Recession risk remains low despite a tougher external environment, which will remain a defining feature for the growth outlook in the coming years. Expansionary fiscal policies and rising wages should support domestic demand.

Many fragilities are lingering in the background and labour market resilience is an important precondition for the expansion to continue.

Underlying inflation pressures continue to build, supporting a gradual uptrend.

We expect no ECB policy rate changes until the end of 2021.

Fires burning on many fronts…

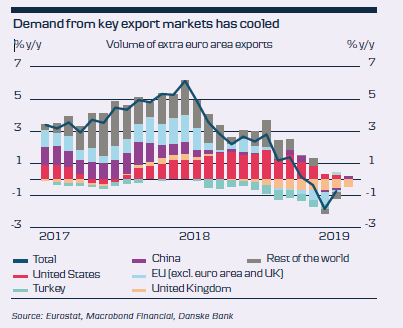

Economic activity in Europe missed expectations in 2018, as a rougher external environment took its toll on the open euro area economy. While weaker external demand has been an important driver behind the slowdown, the euro area was also hurt by a number of sector- and country-specific factors. These included the introduction of new emissions test standards that hit European carmakers, disruptions due to the French ‘gilet jaune’ protests, political uncertainty in Italy on the back of the escalating budget fight and transport problems due to a low water level in the Rhine river.

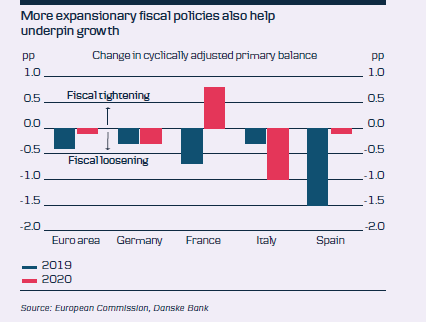

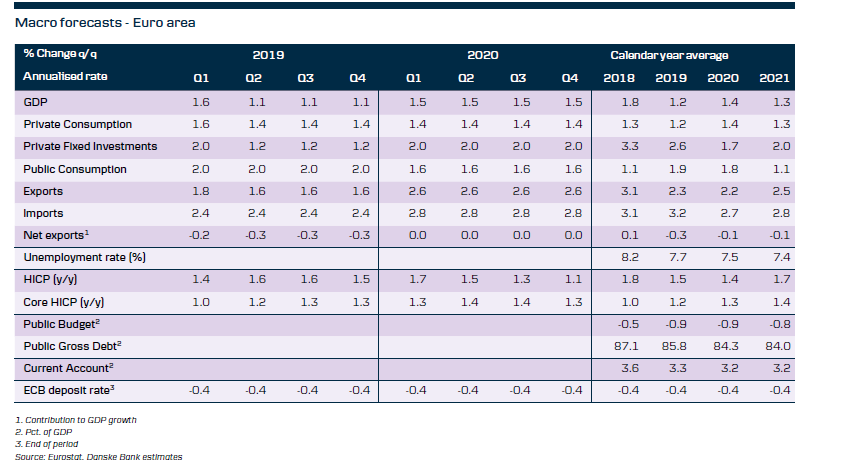

Amid ongoing subdued readings in leading indicators, questions about an impeding recession have intensified. Although we expect the expansion pace in the euro area to slow down further in 2019, we still see the risk of an imminent recession as low. We expect a less favourable external environment will remain a defining feature for the growth outlook in the coming years, but many of the temporary factors will start/or have already started to unwind and domestic demand remains an important backbone of the ongoing expansion. Hence, we expect the euro area economy to grow by 1.2% in 2019 and 1.4% in 2020, before moderating back to potential at 1.3% in 2021.

At the start of 2019, the quarterly growth pace already picked up some speed to 0.4% q/q, but we remain sceptical that the economy can maintain its current momentum for the remainder of the year, as the export outlook remains cloudy. In 2020, the economic fundamentals should remain relatively firm, underpinned by accommodative monetary and fiscal policies and a strong labour market, while the growth rate will also get an ‘artificial’ boost from a larger number of working days in several countries.

… but expansion is not yet out of fuel

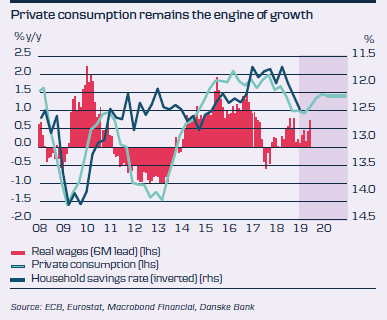

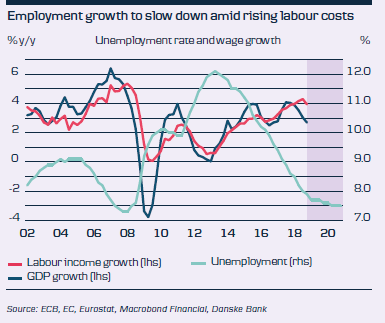

Since the beginning of 2013, private consumption has been the main driver of the recovery. Still, private consumption growth was slower than we previously expected as households responded to the growth moderation by increasing precautionary savings, while there were also some knock-on effects from the car production issues mentioned above. That said, we still see scope for consumer spending growth to hold up in light of robust demand for credit, low borrowing costs and rising real wages amid abating inflation pressures. Expansionary fiscal measures in some countries should further contribute to disposable income growth. An important factor here remains the resilience of the labour market situation. Although we could see employment growth slowing somewhat in line with the slackening growth, we still expect the unemployment rate to reach 7.5% in 2020, with nominal wage growth at 2.3% remaining at the highest rate in 10 years.

