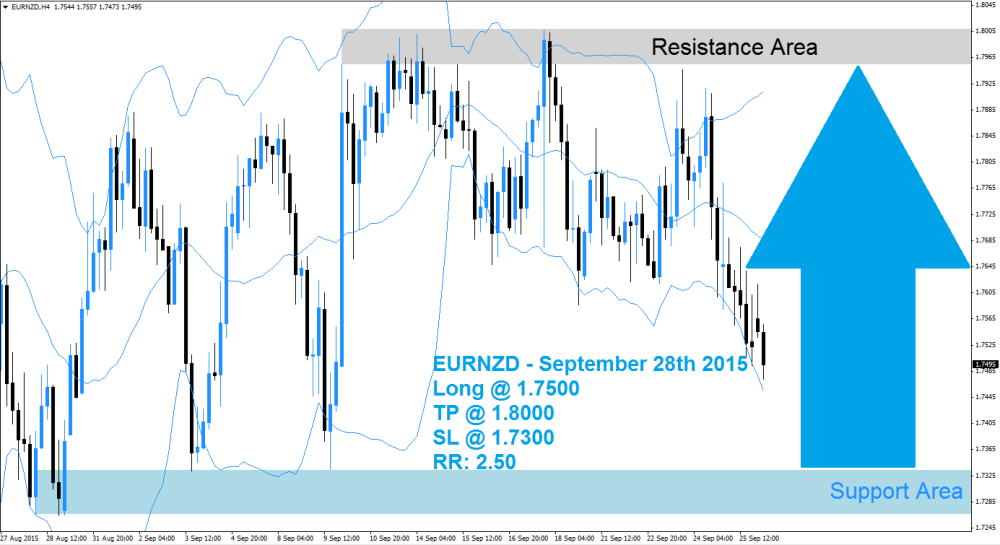

The EUR/NZD started to sell off after setting a lower high below of its resistance area, marked in light grey in the above H4 chart, which caused buy orders to be replaced with sell orders while forex traders also closed existing long positions in order to realize floating trading profits. The profit taking sell-off could be near an end as this currency pair is approaching its support area which is visible in light blue. The upside potential outweighs the downside risk.

The Bollinger Band® indicator has diverged as the upper band is sloping to the upside and is trading near the resistance area. On the other other side, the middle band as well as the lower band are sloping to the downside. The EUR/NZD is trading between the lower band and the upper band with price action located close to the lower band. A breakout above the middle band is expected to result in a short-covering rally.

Forex traders are advised to enter long positions at 1.7500 and below this level which will position their trading portfolio to profit from the expected short-covering rally. Conservative forex traders should wait for a breakout above the middle band of the Bollinger Band indicator before entering their long positions. A take profit target of 1.8000 has been set for a potential trading profit of 500pips on the H4 chart. More buy orders are expected after the EUR/NZD completes its breakout above the middle Bollinger Band. Forex traders should protect this trade with a stop loss level at 1.7300 for a potential trading loss of 200pips which will result in a Risk-Reward (RR) ratio of 2.50.

- EUR/NZD Long at 1.7500

- TP at 1.8000

- SL at 1.7300

- RR: 2.50