Pressure on the euro returned this week, marking a sell-off against the broader currency front, signalling the possible start of a prolonged downward trend.

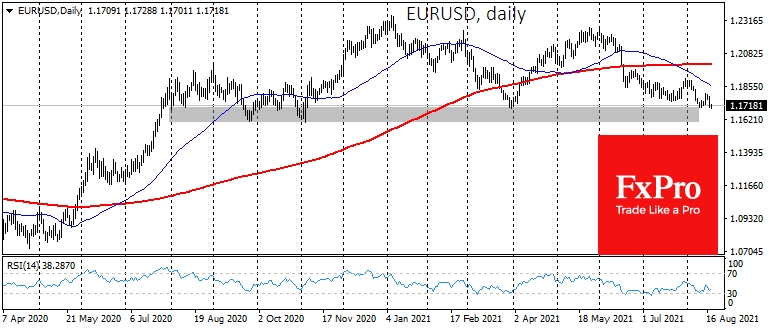

EUR/USD is flirting with an upper bound of the 1.1600-1.1700 area, where it has repeatedly received support from buyers over the past 12 months. However, the dynamics of the single currency against many other major competitors reflect a reversal to the downside. This is an important signal that the markets have switched to another gear.

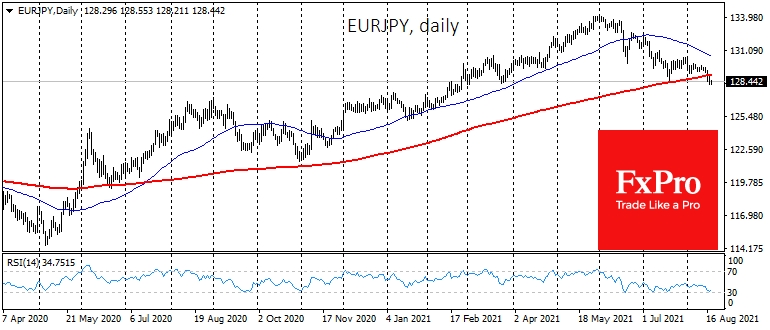

This week, EUR/JPY slid below its 200-day moving average as an essential confirmation of the down reversal that started in June. The latest downside momentum confirmed a head-and-shoulders pattern with the potential to pull back from the current 128.4 to 122.5, where the pair last traded in November 2020.

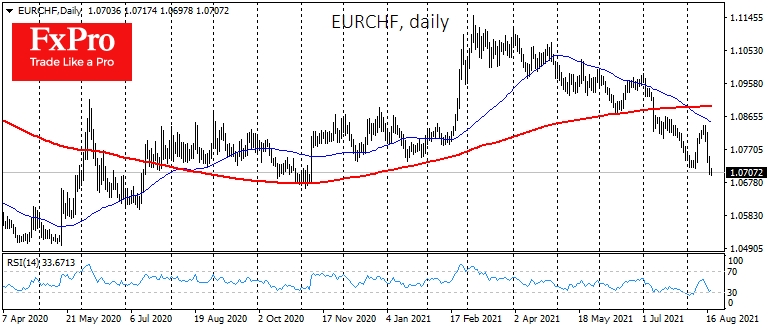

An equally eloquent dip we saw yesterday on the EUR/CHF. At the beginning of the month, the pair was gaining support on the decline to 1.0720. The Swiss National Bank was likely behind the rebound, trying to stop a five-month plunge, which began to look particularly worrisome in July.

On Tuesday, the pair rewrote its lows from last November and, at the time of writing, remains near 1.0700. Will the SNB come in for support this time too? So far, it looks unlikely, as it appears more and more like a history of the euro falling rather than the franc rising. However, an uptrend in the pair cannot be ruled out during the trading in Europe today.

Interestingly, the single currency manages to develop gains against the pound after updating its lows since February 2020.

Fundamentally, the pressure on the euro is due to the slowdown in China and the high prices of raw materials and energy that Europe imports. Also worth noting is the rise in the dollar after yesterday’s data. Retail sales fell more sharply than expected but remain at elevated levels relative to the long-term trend.

The Fed reported industrial production growth of 0.9% for July. The market reacted with the higher dollar buying on both news due to heightened expectations of an imminent policy reversal.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Confirmed Reversal

Published 08/18/2021, 06:33 AM

Updated 03/21/2024, 07:45 AM

Euro Confirmed Reversal

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.