Two forces combined helped EUR/NZD break to its highest level since April 2016 by the close of last week. The unexpected Labour-NZ First coalition stunned markets to weaken NZD across the board, whilst Euro crosses benefitted from the perception that Spain was squeezing Catalan’s hopes of independence. Early trading this week has seen the cross retrace slightly lower as traders decide which way to take it next.

Politics are likely to remain a driver for NZD for the foreseeable future, whilst traders will also be keeping a close eye on Thursday’s ECB meeting on monetary policy. Whilst we make no effort to second-guess the outcomes of these events, we are keen to explore bullish opportunities on EUR/NZD from a technical standpoint.

A strong bullish trend is underway after carving out a series of higher swing lows. Bullish momentum is also on the increase, as demonstrated by the fact prices now accelerate away from the 20-week exponential moving average. The break higher last week was more than cleared 1.6832 resistance, although the size of this bullish candle provides us with a small issue.

However, as it was the widest ranging week in seven weeks, it is possible that the move may have moved a bit too far, too soon. And it is for this reason we are keenly watching the daily timeframe to see if a low volatility retracement or evidence of price compression present itself before committing to a bullish setup.

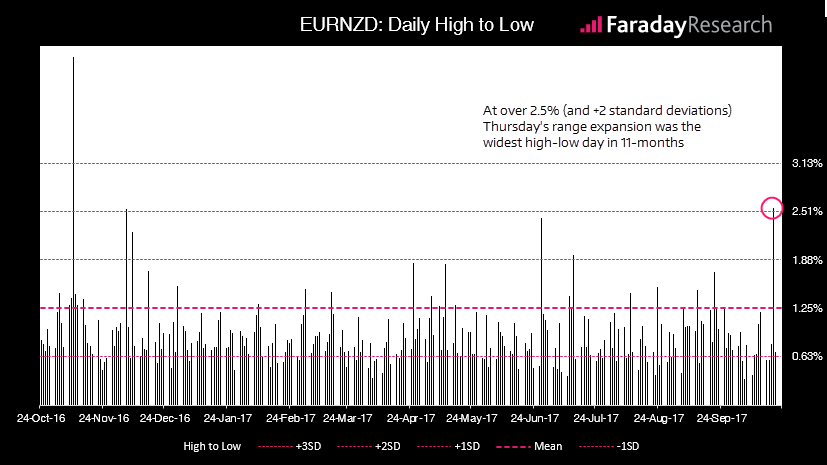

Thursdays price action is a good example of range expansion, in fact it was the widest single session in 11-months. However we should note that Friday’s price action formed a small upper wick near the top of the Keltner channel and this is a minor sign of price exhaustion.

Yet as the strong bullish trend takes precedence over the minor exhaustive signals just mentioned, we aim to position ourselves for a long trade if a low volatility retracement or evidence of price compression are to occur on the daily timeframe. With any luck our patience will be rewarded with a low volatility pullback to enable us to rejoin the trend.