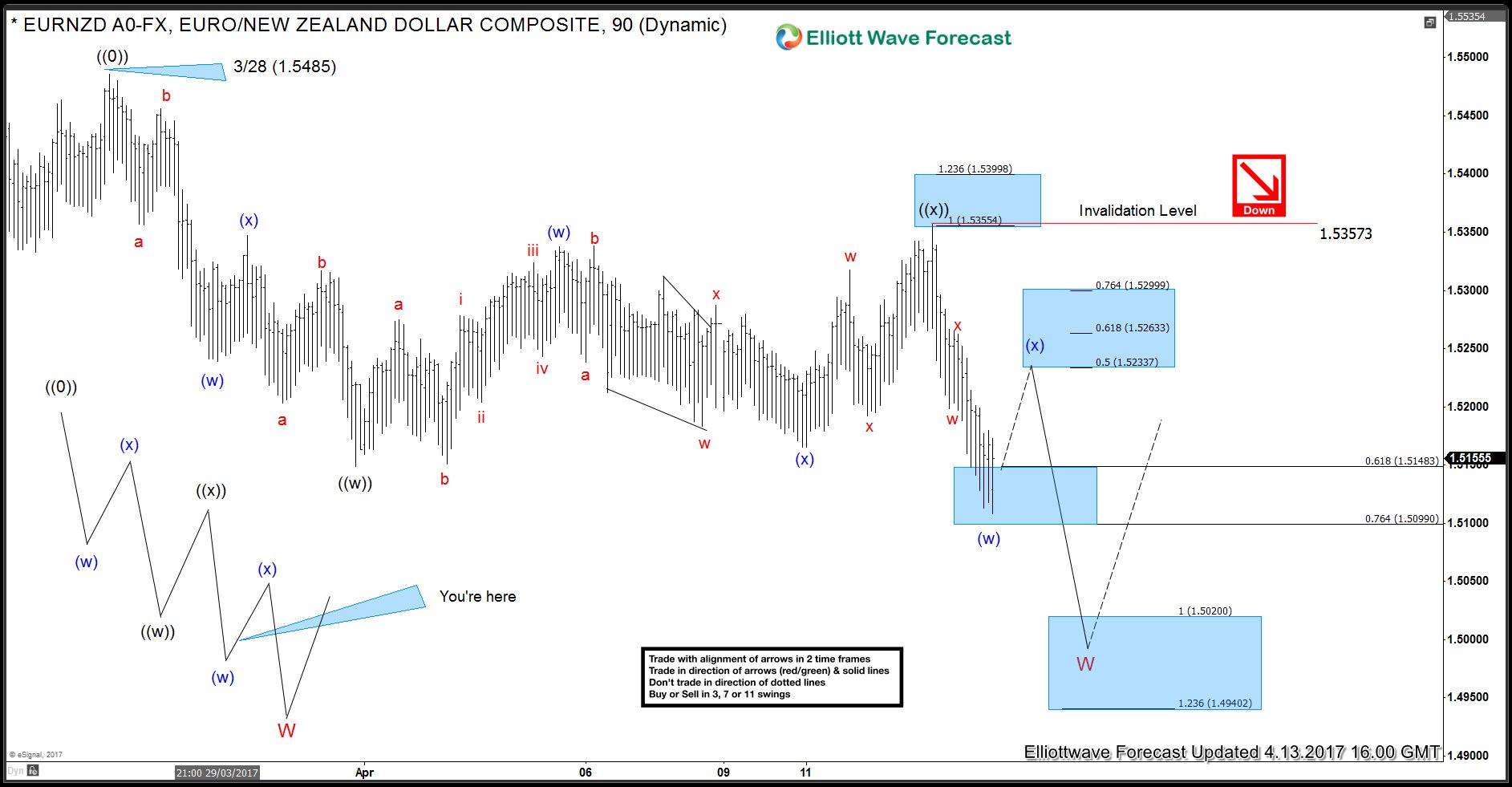

EUR/NZD rally this week failed as pair found sellers in 1.5355 – 1.5399 area and made new lows below 1.5149 low. With the new low seen today, pair is now showing 5 swings sequence down from 3/24 (1.5485) peak. 5 swings means the sequence is incomplete and pair is in need of another swing lower to complete 7 swings sequence or a double three Elliott wave structure down from 3/24 (1.5485) peak. Decline from 1.5485 to 1.5149 was corrective and hence labelled as ((w)). Bounce to 1.5357 was also corrective and hence labelled wave ((x)). As initial decline from 1.5485 – 1.5149 was corrective, that means decline from 1.5357 should also be in a corrective sequence.

Pair made a new low below 1.5149 and reached 0.618 – 0.764 Fibonacci extension area of ((w))-((x)), this is the typical area for 5th swing to end in a 7 swings sequence. Therefore, from this area, we can see a bounce in the pair to correct the decline from 1.5357 high and then it should turn lower again again. It remains to be seen how big the bounce would be but it should unfold in 3, 7 or 11 swings and 50 – 61.8 Fibonacci retracement area lies between 1.5236 – 1.5265. As far as 1.5357 high remains intact, we expect the bounce to fail and pair to continue lower towards 1.5020 – 1.4940 area to complete a double three (7 swings) Elliott wave structure down from 1.5485 peak. Afterwards, pair should bounce again to correct the decline from 1.5485 peak or at least from 1.5357 high.EUR/NZD Elliott Wave Analysis