Key points

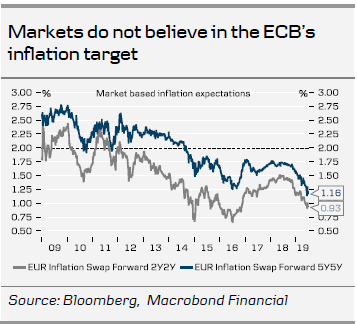

- Markets do not believe in the ECB’s inflation target.

- Brace for more negative economic surprises.

- Policy continuity under new ECB President Christine Lagarde.

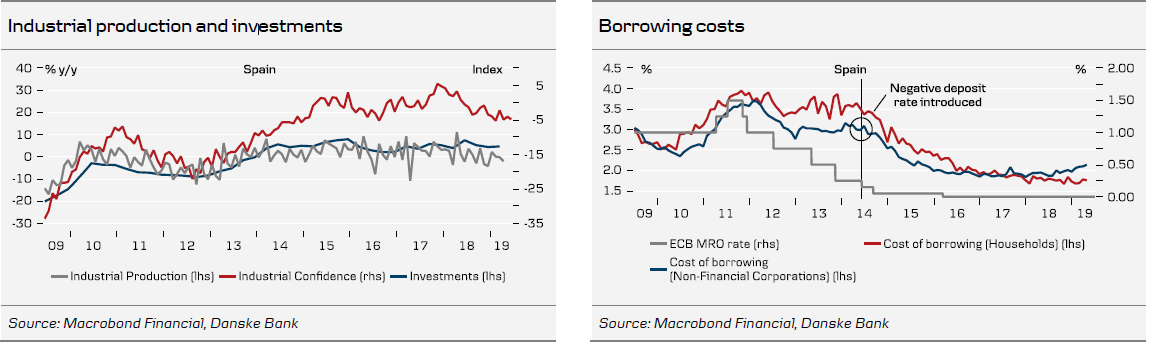

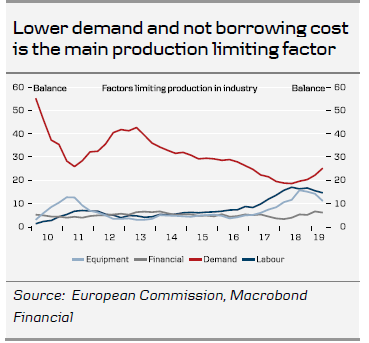

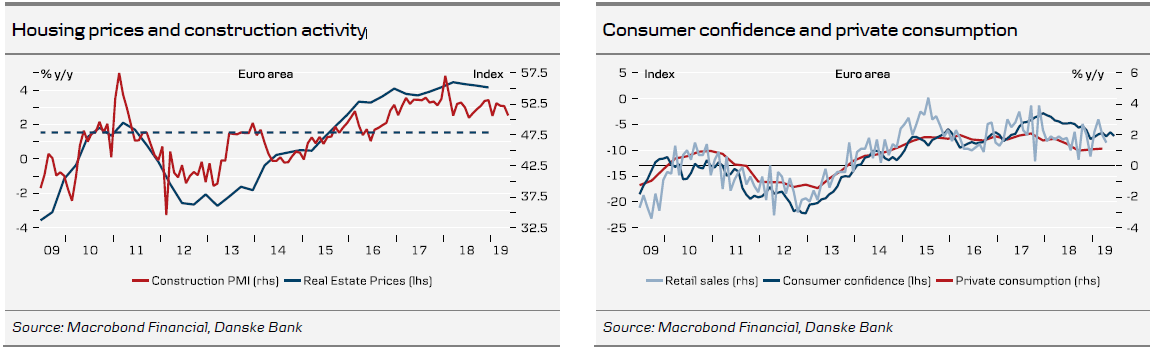

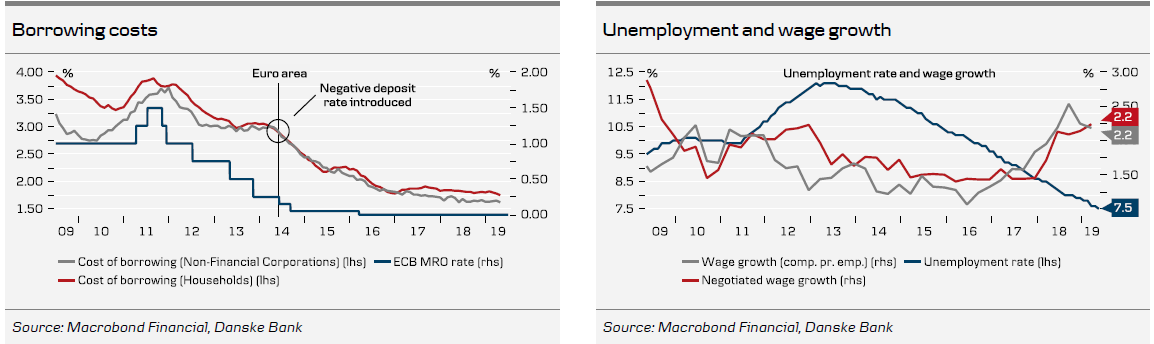

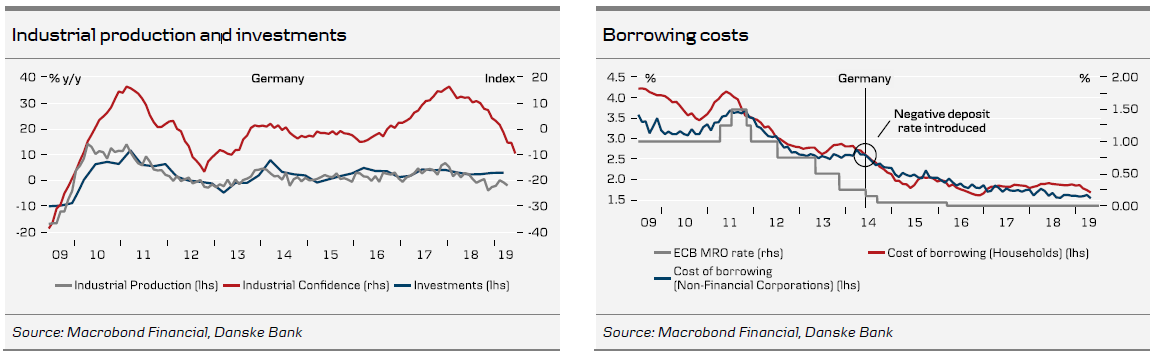

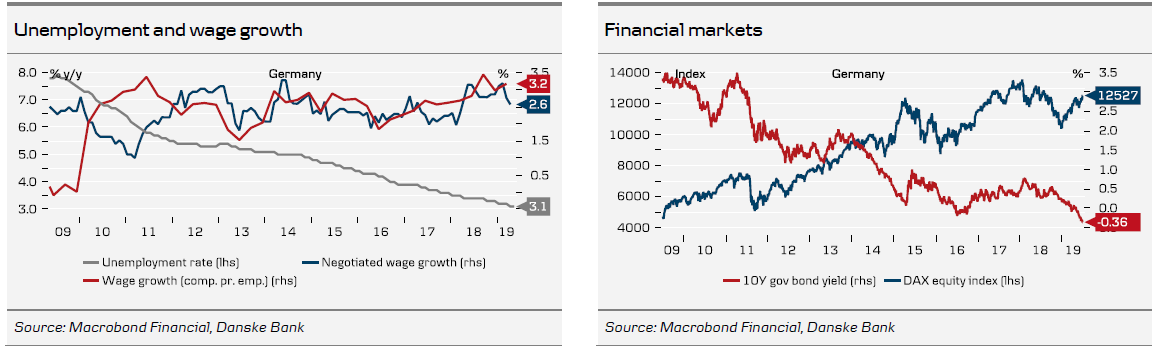

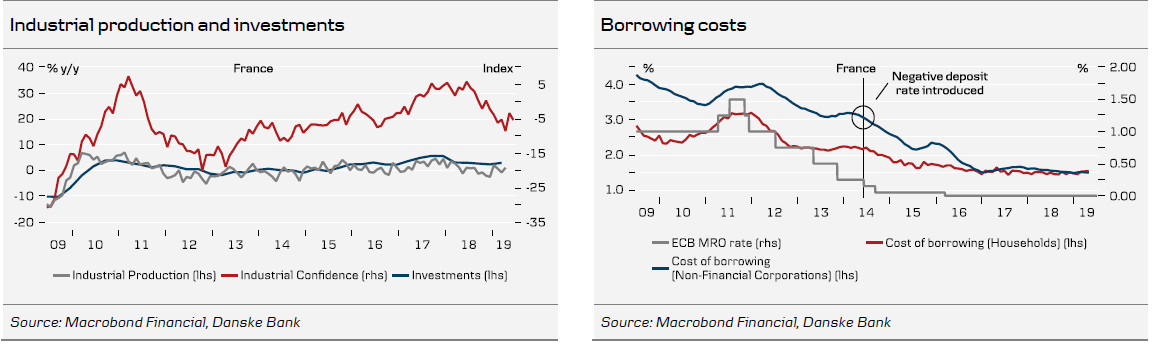

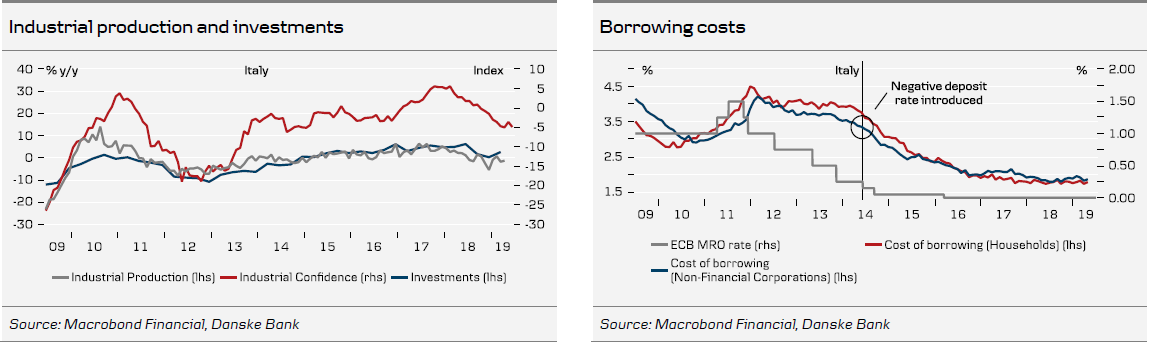

The key event this month was without a doubt the annual ECB conference in Sintra, where Mario Draghi opened the door for new monetary policy easing. Although not much has changed in terms of the subdued growth and inflation outlook since the June meeting, the big thorn in Draghi’s side has been a collapse in market-based inflation expectations, which indicate that the markets do not believe in the ECB’s ability to achieve its inflation target at close to but below 2% even on a 10y horizon. To restore credibility and re-anchor inflation expectations we expect a big package from the ECB to be announced at the September meeting with both a 20bp rate cut, a tiering system, extended forward guidance, and a restart of QE (see more: New ECB call - rate cut and restart of QE, 18 June). Although this will be the biggest single easing package since March 2016, we think it is not likely to do much to kick-start the economy since borrowing costs are already very low and a lack of (external) demand instead of too tight financial conditions remains the key issue. In that light fiscal policy remains the most effective channel to brighten the growth and inflation outlook.

