Scandinavian Capital Markets

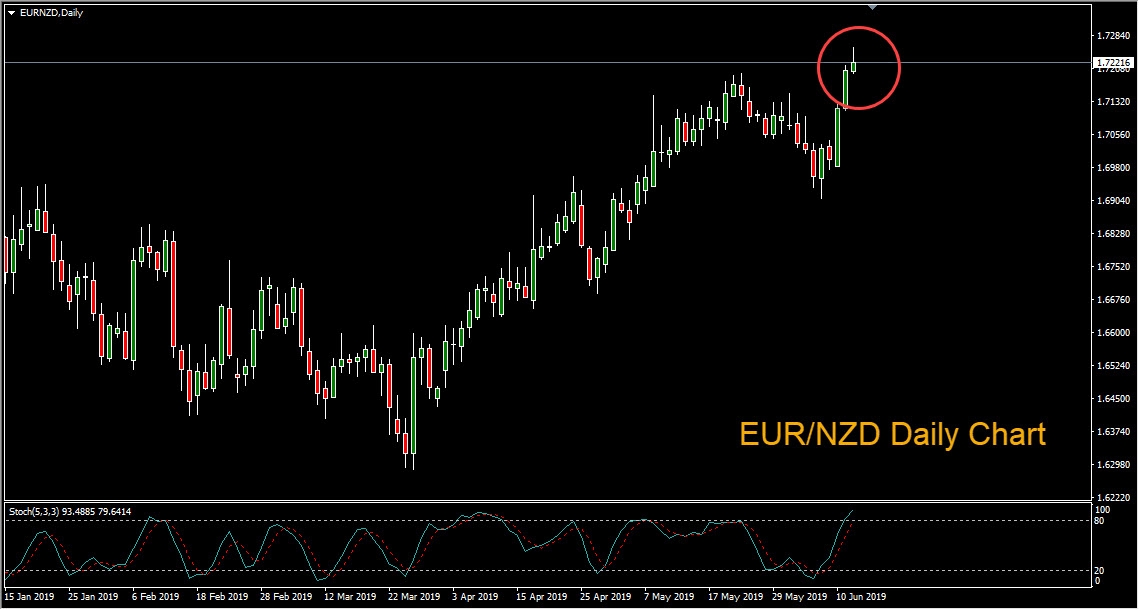

EUR/NZD rallied to its highest levels since late October in early trading on Wednesday. Looking at the daily chart above we can see that price has been in a steady uptrend since March 27th.

Kiwi Slides

The New Zealand dollar drifted lower this week as the market remained focused on trade tensions between the US and China and the increased likelihood of a rate cut from the Federal Reserve. The CME FedWatch Tool now shows a 17.5 % chance that the Fed will ease rates at the June 19th meeting. After that the G20 summit in Osaka, Japan takes place on June 28th and 29th. US President Donald Trump said on Monday that he will impose tariffs on at least $300bn worth of goods if he and China’s President Xi Jinping are unable to come to a trade deal at the summit.

Trump Complains About Weak Euro

Meanwhile on Tuesday President Trump tweeted that the euro is devalued against the dollar and blasted the Federal Reserve for their monetary policy:

"...the Euro and other currencies are devalued against the dollar, putting the U.S. at a big disadvantage. The Fed Interest rate way too high, added to ridiculous quantitative tightening! They don’t have a clue!"

The Federal Reserve has been under pressure to contain the economic risk posed by the Trump administration’s ongoing trade wars. While the Fed is an instrument of the US Government, it considers itself an independent central bank because its monetary policy decisions do not have to be approved by the President.

The Bottom Line

EUR/NZD may be forming a pin bar or shooting star pattern on the daily chart, which would signal a potential bearish reversal in the pair. The next major release on the economic docket is US Consumer Price Index (CPI), due for release at 8:30am ET on Wednesday. CPI is a key gauge of changes in purchasing trends and inflation.