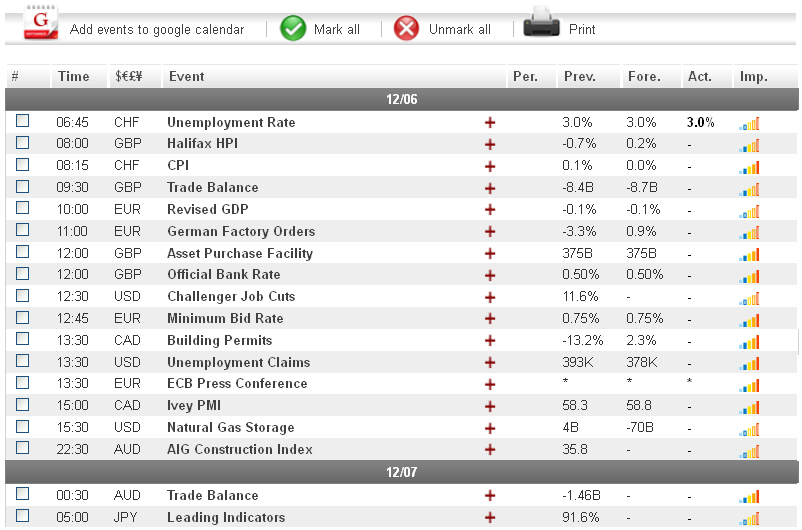

A disappointing eurozone retail sales figure led to heavy euro losses during mid-day trading yesterday. The news also resulted in other higher-yielding assets, like gold and silver, turning bearish throughout the European session. Today, the main pieces of news are likely to be the EU Minimum Bid Rate and ECB Press Conference, which could both lead to additional losses for the common-currency if they indicate a slowing down in the eurozone economic recovery. Additionally, the US Unemployment Claims may generate some volatility for the US dollar ahead of Friday's all-important nonfarm payrolls figure.

Economic News

USD - Dollar Reverses Gains vs. Yen as Risk Aversion Hits Marketplace

After shooting up close to 50 pips against the Japanese yen during the Asian session yesterday, the USD turned bearish during mid-day trading, as risk-aversion due to disappointing eurozone and US news hit the marketplace. The greenback fell around 25 pips, eventually trading as low as 82.04. The USD had slightly better luck against the Canadian dollar, and was able to gain close to 20 pips during the first part of the day to eventually peak at 0.9930.

Today, the main piece of US news is likely to be the weekly Unemployment Claims figure, set to be released at 13:30 GMT. Following a worse than expected ADP Nonfarm Employment Change figure, investors will be closely watching today's news for additional clues as to the current state of the US economic recovery. Should the end result be higher than the expected 382K, the dollar may take losses before Friday's all important nonfarm payrolls report.

EUR - Disappointing EU Retail Sales Report Leads to Euro Losses

The euro turned bearish against virtually all of its main currency rivals yesterday, following the release of a worse than expected eurozone retail sales report that caused investors to shift their funds to safe-haven assets. The EUR/USD fell by more than 50 pips over the course of European trading, eventually reaching as low as 1.3060. Against the JPY, the euro fell close to 70 pips to trade as low as 107.16, while the EUR/GBP dropped more than 30 pips

Today, the eurozone Minimum Bid Rate and ECB Press Conference, scheduled for 12:45 and 13:30 GMT respectively, are likely to have the biggest impact on euro pairs. Any signs that the eurozone economic recovery is slowing down could cause the common-currency to extend its bearish trend during afternoon trading. Later in the week, traders will not want to forget to pay attention to the US nonfarm payrolls figure, as it is likely to have a significant impact on the euro.

Gold - Risk Aversion Turns Gold Bearish

The price of gold fell by more than $12 an ounce during European trading yesterday, as disappointing news out of both the eurozone and US led to risk aversion in the marketplace. The precious metal fell as low as $1691 before a slight upward correction brought prices back to $1694 by the afternoon session.

Today, gold traders will want to pay attention to news out of the eurozone and what affect it has on investor risk appetite. Signs of an economic slowdown in the EU could result in gold taking additional losses during the second half of the day.