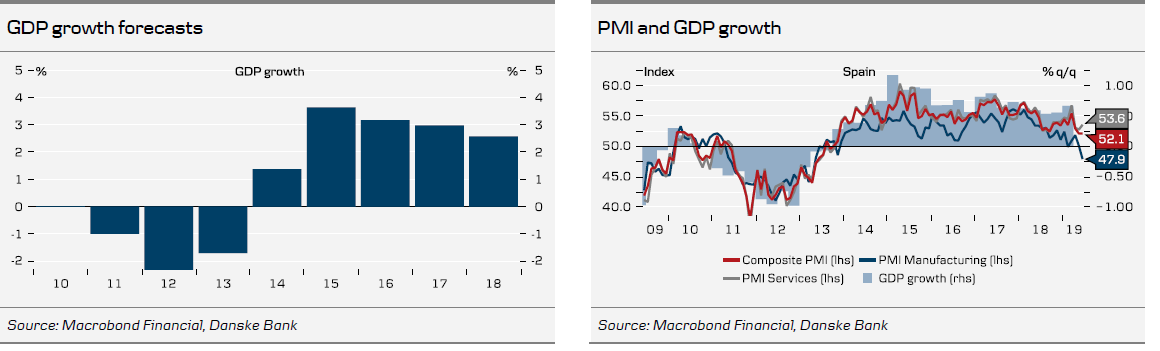

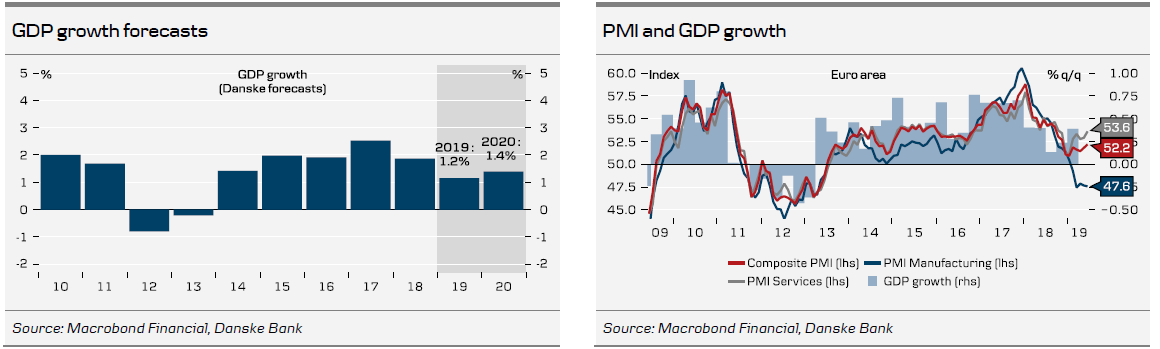

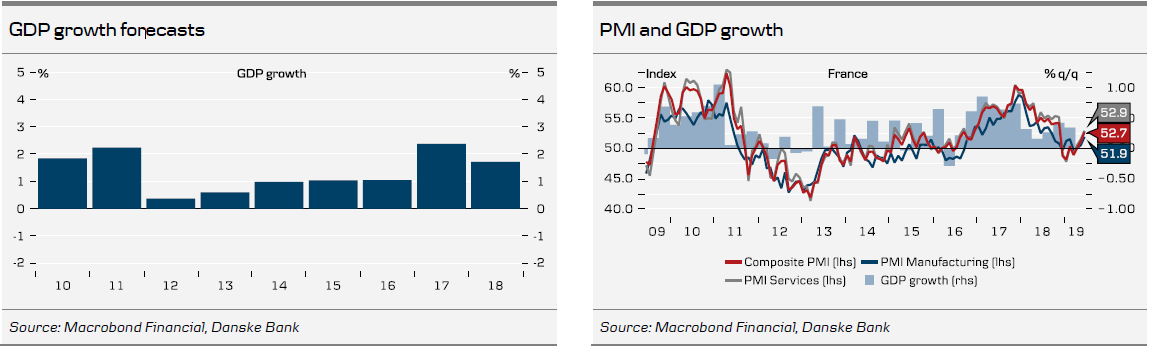

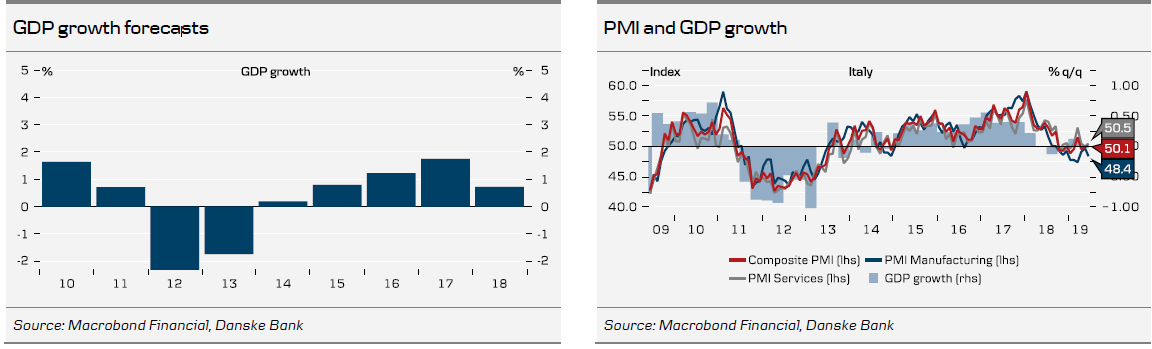

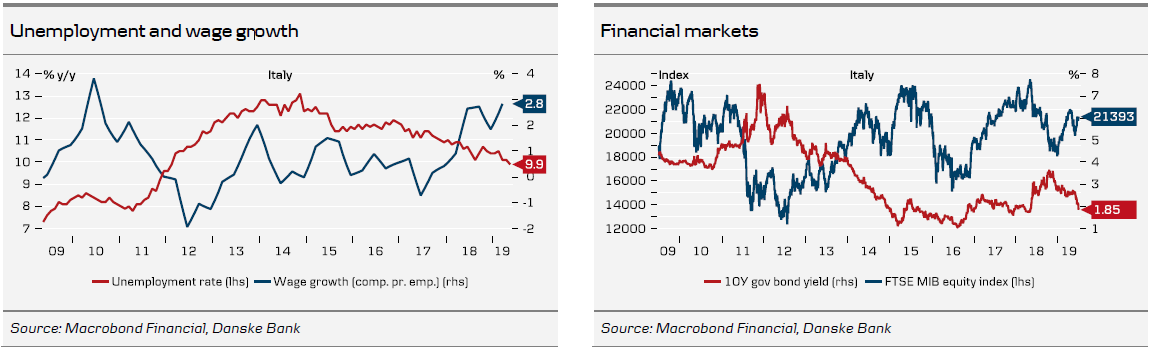

Stimulus from fiscal policy would be warmly welcomed since this month’s PMI data indicates that growth remained subdued in June with the composite PMI coming in at 52.2, which corresponds to a 0.2% q/q Q2 GDP growth. The service sector still compensates for problems in the very weak manufacturing sector which remains mired in contractionary territory and showed further signs of deterioration especially in the periphery countries. However, the service sector cannot carry the sole burden of the euro area growth outlook forever especially as companies have started to reassess staffing levels. We think markets should brace themselves for more negative economic surprises in coming weeks, both in terms of hard data and PMIs (see more Euro Area Research - Catching up with reality, 27 June).

