Short sellers in the euro have been slowly dying inside these past two weeks. Despite the overarching risk of a Greek default, flat inflation, and poor job figures, the euro continues to appreciate. It is therefore time for our short-sellers anonymous meeting… please take your seats.

There is nothing quite as frustrating or as humbling as watching a market prove your economic prowess wrong. The euro has been quite adapt at this in recent weeks, as any movement by the pair seems to be heavily coupled to US economic weakness, rather than any eurozone fundamentals.

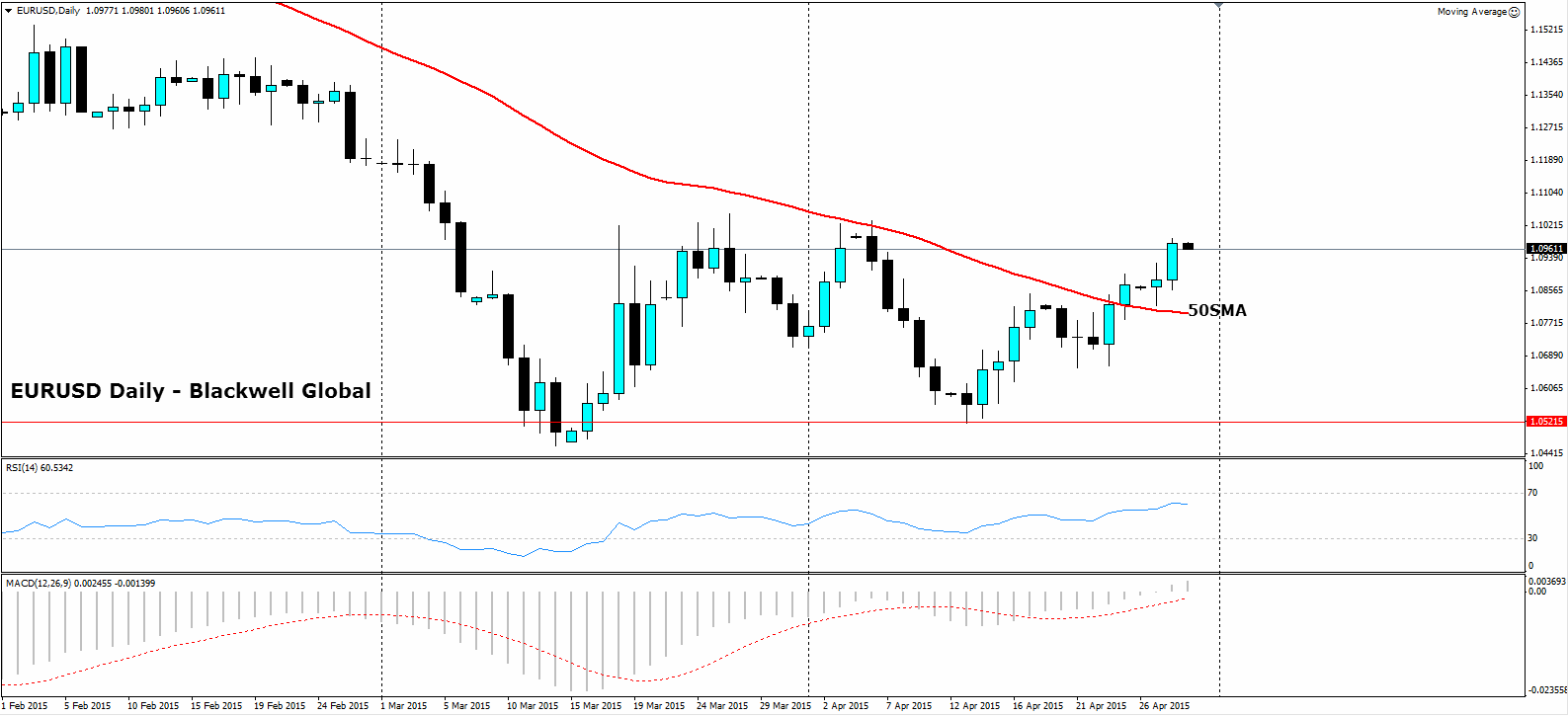

This will continue to be evident today as the FOMC meetingis due, and considering the high probability that rates will remain stagnant, the euro may potentially test the 1.10 level. The technical indicatorsreally tell the story as price action penetrates the 50SMA, unabated, on its inexorable rally north.

Now, despite my position as president of Short Sellers Anonymous, I urge you to consider the ramifications of a long position on the euro. Any upside gain is likely to be limited solely to perceived US weakness and, when the tide eventually turns, it is highly likely that the euro will decline rapidly testing support at the 50SMA.

The real question to be asking is, to what extent has a Greek default been priced into the market. My view is that whilst the Euro continues to appreciate, the less priced in any potential Grexit is. Any subsequent move by Greece to default is likely to send the currency pair tumbling back down towards parity and is a very real risk, at this stage, considering the loan repayment schedule.

However, there is so much political machismo being displayed within the negotiation meetings that it is nearly impossible to determine their respective bottom lines. The reality is that the negotiation’s remit exceeds basic economic needs and drops into the realm of politics, which complicates predicting its outcome significantly.

So do not relent my fellow short sufferers, help is on the way in the form of an eventual US rate rise, or even a Greek default. Take solace in the thought that, whilst your long position friends laugh, it is you that shall laugh last and hardest.