Last week once again confirmed the euro’s bearish trend. To the great pleasure of buyers of the single currency, the EUR/CAD pair reached an historic low and the EUR/USD fell to a two-year low. In addition to the uncertainties in Europe, these declines are in part due to the European Central Bank’s decision to lower its interest rates by 25 basis points, and its leaders’ openness to lowering rates again should economic conditions warrant. Bloomberg has recognized Stéfane Marion, our Chief Economist and Strategist, as the Top Forecaster of the USD/CAD pair among a vast group of large banks around the world and 5th best forecaster of the EUR/USD, and he expects the EUR/USD pair to reach 1.18 before the end of 2012. According to the minutes of the last FOMC meeting, most of its members believe that the current economic situation does not call for a third round of quantitative easing.

Canada

The week in Canadian news begins on a strong note on Tuesday with the Bank of Canada’s key interest rate decision, and of course we will carefully parse the press release that follows. It should be recalled that the global economic outlook has deteriorated slightly since the last two speeches. In addition, the U.S., our largest trading partner, is struggling to get its economy back on a growth track. We are looking forward to the release of the Bank of Canada’s Monetary Policy Report on Wednesday. The week will end with the Consumer Price Index for June, expected at 1.8%.

United States

A great deal of important economic news is expected south of the border this week. On Monday we will have both the Retail Sales figure and the Consumer Price Index for June. Economists are expecting the latter to come in at 1.6%. The most important data are expected on Tuesday and Wednesday. Mr. Bernanke will table his report on monetary policy in the Senate banking committee on Tuesday and will give his bi-annual report to the House financial services committee. Given several months of disappointing U.S. employment numbers and the fact that this is an election year, the politicians are sure to have more pointed questions than usual for Mr. Bernanke. Also on Wednesday, the Federal Reserve will release its Beige Book on the U.S. economy.

International

In international news, the eurozone’s Consumer Price Index for June will be released on Monday. This will be followed on Tuesday by the latest figure for Germany’s ZEW Economic Sentiment Index and the minutes of the latest Reserve Bank of Australia meeting. On Wednesday, Italy’s Chamber of Deputies will vote to approve the European Stability Mechanism (ESM) and the fiscal pact. Friday, eurozone’s finance ministers will host their 20th summit. Have a good week!

The Loonie

“All wars are civil wars, because all men are brothers,” François Fenelon Despite the official statements from politicians, many governments and monetary authorities are showing a willingness to devalue their currencies. In an environment characterized by large government deficits, more inflation brings down the real cost of government borrowing. Furthermore, depreciating a country’s currency stimulates exports, which produces the tax revenues needed to improve a government’s fiscal position. Therefore the solution to government indebtedness may be found through a combination of measures that both drive up inflation and depreciate currencies. Unfortunately, this cure cannot work for all countries at the same time.

Because the value of a currency is expressed as a rate of exchange with another currency, it is impossible for many countries to depreciate their currencies at the same time. When this solution is applied in one country, it has adverse effects on its trading partners, leading to wars in the currency market, in which countries respond to decisions made by neighbouring countries. Despite what they may be saying, U.S. authorities are doing their best to bring down the value of the U.S. dollar, including large fiscal deficits, an expansionary monetary policy (quantitative easing), interest rates near zero and constant pressure on China to let it currency rise. Europe is in a similar position, with its fiscal problems and its repeated injections of liquidity into the markets (through LTROs). The instability generated by this unhealthy situation, in which countries try to solve internal problems by manipulating foreign trade, represents the greatest collateral damage to this solution.

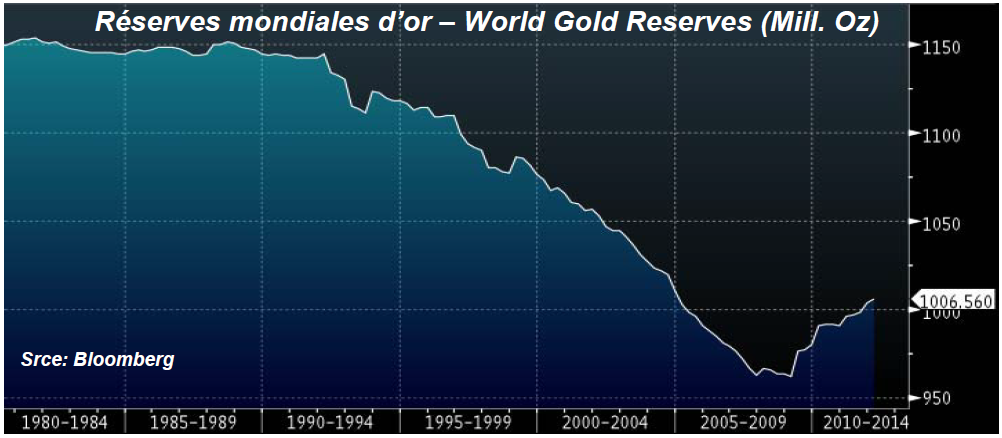

Where will this currency war? Actually, it is hard to say. We should therefore not be surprised that monetary authorities, who have sold off a major portion of their gold reserves since 1990, have been buying gold again over the last four years. Given that this is an election year in the U.S., we should not be shocked to hear the U.S. complaining and entering into disputes over the trade practices of other countries. International political and economic tensions will therefore continue to exacerbate currency market turmoil.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro's Bearish Trend Continues

Published 07/17/2012, 08:42 AM

Updated 05/14/2017, 06:45 AM

Euro's Bearish Trend Continues

Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.