As an eternal bear I am always on the hunt for new and exciting positions that lend themselves towards the short side. Subsequently, the EUR/NZD is now flashing some interesting signals that could be pointing towards a short side move in the days ahead.

The past few months have been a roller coaster for the EUR/NZD currency pair as a range of fundamental and technical changes have caused some sharp volatility in the pair. In particular, the economic situation in Europe seems to be teetering on the edge as the ECB again moves to extend their program of quantitative easing. Subsequently, there are plenty of fundamental reasons to be negative about the future direction of the pair.

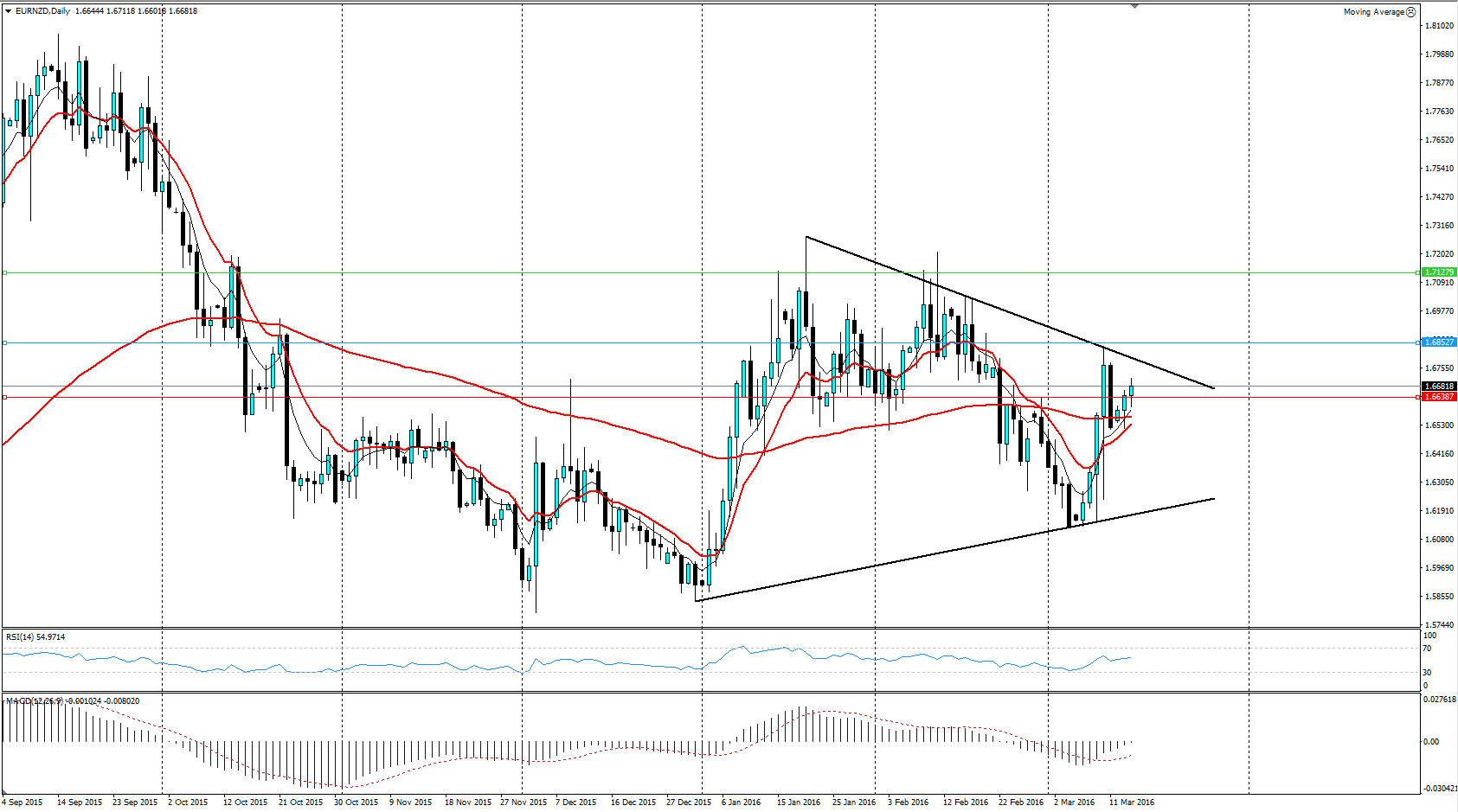

In fact, taking a look at the technical indicators shows a definite bias towards the short side as the pair continues to drift lower under the effects of a bearish trend line. The trend line has actually proved to be highly valid over the past few months as the market has sought to strongly sell the currency upon a touch of the line.

In addition, the moving averages also provide some interesting insight into the pairs overall trend direction. The past few days have seen price action rallying above the 100-Day moving average but the near term could see the pair under pressure as the 12 and 30 EMA’s start to bearishly decline. In fact, the upcoming NY session could be critical for the EUR/NZD as a price action cross of the 100-day MA to the downside could predicate further falls.

The oscillators on the other hand are providing a relatively mixed signal with RSI fairly neutral and trendless. However, the stochastic oscillator is significantly more bearish as it declines sharply within the neutral zone. Subsequently, given the contradictory signals, it would appear that the general bearish trend, along with the moving averages, are likely to decide the day ahead.

Subsequently, watch for the EUR/NZD to rally slightly before declining sharply past the 100-day moving average towards support at 1.6392. However, keep a close watch on the Eurozone Manufacturing and Services PMI’s as, ultimately, a strong result could again buoy the pair and spoil the bearish party.