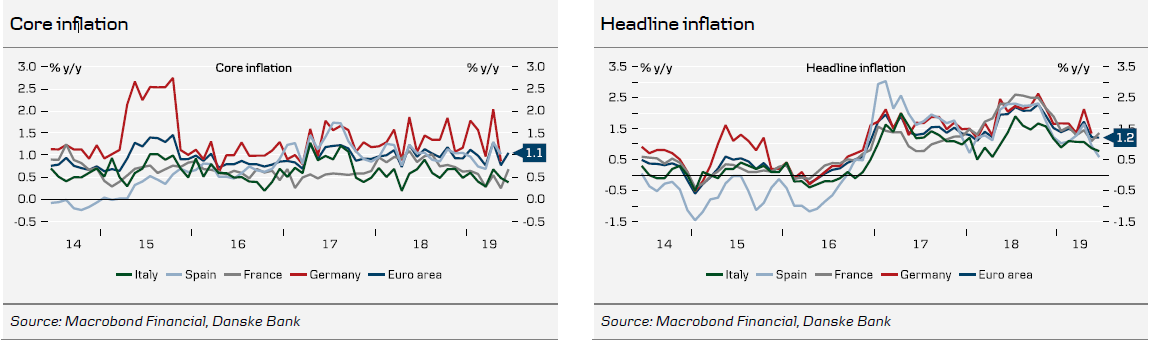

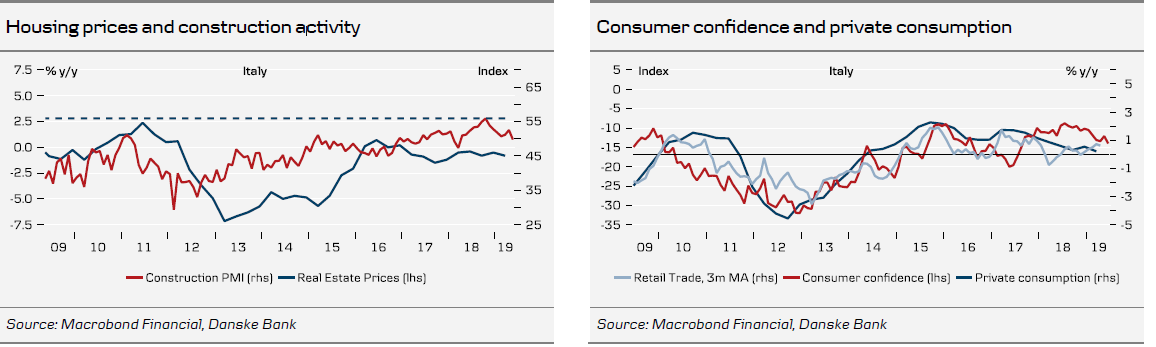

Another worry for the ECB is the still low inflation figures, which this month came in flat at 1.2% y/y. Core inflation took a sizeable jump from 0.8% in May to 1.1% in June, however this was mainly driven by temporary and seasonal effects from the timing of Whitsun and the reversal of the base effect from last year’s cut in French social housing costs. Hence, muted underlying inflation pressures continue to be a key argument for the ECB to go ahead with another easing package in the coming weeks. The Brussels personnel poker ended in a deal that saw two women take over the reins at the ECB and EU Commission. Although coming without formal central bank experience, we think Christine Lagarde will continue the ECB’s monetary policy journey very much in the style of Draghi (see ECB Research - Lagarde to take 'one of the most difficult' jobs, 3 July). The appointment of Ursula von der Leyen as Commission president could still face a rocky road amid opposition in the Parliament, but eventually we expect her to become a consensus builder who strives to unite the different factions in the EU. Markets meanwhile cheered the Commission’s decision not to launch an excessive deficit procedure against Italy at the current stage, after the government promised to rein in some of its spending plans. We still see a fair chance that a renewed stand-off looms in the autumn over the 2020 budget (see Italy - Budget fight 2.0, compromise or new elections? 21 June).

