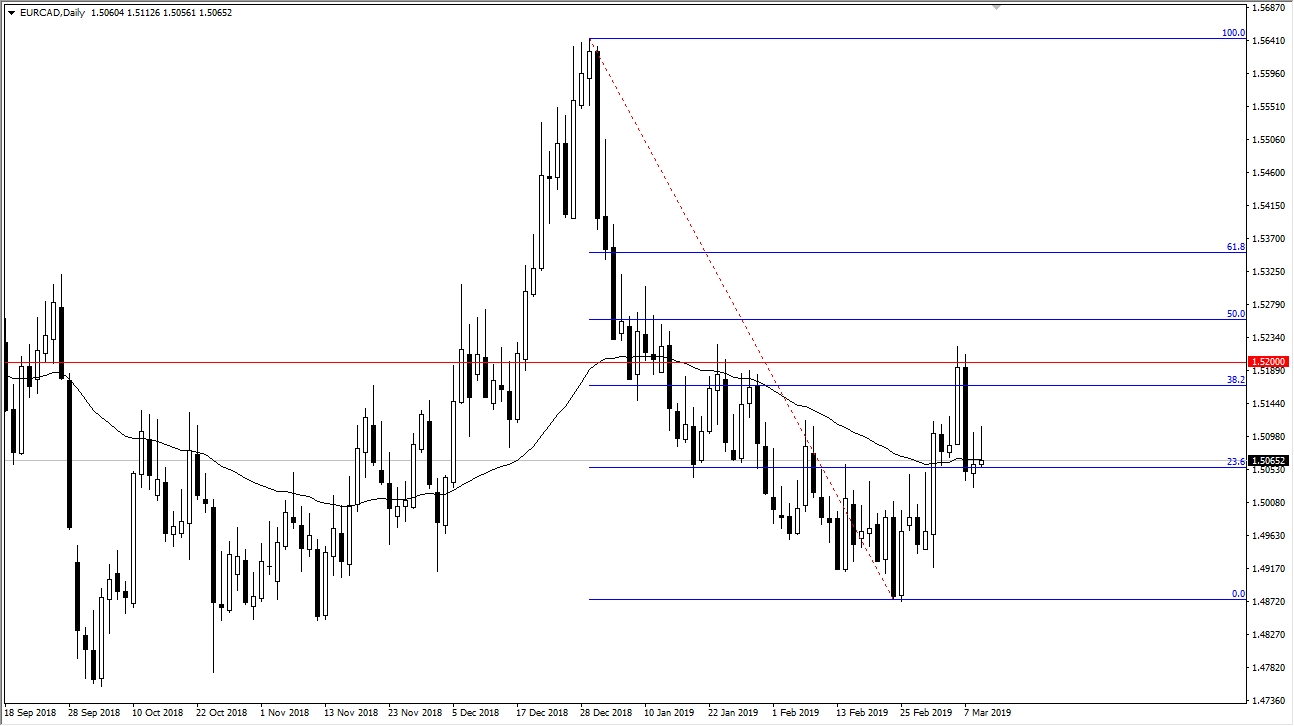

The euro initially tried to rally during the trading session on Monday but gave back the gains as we reached towards the 1.51 level. This is an area that had seen quite a bit of selling on Friday as well, so it does suggest that perhaps the Euro is still on its knees.

Looking at the candle stick from the Thursday session after the ECB press conference, it’s clear that there was a lot of technical damage done. The fact that we have formed a couple of shooting star shaped candles after that suggests that we probably have further to go at this point. This is a particularly weak sign, considering that the Canadian dollar itself isn’t exactly strong at the moment.

If oil comes into rally mode again, that will probably essentially be the reason for this market break down significantly. At that point, the market could very well go looking towards 1.49 handle. Either way, it certainly looks as if the path of least resistance is going to be lower. We have the 50 day EMA crossing for price right now as well, so that of course will have a certain amount of influence. Ultimately, we will have one of two scenarios unfolding rather quickly: we will either break down below the bottom of the Friday candle, sending this market down towards the 1.49 handle, or if we get a complete turnaround, breaking above both shooting stars would be a bullish sign that we are probably going to go back towards the 1.52 level to test major resistance.

That being said, it is essentially a “binary trade”, meaning that we either by on a break out to the upside of this cluster, or sell below. In the meantime sitting on the sidelines will probably continue to be the only thing you can do until we get some type of clear and decisive effort.