Traded the EUR/USD lately?

If so, you may have been slightly disappointed at the amount of volatility going around in the world’s most popular pair. The market has been very quiet as of late and many are now worried that there is not much left when it comes to trading opportunities. But that may not necessarily be the case at present.

So far the Greek crisis has led to an awkward turning point, where you have Greece on one side of the table and the Troika on the other, neither of which are willing to blink first over the state of affairs. But what is the major sticking point here is that for both of the parties giving way is political suicide for them, and the Germans are not in this to lose.

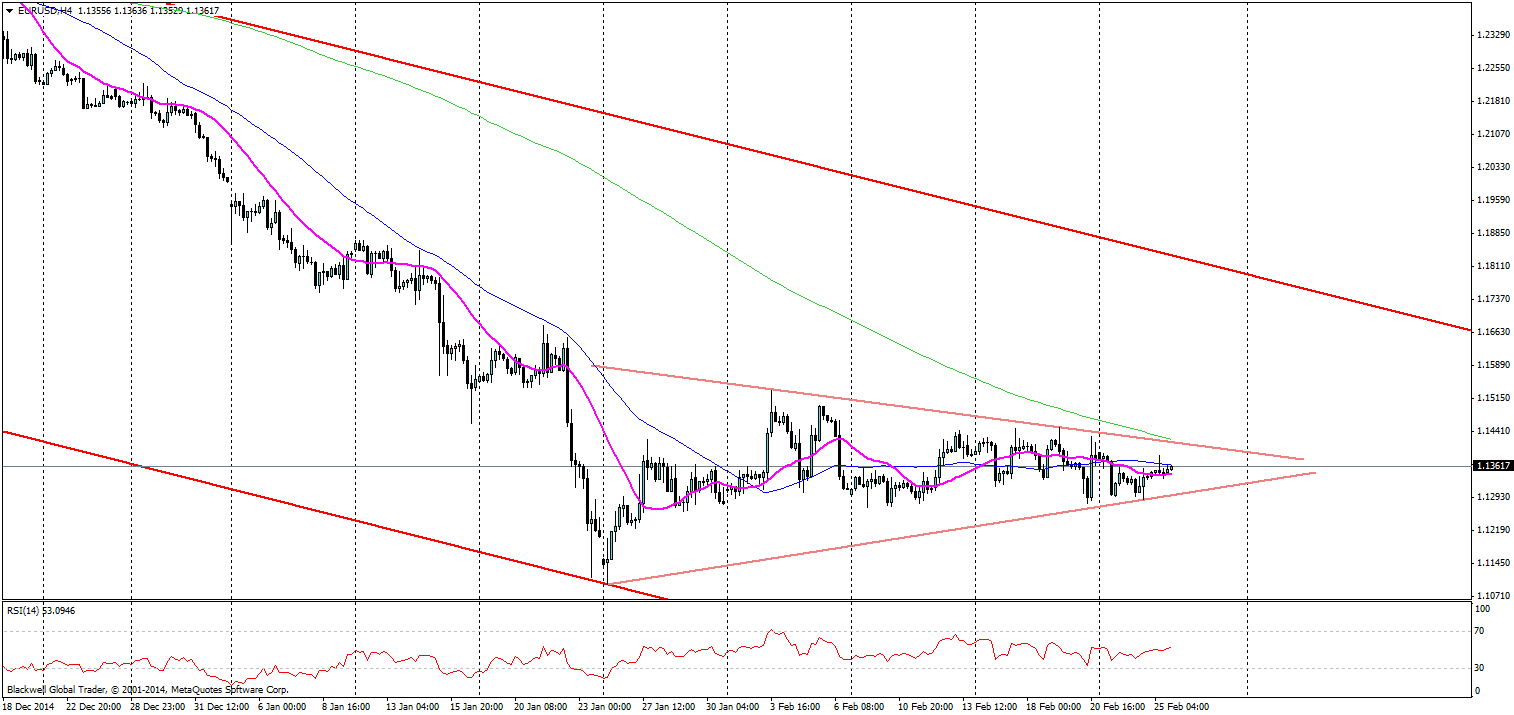

So for now the euro is consolidating and ranging sharply as a pennant pattern forms on the chart, and little is looking it will give in the meantime.

So with a pennant consolidation pattern forming what is next for the market? Well the obvious answer is down, long term prospects for the euro continue to falter in the long run and the current consolidation is just the market mulling over Greece’s next move, which is likely to try and put pressure on itself to get the eurozone to act.

Certainly the market is looking for movement and another rejection of the top part of the pennant could position the euro for further falls, and this may be further extended by Yellen. Yellen is expected to talk up large prospects of a rate rise in the FOMC meeting in March. So in the long run we can expect a drop in the euro.

With Greece and Germany stuck in a political game the only room for the euro to move is down at this rate and that will help the Eurozone as a whole. Don’t expect the deadlock to stop, but do expect volatility to come back to the market and push the euro lower, as the current amount is unusual for the currency pair.