Friday’s NFP report gave dollar bulls little reason to celebrate. While the U.S. jobless rate held steady and wages picked up slightly, payrolls gain fell short of expectations with nonfarm payrolls rising only 148K in December. As expected, the market’s reaction to Friday’s report was muted. This is not least due to the fact that the appetite for monetary policy speculation has shifted out of favor of the U.S. dollar. While the Federal Reserve will continue to be the most hawkish central bank, investors are deterred by political risks and the scandal in the U.S. government, spurring concerns about US-investments.

The dollar initially fell after Friday’s job report but was later able to stabilize against the euro and pound sterling.

At the opening of this week we saw both EUR/USD and GBP/USD trading within narrow price ranges. The economic calendar this week is relatively light in terms of market moving events.

U.S. inflation data will be the most interesting piece of economic data this week but the CPI report (due on Friday) is forecast to show a muted price growth, giving dollar advocates no reason to assume faster Federal Reserve tightening in 2018. With this in mind, we still tend to expect further upside momentum in both major currency pairs but recommend traders to keep an eye on important price barriers, shown in our technical analysis below.

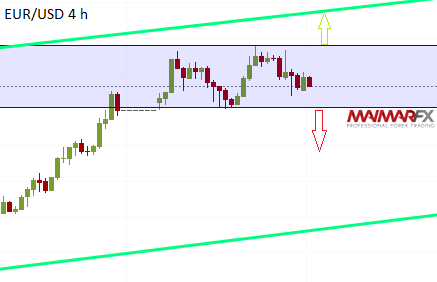

EUR/USD

The euro remained confined to its current trading range between 1.2090 and 1.20. If the euro drops below 1.1990 it may extend its slide towards 1.1930 and 1.19. In the bullish case of a break above 1.2090 we anticipate further bullish momentum towards 1.2135.

GBP/USD

The cable formatted an ascending triangle in the 4-hour chart, suggesting upcoming bullish momentum in the case of a sustained break above 1.3590. If the pound, however, drops below 1.3540, the bias may change in favor of the bears. Next lower targets could be at 1.35 and 1.3450.

Here are our daily signal alerts:

EUR/USD

Long at 1.2075 SL 25 TP 20, 50

Short at 1.1995 SL 25 TP 30, 50

GBP/USD

Long at 1.3590 SL 25 TP 20, 60

Short at 1.3530 SL 25 TP 20, 60

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.