Crude Oil - Crude Oil Takes Slight Losses Following US News

The price of crude oil took minor losses during European trading yesterday, following the release of a worse than expected US ADP Nonfarm Employment Change which led to speculations that US oil demand may weaken. Overall, the commodity fell just over $0.70 a barrel to trade as low as $88.09.

Today, oil prices are likely to see volatility following the ECB Press Conference at 13:30 GMT. If the press conference signals any improvements in the euro-zone economic recovery, risk taking among investors may result in crude recovering some of yesterday's losses.

Technical News

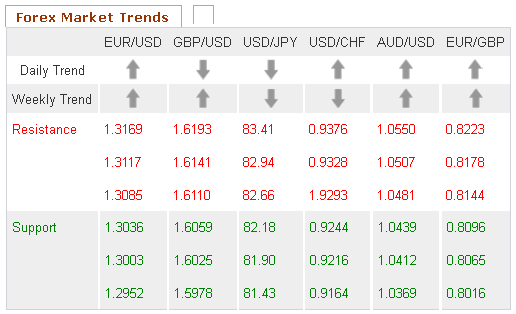

EUR/USD

The Williams Percent Range on the weekly chart has crossed over into overbought territory, signaling that a downward correction could occur in the coming days. Furthermore, the MACD/OsMA on the same chart appears close to forming a bearish cross. Opening short positions may be the smart choice for this pair.

GBP/USD

While the MACD/OsMA on the weekly chart has formed a bearish cross, most other long-term technical indicators place this pair in neutral territory. Taking a wait and see approach may be the best choice at this time, as a clearer picture is likely to present itself in the near future.

USD/JPY

The Slow Stochastic on the weekly chart has formed a bearish cross, indicating that a downward correction could take place in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed over into overbought territory. Opening short positions may be the best option for this pair.

USD/CHF

A bullish cross on the daily chart's Slow Stochastic is signaling that an upward correction could occur in the near future. This theory is supported by the Williams Percent Range on the weekly chart, which has fallen into oversold territory. Opening long positions may be the best choice for this pair.

The Wild Card

USD/ZAR

The Bollinger Bands on the daily chart are narrowing, indicating that this pair could see a price shift in the near future. Additionally, the Williams Percent Range on the same chart has dropped into oversold territory, signaling that the price shift could be bullish. Opening long positions may be the best choice for forex traders today.

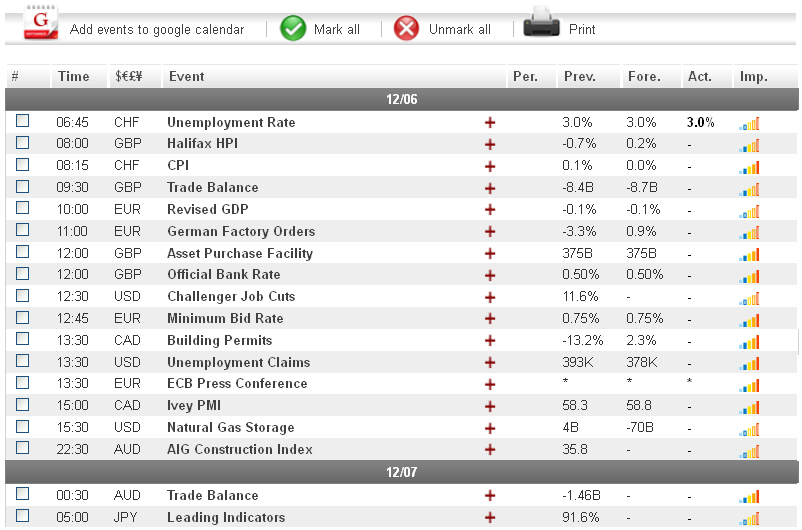

Economic News

USD - Dollar Reverses Gains vs. Yen as Risk Aversion Hits Marketplace

After shooting up close to 50 pips against the Japanese yen during the Asian session yesterday, the USD turned bearish during mid-day trading, as risk-aversion due to disappointing eurozone and US news hit the marketplace. The greenback fell around 25 pips, eventually trading as low as 82.04. The USD had slightly better luck against the Canadian dollar, and was able to gain close to 20 pips during the first part of the day to eventually peak at 0.9930.