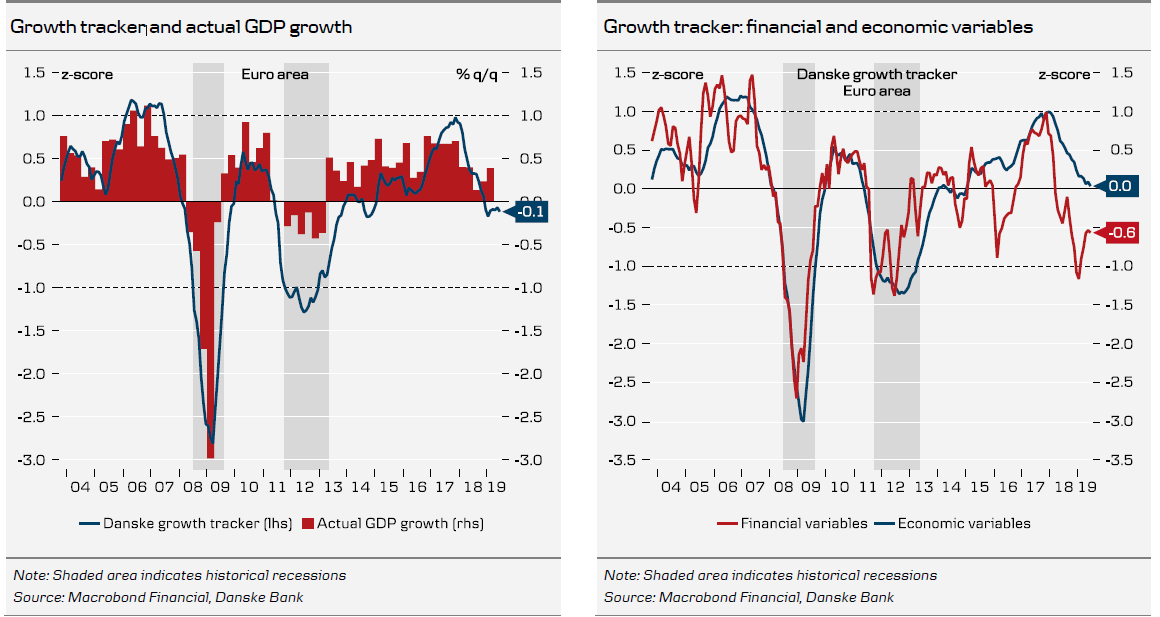

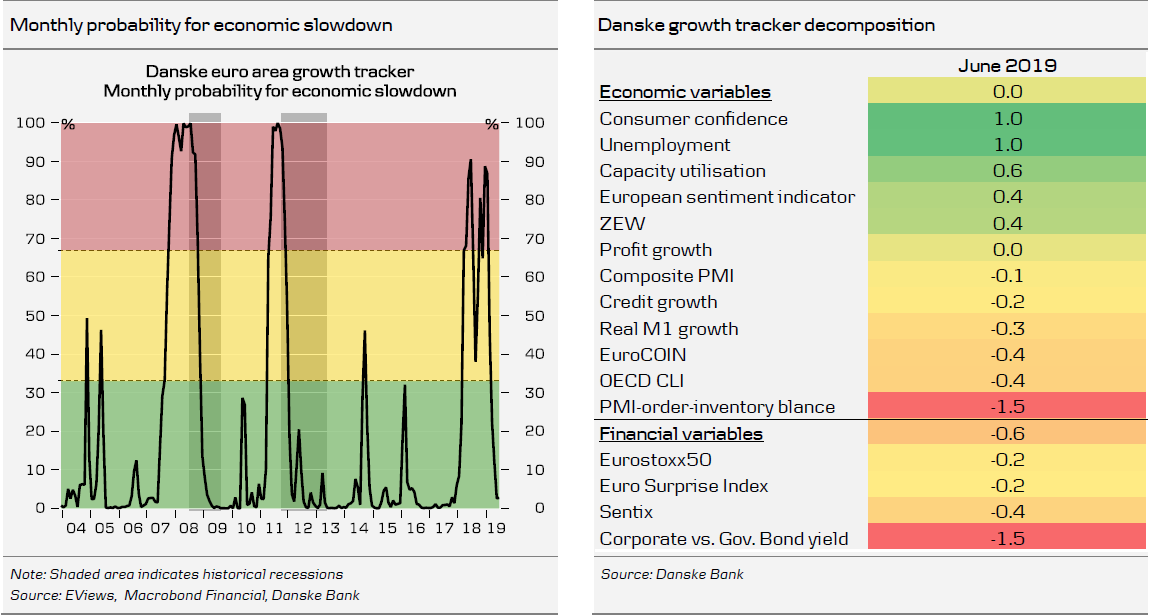

Danske euro area growth tracker

Our Danske growth tracker has shown a slight deterioration in June, as economic variables have started to run into some headwinds and financial variables have stalled in