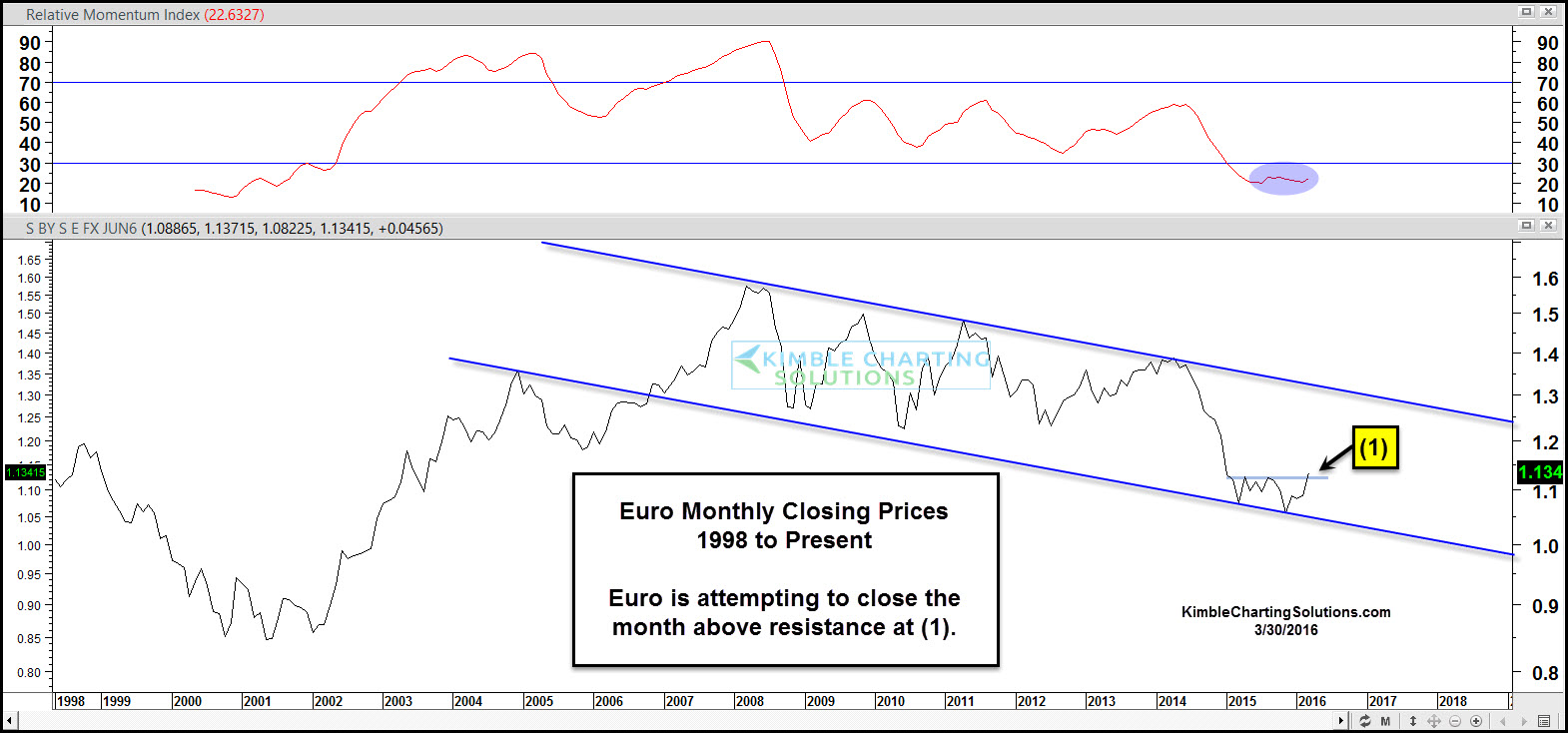

Since 2008, the euro has been been in a down trend, creating a series of lower highs and lower lows. The world has had little interest in owning the euro over the past eight years. Is this trend about to change?

The chart below looks at the euro over the past 18-years, on a monthly closing basis.

The above chart looks at the euro on a “monthly closing basis.” The euro hit falling channel support late last year and has been pushing higher since. The month is coming to an end and the euro is attempting to do something that it hasn’t done in a year and that is; closing at a new monthly high, above resistance at (1) above.

As you can see, monthly momentum is very oversold and at levels last seen 15-years ago.

Euro weakness has rippled into the commodities space over the past few years. The euro is attempting to do something it hasn’t done in a year, which is to close at a new monthly closing high.

If the euro would breakout and King Dollar would break down, it would send a message that the Risk Trade could continue for a while. If the euro, Aussie, Canadian dollar and Brazilian real would rally, commodities could do well.