Today, the main piece of US news is likely to be the weekly Unemployment Claims figure, set to be released at 13:30 GMT. Following a worse than expected ADP Nonfarm Employment Change figure, investors will be closely watching today's news for additional clues as to the current state of the US economic recovery. Should the end result be higher than the expected 382K, the dollar may take losses before Friday's all important nonfarm payrolls report.

EUR - Disappointing EU Retail Sales Report Leads to Euro Losses

The euro turned bearish against virtually all of its main currency rivals yesterday, following the release of a worse than expected eurozone retail sales report that caused investors to shift their funds to safe-haven assets. The EUR/USD fell by more than 50 pips over the course of European trading, eventually reaching as low as 1.3060. Against the JPY, the euro fell close to 70 pips to trade as low as 107.16, while the EUR/GBP dropped more than 30 pips

Today, the eurozone Minimum Bid Rate and ECB Press Conference, scheduled for 12:45 and 13:30 GMT respectively, are likely to have the biggest impact on euro pairs. Any signs that the eurozone economic recovery is slowing down could cause the common-currency to extend its bearish trend during afternoon trading. Later in the week, traders will not want to forget to pay attention to the US nonfarm payrolls figure, as it is likely to have a significant impact on the euro.

Gold - Risk Aversion Turns Gold Bearish

The price of gold fell by more than $12 an ounce during European trading yesterday, as disappointing news out of both the eurozone and US led to risk aversion in the marketplace. The precious metal fell as low as $1691 before a slight upward correction brought prices back to $1694 by the afternoon session.

Today, gold traders will want to pay attention to news out of the eurozone and what affect it has on investor risk appetite. Signs of an economic slowdown in the EU could result in gold taking additional losses during the second half of the day.

Crude Oil - Crude Oil Takes Slight Losses Following US News

The price of crude oil took minor losses during European trading yesterday, following the release of a worse than expected US ADP Nonfarm Employment Change which led to speculations that US oil demand may weaken. Overall, the commodity fell just over $0.70 a barrel to trade as low as $88.09.

Today, oil prices are likely to see volatility following the ECB Press Conference at 13:30 GMT. If the press conference signals any improvements in the euro-zone economic recovery, risk taking among investors may result in crude recovering some of yesterday's losses.

Technical News

EUR/USD

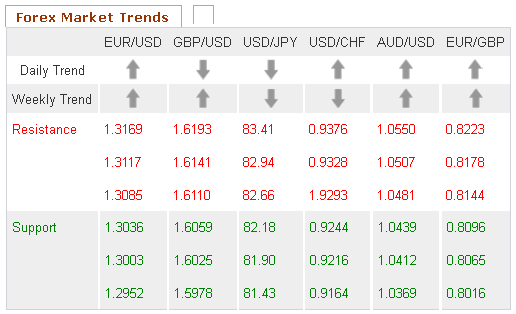

The Williams Percent Range on the weekly chart has crossed over into overbought territory, signaling that a downward correction could occur in the coming days. Furthermore, the MACD/OsMA on the same chart appears close to forming a bearish cross. Opening short positions may be the smart choice for this pair.

GBP/USD

While the MACD/OsMA on the weekly chart has formed a bearish cross, most other long-term technical indicators place this pair in neutral territory. Taking a wait and see approach may be the best choice at this time, as a clearer picture is likely to present itself in the near future.

USD/JPY

The Slow Stochastic on the weekly chart has formed a bearish cross, indicating that a downward correction could take place in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed over into overbought territory. Opening short positions may be the best option for this pair.

USD/CHF

A bullish cross on the daily chart's Slow Stochastic is signaling that an upward correction could occur in the near future. This theory is supported by the Williams Percent Range on the weekly chart, which has fallen into oversold territory. Opening long positions may be the best choice for this pair.

The Wild Card

USD/ZAR

The Bollinger Bands on the daily chart are narrowing, indicating that this pair could see a price shift in the near future. Additionally, the Williams Percent Range on the same chart has dropped into oversold territory, signaling that the price shift could be bullish. Opening long positions may be the best choice for forex traders today.