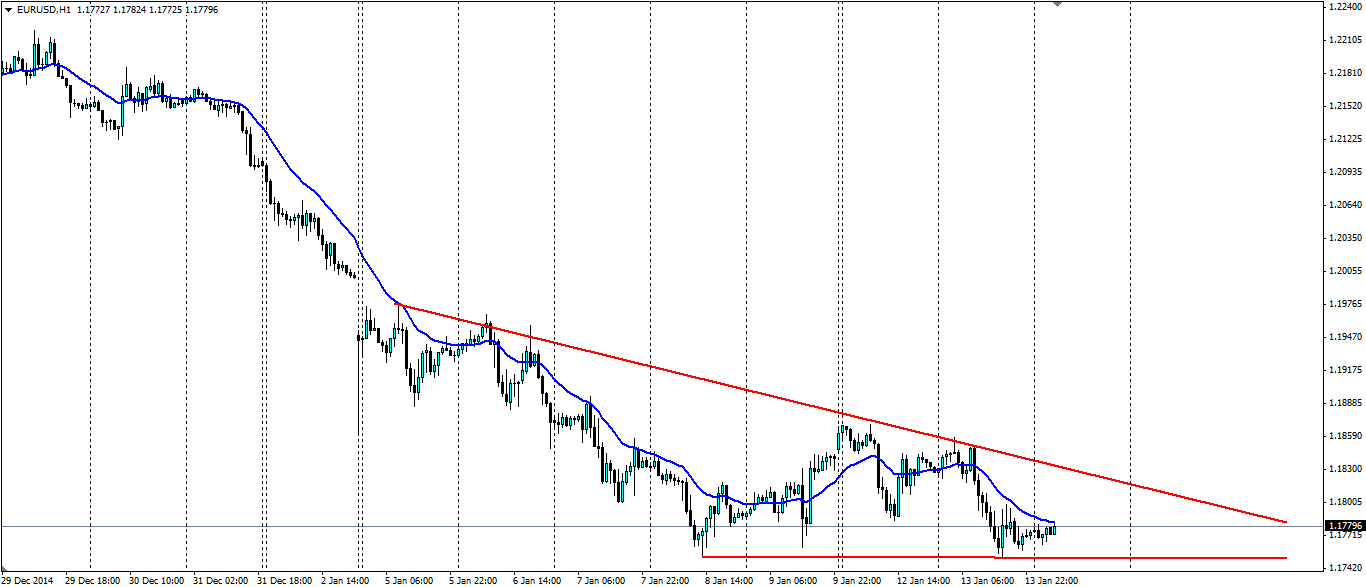

Euro Consolidates Before Breakout

The Euro has found a bit of support recently at a nine year low. So far the market has respected the support level, but a consolidation in a downward triangle could point to a breakout and a continuation of the bearish trend.

Source: Blackwell Trader

The speculation of a new round of stimulus from the ECB, this time in the form of Quantitative Easing, has been leading the Euro to these lows. There is a big test for Draghi later on today. A court ruling is due on the legality of the ECB’s Outright Monetary Transactions (OMT) programme, a predecessor to the expected Quantitative Easing programme Draghi is set to announce this month. The OMT programme announced in September 2012 was sent to the EU Court of Justice to rule on whether the ECB overstepped its mandate in announcing the programme.

If the court rules that indeed the ECB had overstepped, the implications for Draghi’s QE programme will be dire. This will please the German contingent of the ECB as they have made it quite clear they are opposed to QE. Draghi sees it as necessary to avoid a deflationary spiral. If the court rules OMT was legal, the Euro will likely breakout of the current consolidation pattern. Alternatively if the court rules the ECB overstepped, the likelihood of more stimulus will be curbed and the Euro could break to the upside.

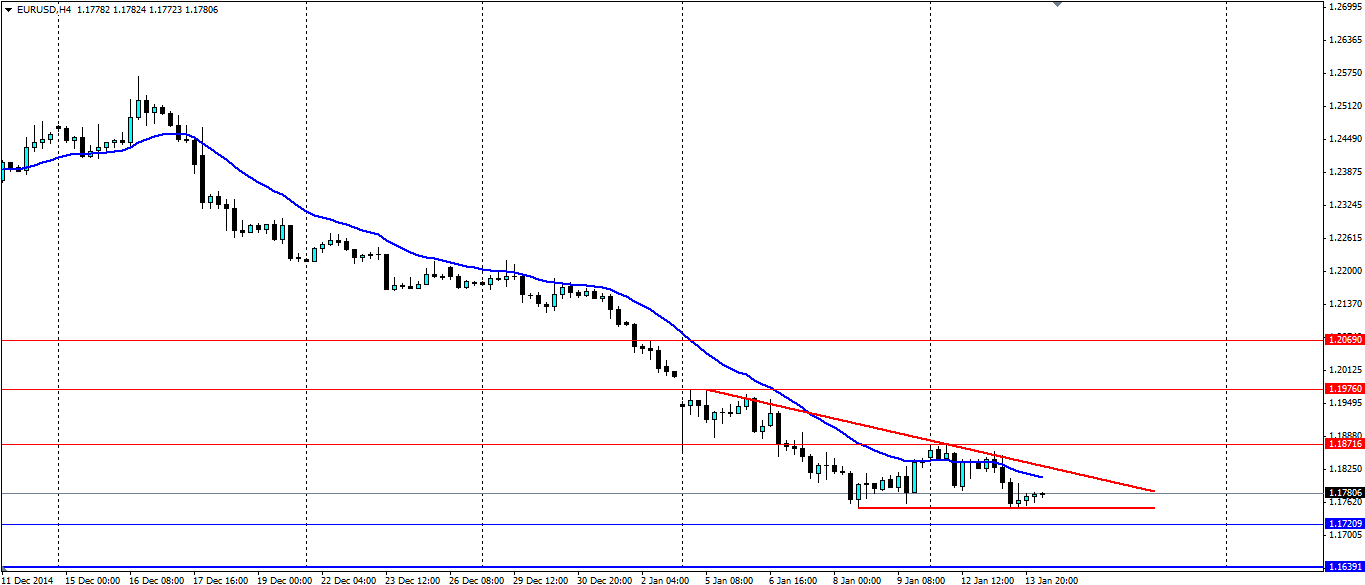

Source: Blackwell Trader

Regardless of the court ruling, the current technical pattern is a consolidating one that precedes a breakout, usually a continuation of the current trend. If it’s to the downside as expected, look for price to find support at 1.1721, 1.1639 and 1.1536, with 1.1639 previously acting as solid support. A topside breakout will find resistance at 1.1871, 1.1976 and 1.2069.