European equity markets fell yesterday for the first time in 9 days as fears that the ECB’s upcoming stress tests on the Eurozone’s banking apparatus would reveal more cracks than people had initially been anticipating. The ECB will be looking at European banks’ balance sheets and could leave banks requiring another round of fund raising should new capital requirements fall foul of the ‘asset quality review’. Needless to say it was peripheral banks that belong to countries that have not received aid from a troika-like programme that were on the rack following the news; Spanish and Italian banks ended the day very much in the red.

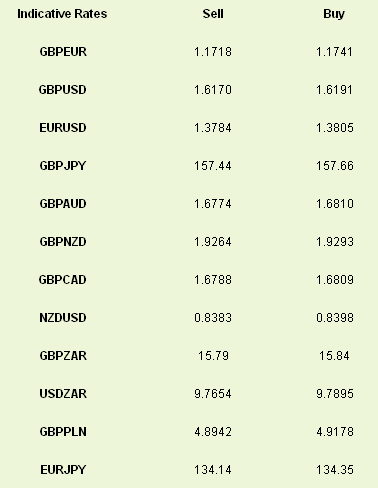

The euro remained resolute however and has pushed above the 1.38 level in EUR/USD terms with GBP/EUR plumbing fresh 7 week lows this morning. As we pointed out yesterday, the recent euro strength is a function of a dollar that is being beaten up by the market as a result of the fiscal shenanigans in Washington DC and a relatively tight monetary policy that is seeing yield and safety hunters alike clamber into the single currency. This euro rally reeks of wanting to test 1.40 in EUR/USD – a 1.3% move higher from here – and could see GBPEUR back towards 1.15 if biases continue. Euro strength could be afforded as a result of this morning’s run of preliminary PMIs from France, Germany and the Eurozone’s manufacturing and services sectors for the month of October. All are expected to show expansion.

Yesterday morning’s Bank of England minutes suggested a sense of quiet calm in London given other central banks around the world are having to defuse various bombs being laid by political risk-taking. Growth figures were revised higher – estimates have shifted so that output during the 2nd half of 2013 would stay at about 0.7% a quarter – the level seen in Q2 this year, while the pace of ‘labour market slack erosion’ – a recovery in the jobs market – is so far faster than had originally been estimated.

We have seen some tempering of near-term rate hike expectations in sterling markets through the past month as doubts have crept in as to the sustainability of the UK’s recovery given the pressure on wages from inflation, in particular the recent fuel cost increase seen from utilities. The MPC commented that a stronger pound may help this issue but similarly would hurt any chances of an export driven recovery.

We maintain our belief that we will see no rate rise from the Bank of England in 2014. Sterling was roughly unchanged after the release with the yield on the UK’s 10yr benchmark gilt falling to the lowest since August 2nd.

While we are focused on the world of central banks we must take a look at a move by the Bank of Canada yesterday. The decision to hold rates at 1.0% was not the issue, but the accompanying Monetary Policy Report detailed a new dovish hint from the Canadian central bank. The report, which was the first to be written solely under the governorship of Stephen Poloz, removed wording suggesting a need for a future rate increase. The report also saw the BoC cut its outlooks on both the Canadian and US economies as a whole – a likely impact of recent machinations south of the border. An era of loose monetary policy quickly weeds out those central banks who do and don’t want to play along.

US jobless claims will be the main bell ringer this session (13.30) whilst an advance reading of manufacturing PMI from the US may be the first signaller of just how badly the US economy was hurt by the shutdown – it is due at 13.58 BST.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Continues Charge As Relative Policy Tightness Continues

Published 10/24/2013, 06:23 AM

Euro Continues Charge As Relative Policy Tightness Continues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.