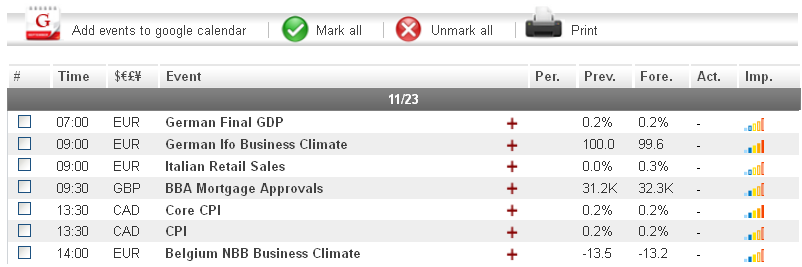

The euro saw gains against virtually all of its main currency rivals yesterday, as the combination of positive Chinese, French and German data boosted confidence in the global economic recovery and encouraged risk taking among investors. Meanwhile, expectations of a new round of monetary easing in Japan next month caused the JPY to take additional losses throughout the day. Today, the euro could see additional volatility following the release of the German IFO Business Climate at 9:00 GMT. A better-than-expected result could lead to additional gains for the common currency.

Economic News

USD - Dollar Sees Mixed Session amid Risk Taking

Risk taking among investors following the release of positive international economic data led to a mixed trading day for the US dollar yesterday. Against the Japanese yen, the greenback gained close to 40 pips during morning trading, eventually reaching as high as 82.76, before staging a downward reversal and falling to the 82.30 level. The USD/CHF dropped more than 40 pips during the first half of the day, eventually trading as low as 0.9339, before a bullish correction brought the pair to 0.9355 toward the end of European trading.

Today, a lack of economic news out of the US means that any dollar volatility will likely come as a result of international data. In particular, traders will want to pay attention to the German Ifo Business Climate at 9:00 GMT and Canadian Core CPI at 13:30. Should either of the indicators come in above their forecasted levels, an increase in risk taking could once again lead to losses for the dollar against its higher-yielding currency rivals.

EUR - German Data Could Result in Additional Euro Gains Today

The euro posted strong gains yesterday following the release of a positive Chinese manufacturing indicator, followed by better than expected French and German manufacturing data. The news boosted confidence in the global economic recovery, which encouraged risk taking among investors. The EUR/USD shot up more than 50 pips during mid-day trading to reach a three-week high at 1.2897. Against the Japanese yen gained close to 70 pips during the morning session, eventually trading as high as 106.56 before staging a downward reversal and falling to 106.10.

As markets get ready close for the weekend, analysts are predicting that the euro could see another bullish day if the German IFO Business Climate figure comes in above the forecasted 99.6. In addition, speculations that a deal could be reached as early as Monday to provide Greece with its next round of bailout funds, could lead to additional risk taking throughout the day, which would likely benefit the euro.

Gold - Gold Sees Modest Gains amid Weakened Dollar

The price of gold saw moderate gains throughout the day yesterday, following a positive Chinese manufacturing indicator which led to risk taking among investors. The precious metal advanced close to $4 an ounce over the course of the day, eventually trading as high as $1731.44 before dropping slightly below the $1730 level towards the end of European trading.

Today, gold traders will want to continue monitoring developments out of the eurozone, particularly with regards to German economic news and any announcements regarding the next round of Greek bailout funds. Positive news may result in gold extending yesterday's gains before markets close for the weekend.

Crude Oil - Oil Prices Steady Following De-escalation in Middle East Conflict

Crude oil largely range traded during the European session yesterday, as nervous investors anxiously waited to see if the recent cease-fire between Israel and Hamas would help put an end to the recent escalation in violence in the Middle East. The violence had generated supply side fears among investors, which resulted in oil prices turning bullish during the first half of the week. The commodity spent most of the day yesterday trading around the $87.50 level.

Today, assuming the situation remains calm in the Middle East, oil traders will want to pay attention to German and Canadian news, scheduled to be released at 9:00 and 13:30 GMT, respectively. Better than expected data could result in the price of oil turning bullish once again before markets close for the weekend.

Technical News

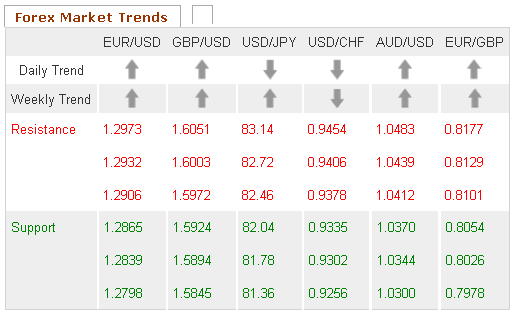

EUR/USD

Most long-term technical indicators are showing this pair trading in neutral territory, making a defined trend difficult to predict. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

GBP/USD

The Bollinger Bands on the daily chart are beginning to narrow, indicating that this pair could see a price shift in the near future. Furthermore, the same chart's MACD/OsMA has formed a bullish cross, signaling that price shift could be upward. This may be a good time for traders to open long positions.

USD/JPY

The Relative Strength Index on the weekly chart is approaching the overbought zone, indicating that a downward correction could occur in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed above the -20 level. Traders may want to open short positions for this pair.

USD/CHF

The Williams Percent Range is currently pointing downward and is approaching the oversold zone. That being said, most other long-term technical indicators show this pair range trading. Taking a wait and see approach may be a wise choice for this pair, as a clearer picture is likely to present itself in the near future.

The Wild Card

EUR/CAD

The Bollinger Bands on the daily chart are beginning to narrow, indicating that a price shift could occur in the near future. Additionally, the Relative Strength Index on the same chart is approaching the overbought zone, signaling that the price shift could be bearish. Opening short positions may be the smart choice for forex traders today.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Benefits From Positive Global Data

Published 11/23/2012, 01:55 AM

Updated 02/20/2017, 07:55 AM

Euro Benefits From Positive Global Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.