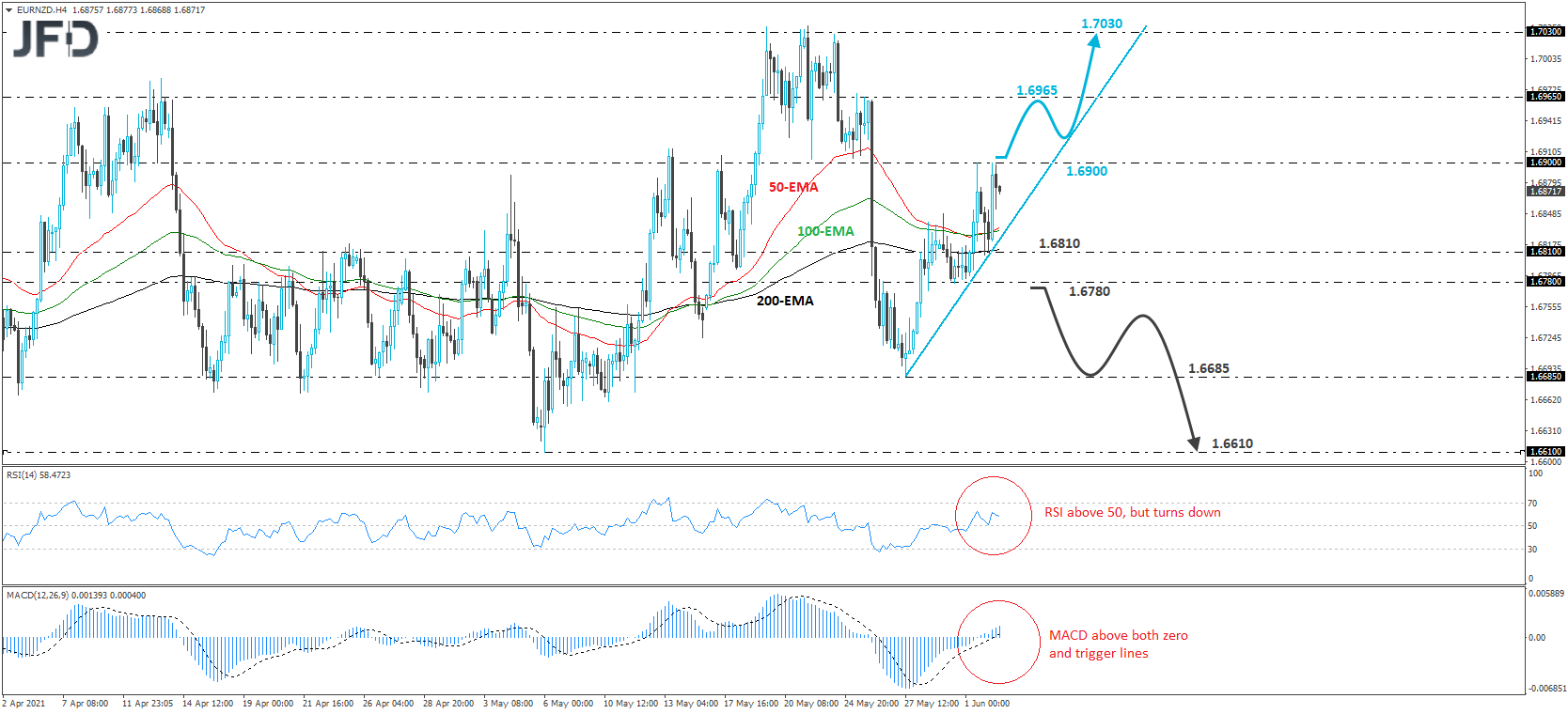

EUR/NZD traded higher today, during the Asian session, after hitting support at 1.6810. However, the rate found resistance at 1.6900, near yesterday’s high, and then it retreated somewhat. Overall, EUR/NZD remains above an upside support line drawn from the low of May 27, and thus, we would consider the very short-term bias to be cautiously positive.

That said, in order to get confident on larger advances, we would like to see a clear break above the 1.6900 zone. Such a move would confirm a forthcoming higher high on the 4-hour chart and may pave the way towards the peak of May 26th, at around 1.6965. If that zone is not able to stop the bulls, then a break higher could see scope for extensions towards the 1.7030 zone, which provided strong resistance between May 19 and 24.

Shifting attention to out short-term oscillators, we see that the RSI lies above 50, while the MACD runs above both its zero and trigger lines. Both indicators detect positive momentum, however, the RSI has just turned down again, suggesting that some further retreat may be looming, perhaps for the rate to challenge again the upside support line before the bulls regain control.

Now, in order to abandon the bullish case, we would like to see a dip below 1.6780. The rate would already be below the aforementioned upside line, and the bears may get encouraged to push the battle towards the low of May 27, at 1.6685. Another break, below 1.6685, could extend the fall towards the low of May 6, at 1.6610.