their upward trend from the last months. Still with a value of -0.1 our tracker signals that at the current stage the recession risk for the euro area remains low.

Euro area

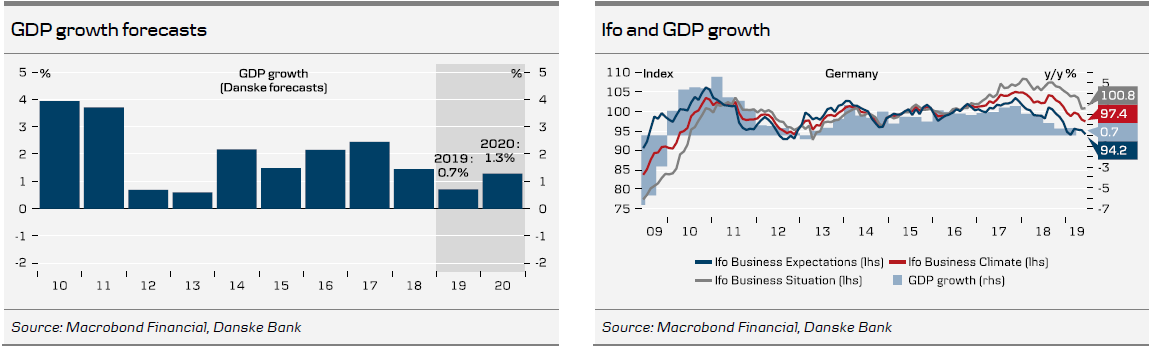

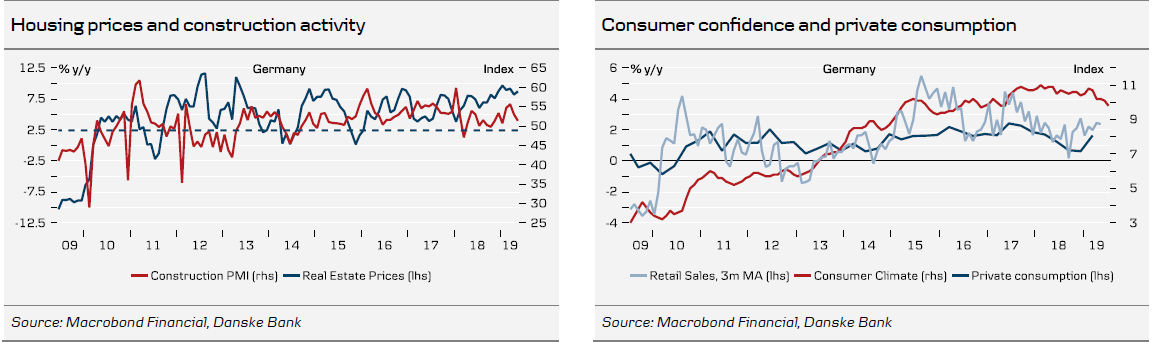

Germany

France

Italy

Spain