The outlook for investments, on the other hand, remains more mixed. Investment spending so far has remained quite resilient to the manufacturing weakness, not least of all due to strong activity in the construction sector. Favourable financing conditions, high capacity utilisation (at 83% in Q1) and somewhat higher public investments should help underpin investment growth in our view. However, despite these positive factors, elevated global uncertainty, declining profit margins and lower sales expectations might induce firms to adopt a ‘wait-and-see’ strategy. While the ongoing slowing of investment growth will take its toll on import growth, we still expect net exports to remain a drag on growth in light of the adverse global trade environment and a weaker growth outlook in key export markets, not least of all China, the US and Turkey.

Many fragilities lingering in the background

Although we think the expansion will continue, it remains a fragile one, with the euro area facing multiple headwinds. As mentioned above, the strength of the employment-consumption relationship is an important factor underpinning domestic demand. However, strong wage growth is increasingly outpacing GDP growth, raising the risk that firms react by starting to cut staffing and thereby weaken the ‘motor of growth’. From the external side, the biggest risk, in our view, stems from further escalation in the US-China trade war and US tariffs on European car imports, which could further weigh on sentiment and investments. However, risks also loom from a disorderly Brexit and a re-play of the Italian budget fight in the autumn spilling over to tighter financial conditions. Progress on reforms to strengthen the EMU has been disappointing so far and momentum is likely to remain lacklustre even after the EU parliamentary elections, leaving questions about how to address the next crisis.

Core inflation pressures continue to build

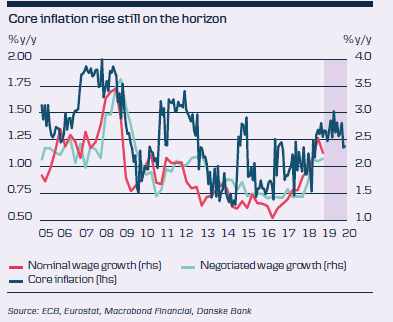

After headline inflation reached 1.8% in 2018 on the back of a strong rise in oil prices, we expect inflationary pressures to abate in the coming years to reach 1.5% in 2019 and 1.4% in 2020. However, with regard to monetary policy, the key inflation metric remains the inflation excluding volatile food and energy prices. Overall, underlying inflation pressures are still subdued, averaging only 1.0% in 2018. However, with the economic expansion continuing, unit labour costs rising and firms’ margins increasingly being squeezed, the structural conditions for a pass-through from wages to prices remain in place. We see scope for core inflation reaching rates of 1.3-1.4% by year-end (see Inflation under the microscope: simmering, not boiling).

ECB policy normalisation postponed

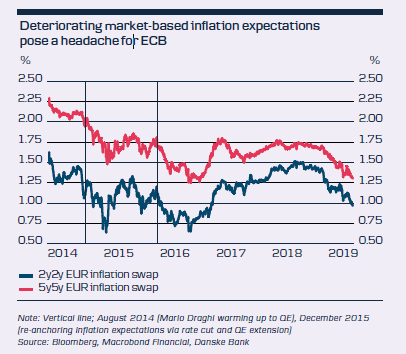

ECB opened for an easing bias at the March meeting by announcing a new series of liquidity operations (TLTROs) and extended rate forward guidance to the end of this year, on the back of a sustained slowdown that extended into 2019. With ECB entering easing mode, we no longer expect any changes in the policy rate until the end of 2021, as the lack of strong inflationary pressures and only moderate euro area growth outlook do not warrant policy tightening. However, our baseline does not include new accommodative monetary policy either. Further stimulus measures could be warranted if we see a deterioration of economic fundamentals that stands to jeopardise the rise in core inflation (see also Guns (and not bazookas) dominate ECB’s crisis arsenal). The market-based inflation expectations (5y5y, illustrating the expected inflation from 5 years to 10 years) are trading close to all-time lows. The ECB has previously stepped up its policy stimuli when inflation expectations were at much higher levels, which has led to the market speculating about the next stimuli measure.

In sum, compared to the Big Picture published in December, the normalisation bias to a tighter monetary policy has been replaced with a neutral to easing bias (should the data warrant it).

The European Game Of Thrones

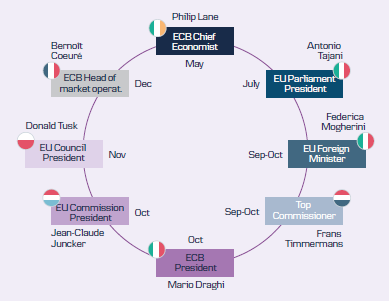

The European parliamentary elections have brought the starting shot for the European ‘Game of Thrones’ to play out in the coming months, where a range of top EU positions will be up for grabs. Informal rules about the balance of power between Northern and Southern (NYSE:SO) member states will guide the political ‘horse trading’.

Over the coming weeks, discussions will intensify over the choice of EU Commission president. Current frontrunners are Germany’s Manfred Weber, the Netherlands’ Frans Timmermans and Denmark’s Margrethe Vestager (see more here). That said, financial markets are equally, if not more, interested in the new ECB president.

The nationality of the next EU Commission president will have important implications for the ECB presidency succession when Mario Draghi steps down in October. With Germany seemingly preferring to secure the Commission presidency, this could pave the way for a more moderate consensus candidate from France or Finland to take over the reins at the ECB. We would expect such policy continuity to be seen as a positive/calming factor for markets. Almost irrespective of the new ECB president, we do not expect a sudden shift in the ECB’s current monetary policy outlook, however the responsiveness and innovative qualities of the next ECB president would be instrumental in shaping the policy response in the next crisis.