Talking Points:

- Euro, Yen Rise as News-Flow from Jackson Hole Fuels Risk Aversion Anew

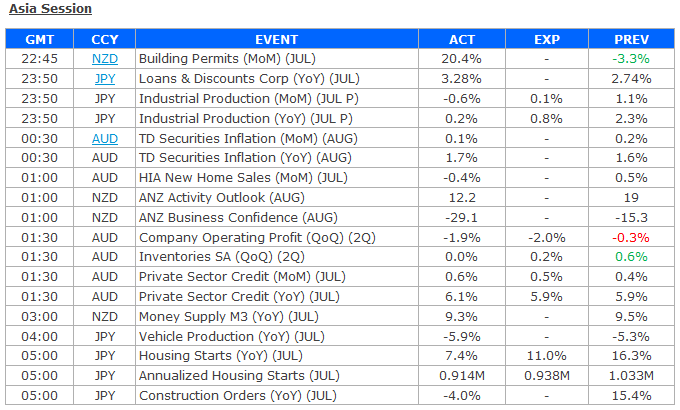

- New Zealand Dollar Underperforms as Business Confidence Hits 6-Year Low

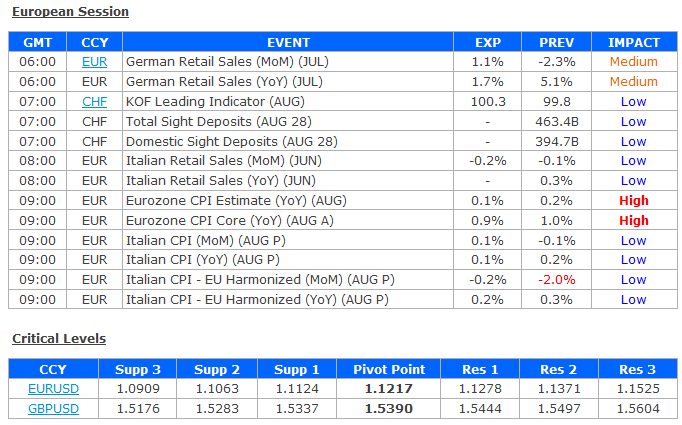

- Eurozone CPI May Reveal Market Outlook for ECB Policy Announcement

The euro and the Japanese yen outperformed in overnight trade as risk aversion swept financial markets anew. The slump in sentiment appeared to drive the unwinding of carry trades funded in the two low-yielding currencies.

The MSCI Asia Pacific regional benchmark stock index fell 0.6 percent as markets responded to news-flow emerging from the central bankers’ summit at Jackson Hole, Wyoming over the weekend. The prospect of tightening against a backdrop of global slowdown and market instability fears unnerved investors.

Federal Reserve Vice Chair Stanley Fischer hinted the FOMC may yet raise rates at next month’s policy meeting despite the recent slump in sentiment. BOE Governor Mark Carney also sounded hawkish, suggesting that rate increase considerations will enter the picture by year-end.

The risk-geared commodity bloc currencies understandably bore the brunt of eroding confidence in the G10 FX space. The New Zealand dollar proved weakest on the session as dour economic data compounded sentiment-fueled selling. The ANZ Business Confidence gauge printed at -29.1 in August, the lowest since March 2009.

Looking ahead, the preliminary set of August's Eurozone CPI figures headlines the economic calendar. The core year-on-year inflation rate is expected to edge lower to 0.9 percent having hit a 15-month high at 1 percent in the prior month.

The market's response to the outcome may help illustrate investor mindset ahead of the ECB monetary policy announcement due later in the week. A soft print that weighs on the euro may hint at building stimulus expansion bets, whereas a lackluster response would suggest traders expect Mario Draghi and company to remain on autopilot for now.