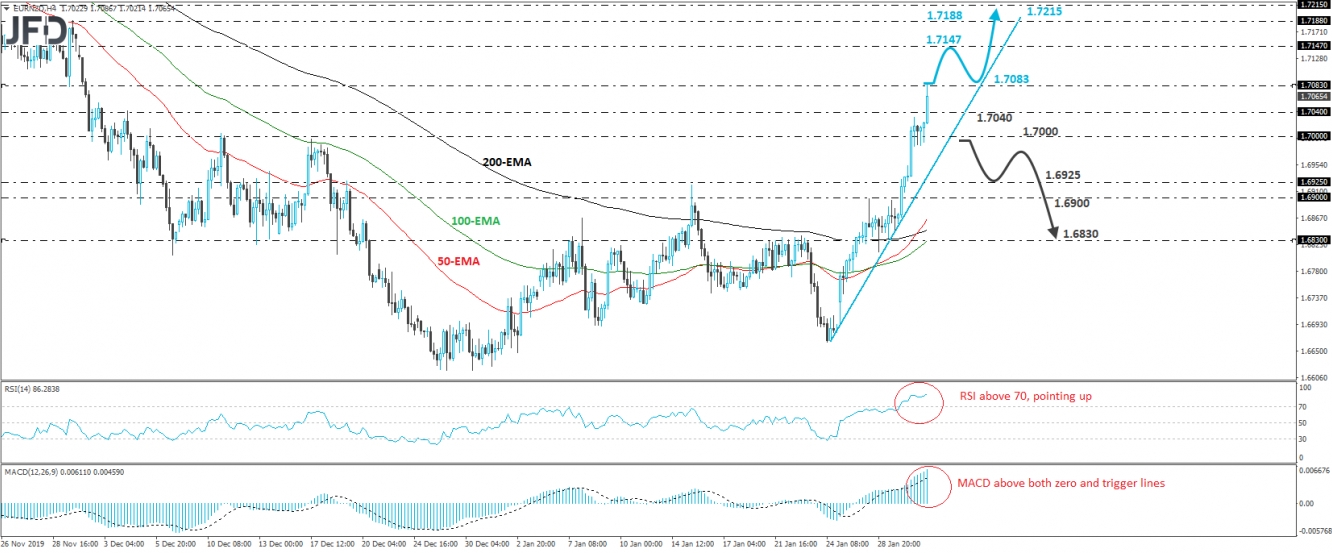

EUR/NZD surged yesterday, breaking and closing above the psychological zone of 1.7000. Today, it pulled slightly back below that hurdle, but it was quick to rebound and climb towards the 1.7083 barrier, marked by the inside swing low of November 29th. The pair has been trading above a steep upside line since January 24th, and thus, we would consider the short-term bias to be to the upside, at least for now.

If the bulls are willing to continue chasing higher territories and manage to overcome the 1.7083 zone, we could see them pushing towards the 1.7147 hurdle, marked by the peak of December 2nd. They may decide to rest after challenging that barrier, thereby allowing the rate to correct down. Nonetheless, as long as the rate stays above the aforementioned upside line, we would see decent chances for the bulls to recharge and perhaps jump above the 1.7147 zone. Such a move may allow extensions towards the 1.7188 zone, which provided strong resistance between November 26th and 29th, or the 1.7215 level, which is defined as a resistance by the high of November 25th.

Shifting attention to our short-term oscillators, we see that the RSI lies well above 70, and still points up, while the MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect strong upside speed and support the case for the current rally to continue for a while more.

In order to start examining whether the bulls have run out of ammunition, we would like to see a decisive break back below 1.7000. This may also confirm the break of the steep upside line and may encourage the bears to shoot for the 1.6925 or the 1.6900 levels. Another break, below 1.6900, may carry larger bearish implications, perhaps paving the way towards the 1.6830 area, marked by Wednesday’s low. That area also acted as a decent resistance between January 21st and 23rd.