Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Guggenheim CurrencyShares Euro (NYSE:FXE)

The Euro's Q3 focused bear opportunity has produced -38% annualized return for the bears since the first week of June (see COT Matrix 07/19/16).

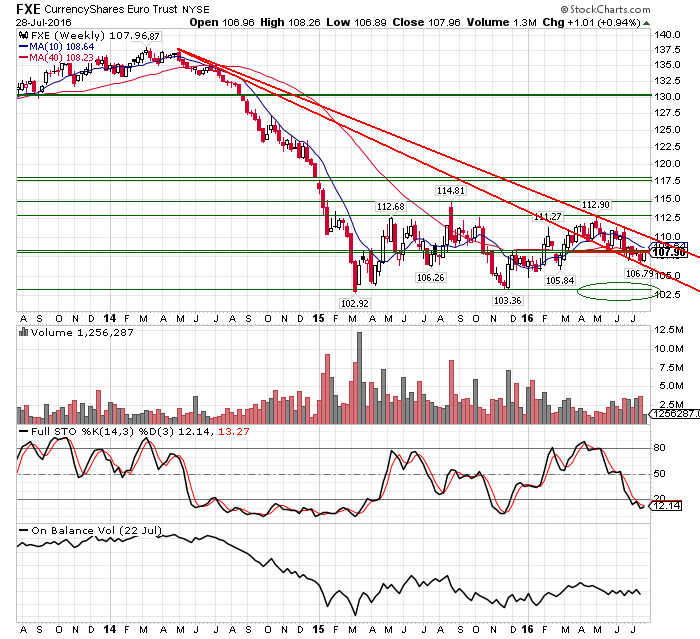

The weekly close below 105.84 maintains the down impulse, while a close above the February gap from 108.06 to 108.29 (red zone) pauses it and favors at least a retest of the 2015 low.

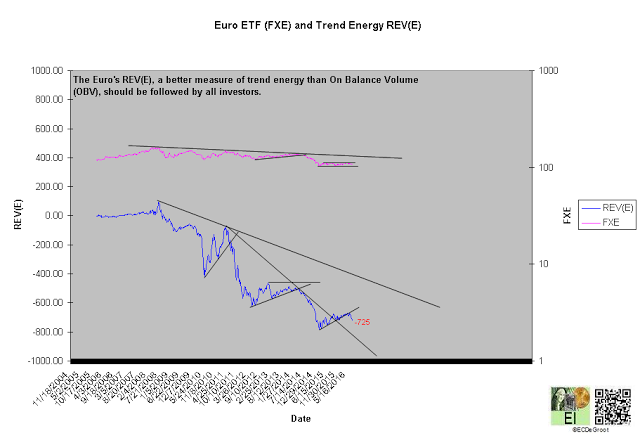

The high volume close below the February gap in June, an indication of increasing downside force, favors the bears. Deteriorating On Balance Volume (OBV), a crude measure of trend energy, suggests increasing distribution since April. Trend Energy REV(E), a better measure of trend energy than On Balance Volume (OBV), has clearly broken its uptrend from the March 2015 low (chart 2). This downside break, an indication of distribution, also favors the bears.